Stock Split Pros And Cons

Learn How to Start Trading With These Step-By-Step Instructions. Be sure to cancel any stop or limit orders with your broker prior to a split.

What Is A Stock Split Is It Good Plus Real Examples

What Is A Stock Split Is It Good Plus Real Examples

The Pros and Cons of Splitting Shares Stock splits are are on the wane but they still have their boosters.

:max_bytes(150000):strip_icc()/dotdash_v2_Understanding_Stock_Splits_Aug_2020-012-b223f723115044d5897cdda57e1be4b7.jpg)

Stock split pros and cons. Someone who would not buy a stock sha. Divestitures are driven by a number of factors united by the view that corporate splits drive increased shareholder value than if the two businesses were to remain together Cogen said. Companies looking to create spinoffs at attractive prices may use reverse splits.

Companies with high share prices may see their prices inflated due to all the retail investors who can now buy their shares. Each share of the stock now has half the value it did before. Make shares more affordable.

If shares become too pricy they can be too expensive for an individual investor to buy. However markets are more complicated than simple logic. In terms of logic a stock split does not change the value of the company that issued it.

In addition a stock that had split outperformed the market by an average of 48 over one year. Affordability of Each Share Is Improved. Should Amazon Split Up.

This of course is one of the reasons why management declares a. However markets are more complicated than simple logic. Affordability of Each Share Is Improved.

A stock split can make shares more affordable possibly making the shares more attractive to a wider range of investors increasing the stock market demand for the stock. A stock split occurs when a company increases its total shares by dividing up the ones it currently has. Outdoor units average around 60dB A the level of a normal conversation.

Stock splits will affect options holders but the necessary adjustments are made automatically in their accounts. The share may appeal to more potential buyers overall if every shares price is lower. A stock split has certain advantages and disadvantages.

Fenwick West mergers and acquisitions co-chair Doug Cogen was extensively quoted in a Financier Worldwide magazine cover story on the pros and cons of corporate splits and divestitures. Greater number of shares. The desire to increase the share price especially if the shares are penny stocks.

A stock split is viewed as a positive event for a company. In terms of logic a stock split does not change the value of the company that issued it. New investors may be more reckless with their money.

Theres no indoor unit with a large fan that makes noise every time the system kicks on no ducts that clang and bang with changes in temperature and no popping pinging radiators. Low prices tend to elicit negative emotions in investors and. Advantages of Stock Splits.

This is typically done on a 2-to-1 ratio. Someone may not buy a stock share for 250000 but 125000 seems more reasonable. For example if you own 10000 shares of a company and.

3 Pros and Cons One analyst thinks Amazon should split in two. Each share of the stock now has half the value it did before. The declaration of a split by the board of directors shows a belief in a continuing increase in the value of the companys shares.

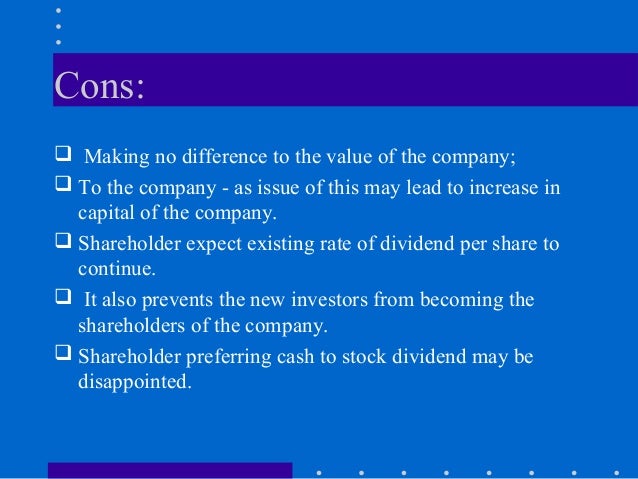

The main advantage of stock splits is theyre affordable as every share has improved and has half the value it did before the split. Stocks with inflated prices often make for poor investments. A reverse stock split reduces the number of shares and increases the share price proportionately.

Appear more legitimate Regular stock split. A Nasdaq study that analyzed stock splits by large-cap companies from 2012 to 2018 found that simply announcing a stock split increased the share price by an average of 25. Pros and Cons of Splits and Divestitures.

Goodluz Adobe Stock. While the value of the money in your pocket has not changed stock splits are a positive in that they stimulate investor interest. According to the BuyandHold investment website a potential benefit of a reverse stock split is that it can create the perception that a companys stock has increased in value.

Four Reasons for a Reverse Stock Split. Because the share price increases it may look more attractive to potential investors resulting in more investment dollars for the company. And a high price on a stock does not mean its a good investment.

One of the primary reasons for a stock split is to help a company control its stock price. Reverse stock splits and regular stock splits are used by many companies but they each offer different benefits. The Pros and Cons of Stocks vs.

Someone who would not buy a stock sha. Reduce number of shareholders. A stock split has certain advantages and disadvantages.

What Is A Stock Split Is It Good Or Bad For Investors Quora

What Is A Stock Split Is It Good Or Bad For Investors Quora

Reverse Stock Splits Good Or Bad For Shareholders Youtube

Reverse Stock Splits Good Or Bad For Shareholders Youtube

What Happens In A Reverse Stock Split If You Don T Have Enough Shares Quora

Why Tesla Will Do A 10 For 1 Stock Split And What It Means For Tsla Shareholders Ep 93 Youtube

Why Tesla Will Do A 10 For 1 Stock Split And What It Means For Tsla Shareholders Ep 93 Youtube

Apple Stock Split History Everything You Need To Know Ig En

Apple Stock Split History Everything You Need To Know Ig En

How Investors Can Gain From Company Stock Splits

How Investors Can Gain From Company Stock Splits

Stock Split Vs Bonus Issue Pros Cons Reverse Split

Stock Split Vs Bonus Issue Pros Cons Reverse Split

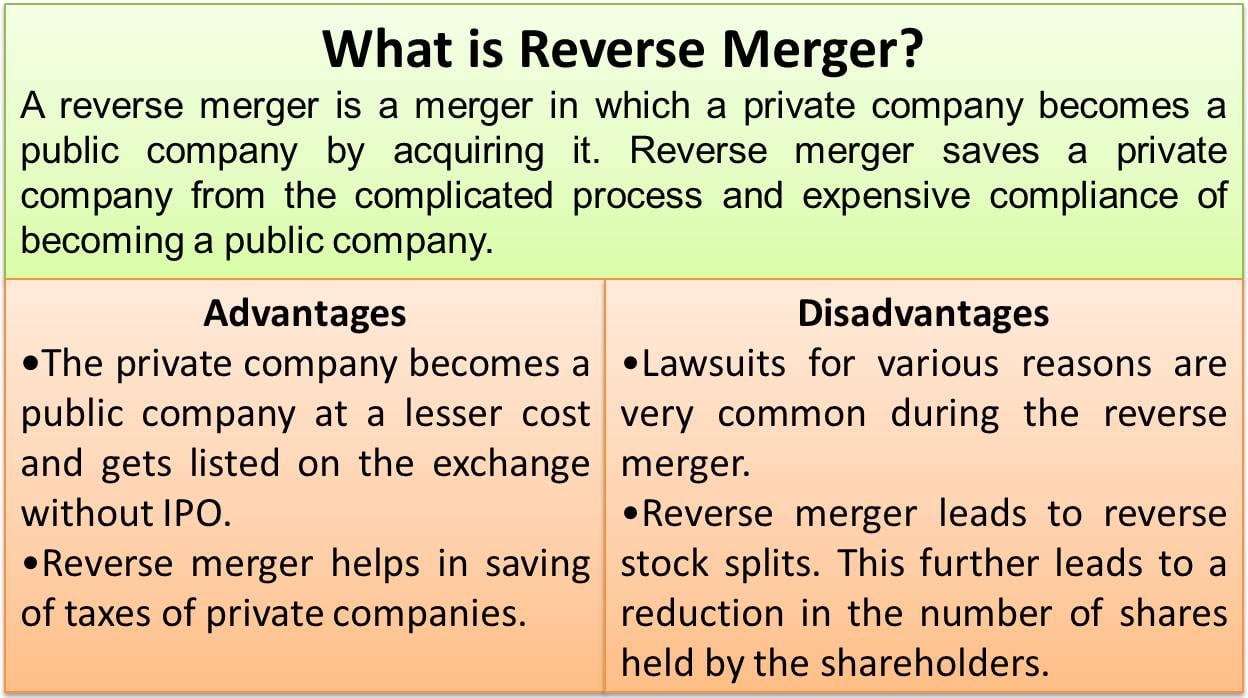

Reverse Merger What Is It Advantages Disadvantages

Reverse Merger What Is It Advantages Disadvantages

Reverse Stock Splits Good Or Bad For Shareholders Cabot Wealth Network

Reverse Stock Splits Good Or Bad For Shareholders Cabot Wealth Network

Stock Reverse Split What It Is Pros Cons Examples

Stock Reverse Split What It Is Pros Cons Examples

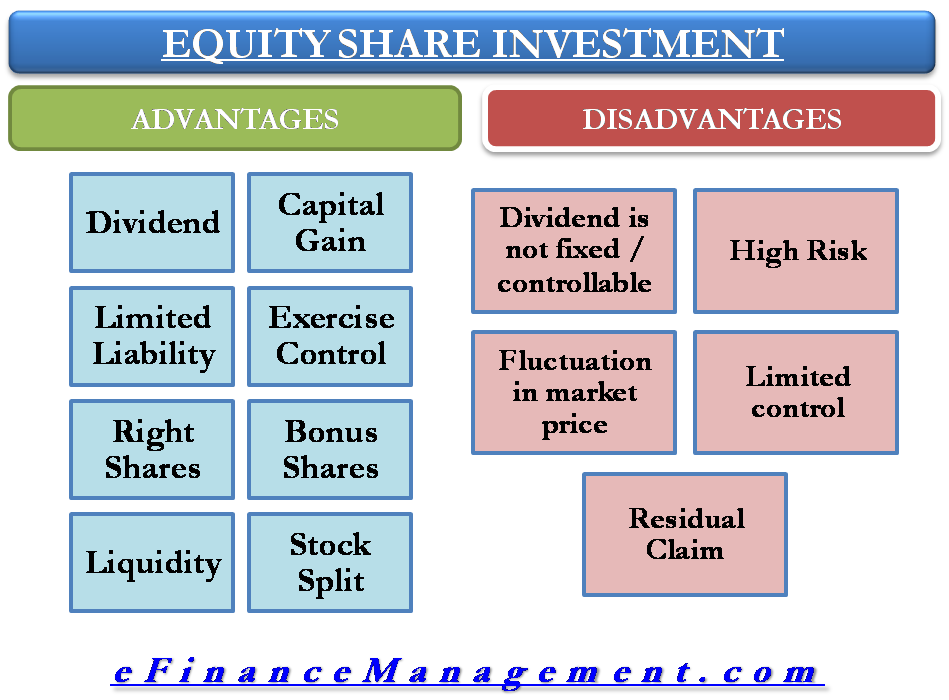

Benefits And Disadvantages Of Equity Shares Investment

Benefits And Disadvantages Of Equity Shares Investment

Reverse Stock Split What It Is What You Should Know Stockstotrade

Reverse Stock Split What It Is What You Should Know Stockstotrade

What Is A Stock Split Definition Types Example Objectives Advantages Disadvantages The Investors Book

What Is A Stock Split Definition Types Example Objectives Advantages Disadvantages The Investors Book

What Is Effect Of Reverse Stock Split Quora

Stock Splits And Bonus Shares Veristrat Inc

Stock Splits And Bonus Shares Veristrat Inc

Relationships Between Stock Split And Bonus Issue Of Shares Their Pr

Relationships Between Stock Split And Bonus Issue Of Shares Their Pr

What Are The Pros And Cons Of Doing A Stock Split Quora

Split Decision The Pros And Cons Of Splitting Shares Wsj

Split Decision The Pros And Cons Of Splitting Shares Wsj

Post a Comment for "Stock Split Pros And Cons"