Stock Standard Deviation Lookup

Answered 9 years ago Author has 372 answers and 12M answer views. Backtest your Standard Deviation trading strategy before going live.

Averaging The N Highest And Lowest Numbers In A List C Tomurtis In 2020 Excel Formula Excel Text Tutorial

Averaging The N Highest And Lowest Numbers In A List C Tomurtis In 2020 Excel Formula Excel Text Tutorial

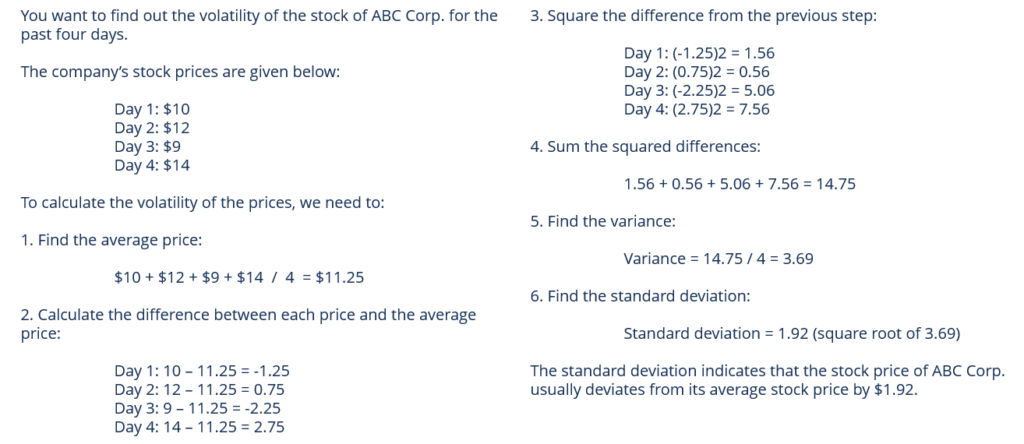

A standard deviation is a measure of how spread out a set of data is.

Stock standard deviation lookup. The correlation coefficient between these stocks is 045. Facebook has current Standard Deviation of 179. We ideally want this variation to be zero.

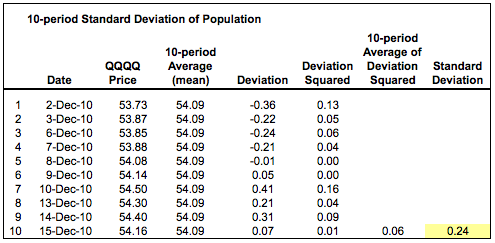

In the table below we list historical volatility standard deviation estimates over the past year and past 5 years. Some investors prefer a conservative approach while others like to take a more aggressive route. Current volatility estimates from our volatility models and the average volatility forecast over the next month.

Coefficient of Variation Standard Deviation Average Price The Stock Volatility Calculator uses closing prices for the last specified number of years for any stock exchange-traded fund ETF and mutual fund listed on a major US. In safety stock calculations the forecast quantity is often used instead of the mean in determining standard deviation. Exchanges are also supported.

This parameter can be changed according to analysis needs. The higher the value of the indicator the wider the spread between price and its moving average the more volatile the instrument and the more dispersed the price bars become. If prices trade in a narrow trading range the standard deviation will return a low value that indicates low volatility.

State of the economy Probability of the states 13 Percentage returns 4 Economic recession Steady economic growth Boom 28 7 Please calculate it 17 Round the answers to two decimal places in percentage form. To find standard deviation on a mutual. It is the most widely used risk indicator in the field of investing and finance.

The standard deviation of a stock is a useful tool for investors to use when searching for their ideal stock. The standard deviation helps to point them in the right direction. β C o v R e R p V a r R p S D R e C o r r R e R p S D R p where R e is the return of the stock and R p is the return of the market portfolio.

Calculate the expected standard deviation on stock. Amazon Inc has current Standard Deviation of 153. A-You have 900 000TL to invest.

Standard Deviation which uses the sigma symbol lets us know how far we are from the mean. I think you are better off looking at the Beta of a stock which is the standard deviation of the stock times its correlation with the market divided by the standard deviation of the market. A high standard deviation indicates a stocks price is fluctuating while a low standard deviation indicates that stocks price is relatively stable.

Conversely if prices swing wildly up and down then standard deviation returns a high value that indicates high volatility. Some stocks traded on non-US. Standard deviation measures the dispersion of a dataset relative to its mean.

A stocks historical volatility is measured as the standard deviation of its past returns annualized. The Standard Deviation is a measure of how spread out the prices or returns of an asset are on average. A volatile stock has a high standard deviation while the deviation of a stable blue-chip stock is usually rather low.

For a mutual fund it represents return variability. Stock B has a standard deviation of 40 and expected return 06. Standard deviation is the statistical measure of market volatility measuring how widely prices are dispersed from the average price.

It is the most widely used risk indicator in the field of investing and finance. You invest 600 000TL in stock A which has a standard deviation of 25 and expected return of 04. Standard deviation is a measure of volatility -- how far a measurement such as rate of return tends to deviate from an average over a particular period.

Knowing the standard deviation for a set of stock prices can be an invaluable tool in gauging a stocks performance. Calculate the expected return and standard deviation of a portfolio that includes A and B. Roughly speaking 21 days equals one month 63 days equals one quarter and 250 days equals one year.

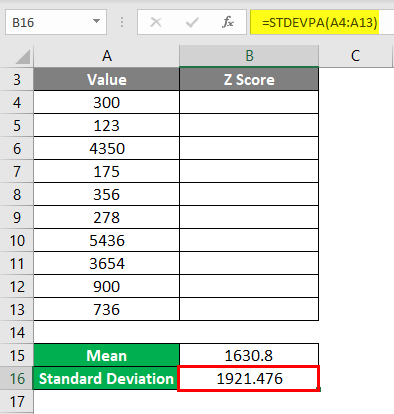

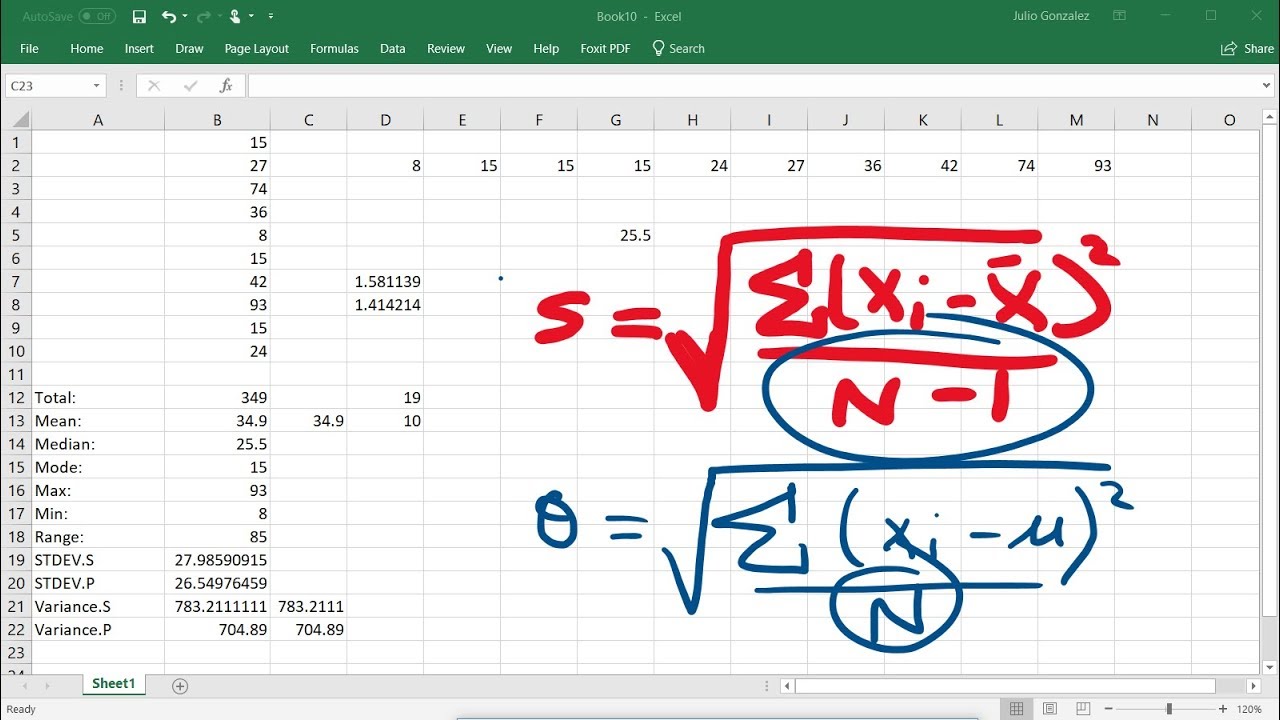

Standard Deviation is commonly used to measure confidence in statistical conclusions regarding certain equity instruments or portfolios of equities. Standard Deviation Standard Deviation is a way to measure price volatility by relating a price range to its moving average. Excel function STDEV calculates the standard deviation of a sample.

The standard deviation is available as an indicator in SharpCharts with a default parameter of 10. Stock exchange and supported by Alpha Vantage. Investors can use standard deviation to predict a funds volatility.

The Standard Deviation is a measure of how spread out the prices or returns of an asset are on average. The standard deviation can also be used on weekly or monthly charts. However you should choose a relevant time period when you would measure it one month one year.

Browse 10939 standard deviation stock photos and images available or search for bell curve or statistics to find more great stock photos and pictures. A few key concepts to take note of regarding standard deviation are. Standard Deviation Stock Screener with an ability to backtest Standard Deviation Stock Screening Strategy and setup trade alerts for Standard Deviation signals.

Standard Deviation is commonly used to measure confidence in statistical conclusions regarding certain equity instruments or portfolios of equities. Checking out standard deviation could still be important to see how volatile the stock price is. Standard deviation measures the dispersion around an average.

Using Standard Deviation To Find Stock Risk Youtube

Using Standard Deviation To Find Stock Risk Youtube

Solved Imperial Taxi Services Solutionzip Taxi Service Taxi Imperial

Solved Imperial Taxi Services Solutionzip Taxi Service Taxi Imperial

Historical Volatility Hv Overview How To Calculate

Historical Volatility Hv Overview How To Calculate

An Introduction To Excel S Normal Distribution Functions Exceluser Com

An Introduction To Excel S Normal Distribution Functions Exceluser Com

Pin By Dave L On News Infographic Marketing Oscar Best Picture Infographic

Pin By Dave L On News Infographic Marketing Oscar Best Picture Infographic

How To Calculate The Standard Deviation In Google Sheets Step By Step

How To Calculate The Standard Deviation In Google Sheets Step By Step

Logical Functions In Excel And Or Xor And Not Excel Logic Spreadsheet

Logical Functions In Excel And Or Xor And Not Excel Logic Spreadsheet

Z Score In Excel Examples How To Calculate Excel Z Score

Z Score In Excel Examples How To Calculate Excel Z Score

Looking For Harvard Financial Accounting Exam Help Answers All The Answers Are Correct And Tested You Can Pur Accounting Exam Financial Accounting Accounting

Looking For Harvard Financial Accounting Exam Help Answers All The Answers Are Correct And Tested You Can Pur Accounting Exam Financial Accounting Accounting

Norm S Dist Function Excel Standard Normal Distribution

Norm S Dist Function Excel Standard Normal Distribution

Standard Deviation Volatility Chartschool

Standard Deviation Volatility Chartschool

How To Use The Excel Stdev Function Exceljet

How To Use The Excel Stdev Function Exceljet

Where Can I Find The Volatility Standard Deviation Of A Stock Quora

Past Surveys Reveal That 30 Of Tourists Going To Las Vegas To Gamble Spend More Than 1 000 This Or That Questions Homework Case Study

Past Surveys Reveal That 30 Of Tourists Going To Las Vegas To Gamble Spend More Than 1 000 This Or That Questions Homework Case Study

Calculating The Standard Deviation Mean Median Mode Range Variance Using Excel Youtube

Calculating The Standard Deviation Mean Median Mode Range Variance Using Excel Youtube

Bitcoin Diamond Wallet Ios Bitcoin Startup Company Investing

Bitcoin Diamond Wallet Ios Bitcoin Startup Company Investing

Standard Deviation How To Use It When Trading Options Tastytrade

Standard Deviation How To Use It When Trading Options Tastytrade

Normal Distribution Statistics The Ultimate Guide

Normal Distribution Statistics The Ultimate Guide

Post a Comment for "Stock Standard Deviation Lookup"