Is Vti The Best Etf

VTI is not more tax-efficient than VTSAX. The ETFs average daily volume over the past 50 trading sessions exceeds 3 million.

Covid Crash Etfs That Worked Etf Com

Covid Crash Etfs That Worked Etf Com

Research performance expense ratio holdings and volatility to see if its.

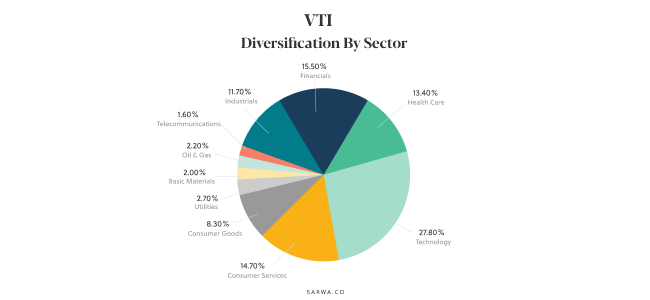

Is vti the best etf. Learn everything you need to know about Vanguard Total Stock Market ETF VTI and how it ranks compared to other funds. Vanguard SP 500 ETF. Vanguard Total Stock Market ETF VTI The Vanguard Total Stock Market ETF NYSEMKTVTI is a broad-market fund that tracks the entire stock market.

Get answers to common ETF questions. WANT TO LEARN MORE. Vanguard Health Care ETF VHT.

The fund offers neutral coverage making no industry size or style. Typically ETFs would be more tax efficient. As I said you can buy or sell the Vanguard Total Stock Market ETF VTI just like a stock anytime during the trading day.

This ETF tracks the SP500 index and holds 508 stocks. The Vanguard Total Stock Market ETF is a well-diversified exchange-traded fund ETF that holds over 3500 stocks. Vanguard Health Care ETF.

Vanguard Growth ETF VUG 4. The Vanguard Total Stock Market ETF VTI is also available as a mutual fund but the ETF version is a better fit for investors who cant meet the 3000 mutual fund minimum. The fund is light on tech but if you want stability over growth potential then VTV is the best Vanguard ETF for you.

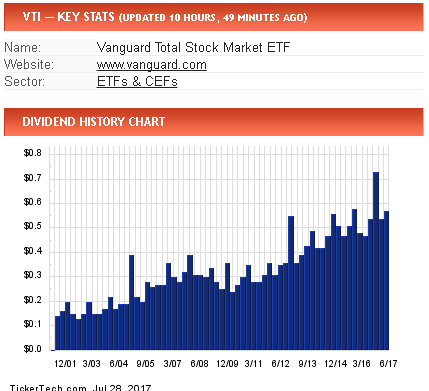

VTI is a good choice for investors or traders looking for comprehensive total-market equity exposure including micro-caps. The Vanguard Total Stock Market ETF announced a 542 cent dividend giving the fund a yield of 186 percent at its current valueThat compares with a 179 percent yield for the Vanguard Small-Cap. Total Market Index which includes a mix of small- mid- and large-cap growth and value stocks.

Hands down one of the best ETFs when it comes to following the US market is Vanguards VTI. Not only does it allow investors to benefit from the performance of the. This permits the mutual fund to gain the tax advantages of the ETF.

I think I may have become to hung up on tax implications. NON Reg Perhaps it is best to stick with Canadian Dividend stocks and Canadian ETFS currently have CNR EMA BNS TD For wanting to increase my USForeign content do that in RRSPs TFSA and RESPs for my grandkids with ETFs such as VTI XAW. The fund has an expense ratio of 004.

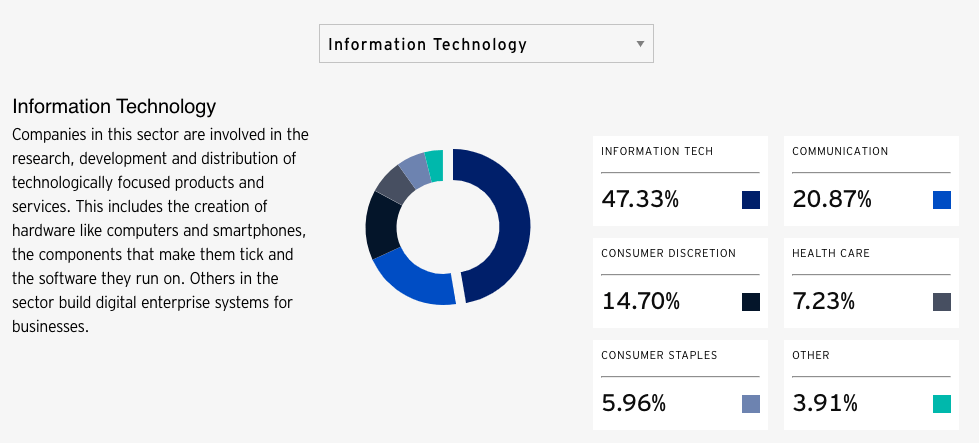

You should put all your money in VTI and not look back. 3 The ETFs top sector is technology with a 212 weighting while Microsoft. In contrast you have to put your trade order for VTSAX in during the day and wait until the end of the day to have your trade executed.

Understand Vanguards principles for investing success. Vanguard Mid-Cap ETF VO. This is a more diversified ETF that holds all the SP500 stocks but also many mid-cap and small-cap stocks.

In dollar terms it trades more than 600 billion on average per day. Vanguard SP 500 ETF VOO 3. Both VTSAX Vanguard Mutual Fund and VTI Vanguard ETF are Vanguards Total Stock Market Index funds.

One of the most popular index funds in the world is the Vanguard Total Stock Market ETF NYSEMKTVTI and for good reason. The fund has an expense ratio of 004. As the name suggests its designed to match the performance of a broad swathe of equities specifically the CRSP US.

According to a study by Longboard Capital Management of thousands of shares over 25 years far more stocks will underperform than overperform. Vanguard Total Stock Market ETF or SPDR SP 500 ETF Trust VTI vs SPY. Why should new investors consider these tax efficient options.

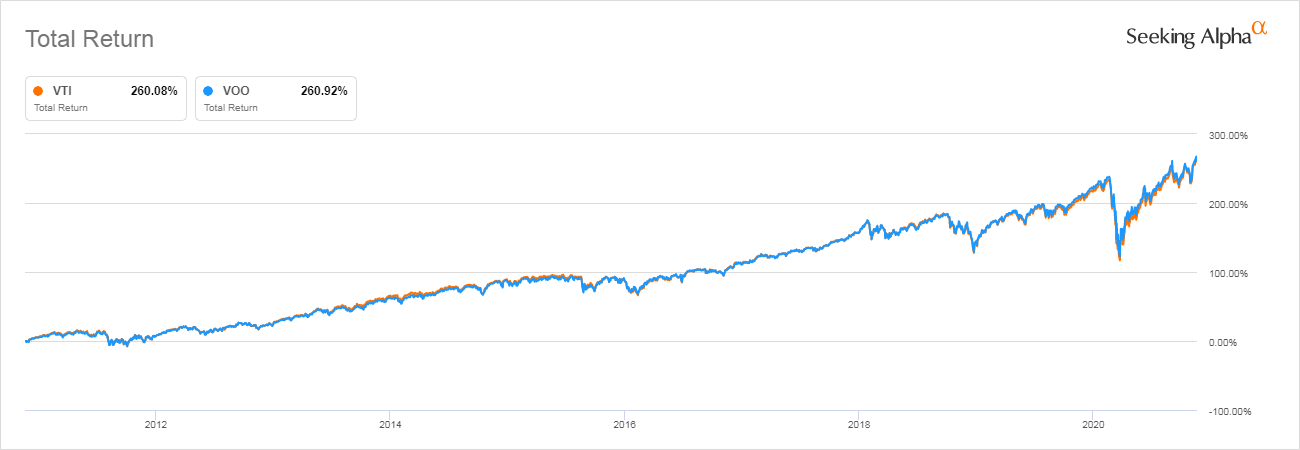

This article examines the differences between VOO and VTI and which one is likely to be a better investment. But if youre new to investing in an ETF or youre only partly invested in this index fund then you might not be sure if you should go all-in and put all of your money in it. Get your ETF recommendation online.

All of these ETFs. Well here it is. I prefer VTI because it is an ETF.

See how 9 model portfolios have performed in the past. The fund is light on tech but if you want stability over growth potential then VTV is the best Vanguard ETF for you. 4 Vanguard ETFs That Could Make You a Millionaire.

It holds 3551 stocks in total. However Vanguards patented heartbeat trading system allows them to treat the ETF as a share class of an identical mutual fund VTSAX in this case. So VTI could be a good idea for long-term.

4 Etfs You Can Hold Forever Investorplace

4 Etfs You Can Hold Forever Investorplace

Vti Vs Vig A Dividend Growth Comparison Nysearca Vig Seeking Alpha

Vti Vs Vig A Dividend Growth Comparison Nysearca Vig Seeking Alpha

Vti Vanguard Total Stock Market Index Fund Etf Shares Etf Quote Cnnmoney Com

Vt Vs Vti Which Index Fund Should You Invest In Four Pillar Freedom

Vt Vs Vti Which Index Fund Should You Invest In Four Pillar Freedom

Vt Vs Vti Which Is Right For You How To Fire

Vt Vs Vti Which Is Right For You How To Fire

Top Etfs To Buy As Markets Look To End Month With Record Highs

Top Etfs To Buy As Markets Look To End Month With Record Highs

Vti Aapl Amzn Pypl Large Inflows Detected At Etf Nasdaq

Vti Aapl Amzn Pypl Large Inflows Detected At Etf Nasdaq

Total Stock Market Vs S P 500 Vti Vs Voo Which Vanguard Etf Is Best Youtube

Total Stock Market Vs S P 500 Vti Vs Voo Which Vanguard Etf Is Best Youtube

Voo Vs Vti Which Etf Is A Better Investment Stock Analysis

Voo Vs Vti Which Etf Is A Better Investment Stock Analysis

Vanguard Vti Vs Voo What Is The Best Etf Index Funds 2019 Youtube

Vanguard Vti Vs Voo What Is The Best Etf Index Funds 2019 Youtube

My 3 Favorite Etfs To Buy During The Stock Market S Pullback Seeking Alpha

My 3 Favorite Etfs To Buy During The Stock Market S Pullback Seeking Alpha

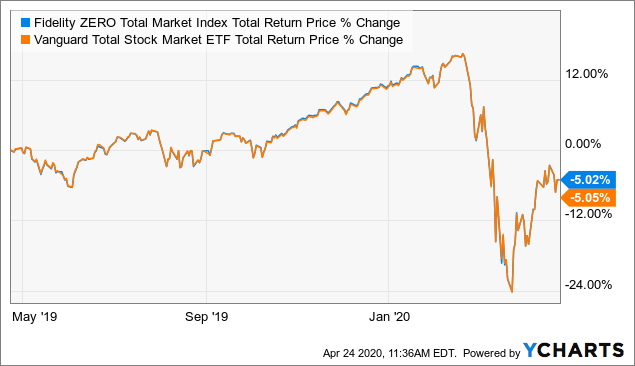

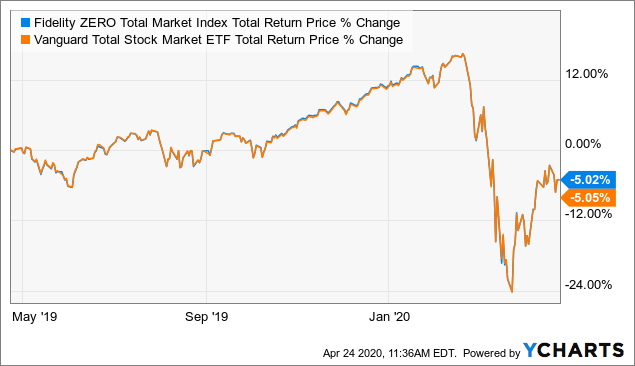

Fzrox Why It Could Be Better Than Both Vti And Spy Mutf Fzrox Seeking Alpha

Fzrox Why It Could Be Better Than Both Vti And Spy Mutf Fzrox Seeking Alpha

Vanguard Total Stock Market Etf Vti Review Market Consensus

Vtsax Vs Vti The Best Index Fund And Top Alternatives

Vtsax Vs Vti The Best Index Fund And Top Alternatives

What Is The Best Vanguard Etf The 2021 Guide Sarwa

What Is The Best Vanguard Etf The 2021 Guide Sarwa

3 Etfs For True Total Market Coverage Nasdaq

Voo Vs Vti Which Etf Is Better To Buy Comparing Investment Options

Voo Vs Vti Smackdown Know How They Differ Before You Invest Nysearca Voo Seeking Alpha

Voo Vs Vti Smackdown Know How They Differ Before You Invest Nysearca Voo Seeking Alpha

8 Etf Buy Opportunities For The Week Ahead Etf Focus On Thestreet Etf Research And Trade Ideas

8 Etf Buy Opportunities For The Week Ahead Etf Focus On Thestreet Etf Research And Trade Ideas

Post a Comment for "Is Vti The Best Etf"