Stock Valuation Research Paper

This time you will be doing research about the valuation of the company to try to determine if its stock price is overvalued or undervalued. The purpose of this paper is to investigate the stock price of the selected companies and evaluate it to empirically examine the selected companies using the Dividend growth model to establish whether share prices of these selected banks on the GSE follow the valuation model of the Gordons model DGM.

Stock Analyst Report Template 4 Professional Templates Report Template Professional Templates Templates

Stock Analyst Report Template 4 Professional Templates Report Template Professional Templates Templates

Traditional approaches to valuing equities have largely focused on the Dividend Discount Model.

Stock valuation research paper. Write a 2- to 3-page paper with the following items. It may be hard to reliably estimate dividend processes in small samples and market participants focus primarily on earnings and other accounting information in analyzing stocks. However due to methodological choices and data availability.

Skip to main content. This article reports the results of a questionnaire survey in JuneJuly 2010 on the use of Fundamental and Technical analysis by brokersfund managers in Indian stock market to. K and Ganesh L Abstract.

INTERNATIONAL ECONOMICS FINANCE JOURNAL Vol. What is an Equity Research Report. We cover analyst salary job description industry entry points and possible career paths.

When it comes to the valuation of equities there are three different methods that are commonly used. Learn about stock investing and read on to see our analysts takes on the latest stock stories. A Generalized Earnings Model of Stock Valuation.

Excerpt from Research Paper. Although all of these papers address various interesting issues related to dynamic stock val-uation none of them incorporates uncertainty and learning about company fundamentals into the valuation framework. This paper the research into valuation models and metrics in finance is surprisingly spotty with some aspects of valuation such as risk assessment being deeply analyzed and others such as how best to estimate cash flows and reconciling different versions of.

Stock valuation can be calculated using a number of different methods. An equity research report is a document prepared by an Analyst Equity Research Analyst An equity research analyst provides research coverage of public companies and distributes that research to clients. You can use Google Finance Yahoo Finance or similar Web pages to find the financial information about this company.

The purpose of this paper is an attempt to reach a better stock valuation model of the Fundamental Analysis Approach by reviewing the theoretical foundations and literature reviews. The most common methods used are the discounted cash flow method the PE method and the Dividend Discount Model In this study we are using Dividend Discount Model DDM to value company stock. Company profile page for Valuation Research Corp including stock price company news press releases executives board members and contact information.

Dividend policy in the. When deciding which valuation method to use to value a stock for the first time its easy to become overwhelmed by the number of valuation techniques available to investors. View Property Valuation Research Papers on Academiaedu for free.

Unlike relative forms of valuation that look at comparable companies intrinsic valuation looks only at the inherent value of a business on its own. As one might expect there are pros and cons to each approach. The purpose of this paper was to study inventory costing methods in greater detail by identifying the prevailing method of inventory valuation consistency in application and harmonization with.

Often promised seldom delivered is the best description for synergy the most widely used rationale in corporate mergers. Our stock-picking approach focuses on long-term advantages and intrinsic value. In this paper we first provide a concise review of stock markets and taxonomy of stock market prediction methods.

Dividend and Non-dividend Stock Valuation Introduction According to Peris the discount growth model is a technique that is used to value dividend stocks and covers gains in both capital and dividends. In this paper learning is done by investors valuing a rm. That provides a recommendation on whether investors should buy.

We then focus on some of the research achievements in stock analysis and. 1 January-June 2011. ESOPs Restricted Stock and Value Download paper The Value of Synergy.

Related literature explores the. These three methods are the dividends valuation method the free cash-flow method and the market-based method. Every investor who wants to beat the market must master the skill of stock valuation.

On a stock level building-stock modelling is commonly used to assess impact of renovation on a national and city level targeting stakeholders operating at a planning or policy level. By Andrew Ang Jun Liu. 27-37 FUNDAMENTAL ANALYSIS AS A METHOD OF SHARE VALUATION IN COMPARISON WITH TECHNICAL ANALYSIS Venkatesh C.

There are valuation. We also examine why companies miscalculate so often when it comes to synergy. Essentially stock valuation is a method of determining the intrinsic value Intrinsic Value The intrinsic value of a business or any investment security is the present value of all expected future cash flows discounted at the appropriate discount rate.

What is the PE ratio of this company. In this paper we explore how synergy is created and how to value it. By reviewing the theoretical foundations for each model of the fundamental analysis models and sequentially beginning of the Discounted Dividend Model DDM through a Multiplier Models and finally the Discounted Cash Flow Model DCFM we find that all these models have strengths despite the lack of accuracy.

Dissertation Question I Need To Formulate A Research Direction And Question From The Topic Information Below 20 Pay This Or That Questions Dissertation Topics

Dissertation Question I Need To Formulate A Research Direction And Question From The Topic Information Below 20 Pay This Or That Questions Dissertation Topics

Business Valuation Written In A Document Business Valuation Written In A Docume Spon Written Val Business Valuation Enterprise Value Financial Advisory

Business Valuation Written In A Document Business Valuation Written In A Docume Spon Written Val Business Valuation Enterprise Value Financial Advisory

Shell S Rev Vs Oil Price Hedge Fund Manager Investing Value Stocks

Shell S Rev Vs Oil Price Hedge Fund Manager Investing Value Stocks

How To Do The Relative Valuation Of Stocks Investment Quotes Stock Market Investing

How To Do The Relative Valuation Of Stocks Investment Quotes Stock Market Investing

How To Find Intrinsic Value Of Stocks Using Graham Formula Intrinsic Value Value Stocks Investment Analysis

How To Find Intrinsic Value Of Stocks Using Graham Formula Intrinsic Value Value Stocks Investment Analysis

Emerging Markets A Bargain Or Fool S Gold Validea S Guru Investor Blog Investors Emergency Fool Gold

Emerging Markets A Bargain Or Fool S Gold Validea S Guru Investor Blog Investors Emergency Fool Gold

Stock Analyst Report Template 7 Templates Example Templates Example Report Template Research Paper Outline Template Executive Summary Template

Stock Analyst Report Template 7 Templates Example Templates Example Report Template Research Paper Outline Template Executive Summary Template

Equity Yields Vs Corporate Bond Yields Corporate Bonds Equity Corporate Profits

Equity Yields Vs Corporate Bond Yields Corporate Bonds Equity Corporate Profits

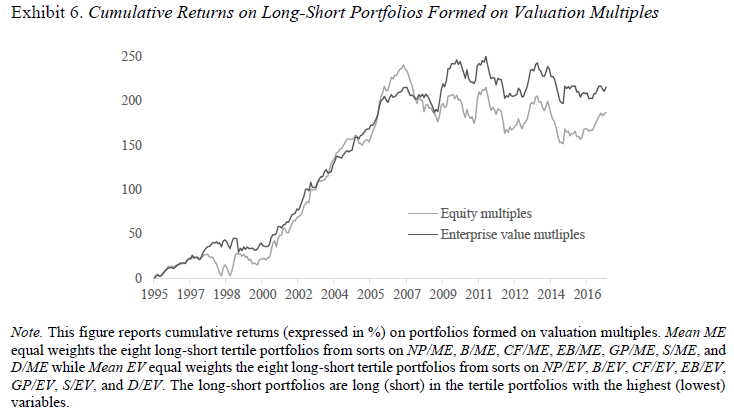

Timing Country Exposure With Value A Valuation Measure Horserace Enterprise Value Exposure Research Paper

Timing Country Exposure With Value A Valuation Measure Horserace Enterprise Value Exposure Research Paper

Momentum Everywhere Including In Factors Momentum Factors Research Paper

Momentum Everywhere Including In Factors Momentum Factors Research Paper

Fin 571 Week 2 Stock Valuation And Analysis All Assignments Class Analysis Financial Information Week

Fin 571 Week 2 Stock Valuation And Analysis All Assignments Class Analysis Financial Information Week

Sample Research Paper Apa Pdf File Research Paper Academic Writing Proposal Writing

Sample Research Paper Apa Pdf File Research Paper Academic Writing Proposal Writing

The Returns To Value Strategies When Valuation Spreads Are Wide Deep Value Strategies Deep Investing In Stocks

The Returns To Value Strategies When Valuation Spreads Are Wide Deep Value Strategies Deep Investing In Stocks

Academic Research Insight Being Surprised By The Unsurprising Earnings Seasonality And Stock Returns Academic Research Insight Academics

Academic Research Insight Being Surprised By The Unsurprising Earnings Seasonality And Stock Returns Academic Research Insight Academics

Researching A Company S Competitors Before Purchasing Its Stock Linda S Stocks Stock Research Competitor Analysis Stock Analysis

Researching A Company S Competitors Before Purchasing Its Stock Linda S Stocks Stock Research Competitor Analysis Stock Analysis

Academic Research Insight Does Past Performance Matter In Investment Manager Selection Academic Research Investing Insight

Academic Research Insight Does Past Performance Matter In Investment Manager Selection Academic Research Investing Insight

10 Yrs Returns Vs P E Ratio This Plot Shows The Correlation Of Expected Returns To The Valuation Of Stocks When You Purc Stock Market Research Paper Graphing

10 Yrs Returns Vs P E Ratio This Plot Shows The Correlation Of Expected Returns To The Valuation Of Stocks When You Purc Stock Market Research Paper Graphing

A Stock Market Crash Of 50 Would Not Be A Surprise Or The Worst Case Scenario Marketing Us Stock Market Stock Market Crash

A Stock Market Crash Of 50 Would Not Be A Surprise Or The Worst Case Scenario Marketing Us Stock Market Stock Market Crash

Bus 657 Bus657 Week 6 Final Paper Ashford Corporate Financing Ashford Research Paper

Bus 657 Bus657 Week 6 Final Paper Ashford Corporate Financing Ashford Research Paper

Post a Comment for "Stock Valuation Research Paper"