What Is The Impact Of Stock Split

In the present study the impact of stock split is identified and the pertinent literatures related to the context are as follows. Iii If bonus shares are issued by a company investors being shareholders get more share as a result of stock split.

What Is A Stock Split Forbes Advisor

What Is A Stock Split Forbes Advisor

Pooja 2013 analyzed the market reaction around stock split announcement using event study methodology by taking a sample of 27 companies that split their stock during the period January 1 2008 to December 31 2009.

What is the impact of stock split. The stock split had no immediate impact on the value of Apple. Although the number of shares outstanding increases by a specific. The stock can be even be split in a 3-for-1 or 5-for-1 manner.

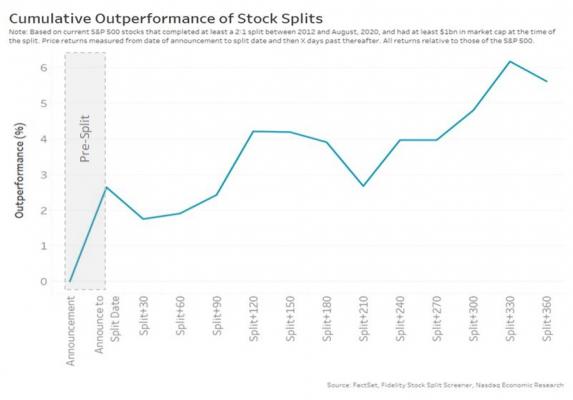

Since a stock split demands a company to increase its outstanding shares your shareholding in the company increases in terms of the number of shares. Researchers at the Stern School of Business at NYU and Emory University looked at more than 40 years of data from 1962 to 2001 and found that of the 1600 reverse stock splits shares underperformed their non-split peers by 156 in the first year following the split 36 in the second year and 54 in the third year. The net effect of a stock split for investors is that they receive an additional share s for every share they own but the value of each share is now reduced by the factor of the split.

During 2015 after the first week of a reverse stock split the results were mixed with an average drop of 6. While a split has no financial impact some corporation boards believe that it is psychologically difficult for investors to buy shares of expensive stock customarily referring to shares over 80. For example a 3-for-1 forward split means that.

However the percentage of your holding in the share capital remains unchanged. Lalit Thakkar managing director-institution Angel Broking says The prime intention behind the stock split is to enhance liquidity in the stock and also to make the stock more affordable. Does it dilute value.

Ii A stock split helps the small investors to acquire shares particularly when the prices of shares are very high. A dividend or cash payment made periodically by a company is impacted by a stock split depending on the dividends date of record or the date on which one must be a shareholder to receive a. The total market value of Apples stock increased on the date of the stock split due to market fluctuation.

Existing shares split but the underlying value remains the same. If it decides to split the stock instead of one share of a particular face value the share holder will have two shares of the same yet equally divided face value. With the exception of INVT the companies that saw a positive stock appreciation had a.

Stock split doesnt increase the value of your investment. Stock split adds additional shares to your portfolio. As the number of shares increases price per share goes down.

After the split Apple had approximately 6 billion shares valued at roughly 94 per share. Hence your total Apple holdings remains the same at 40900 400 shares times 10225. The most common type of stock split is a forward split which means a company increases its share count by issuing new shares to existing investors.

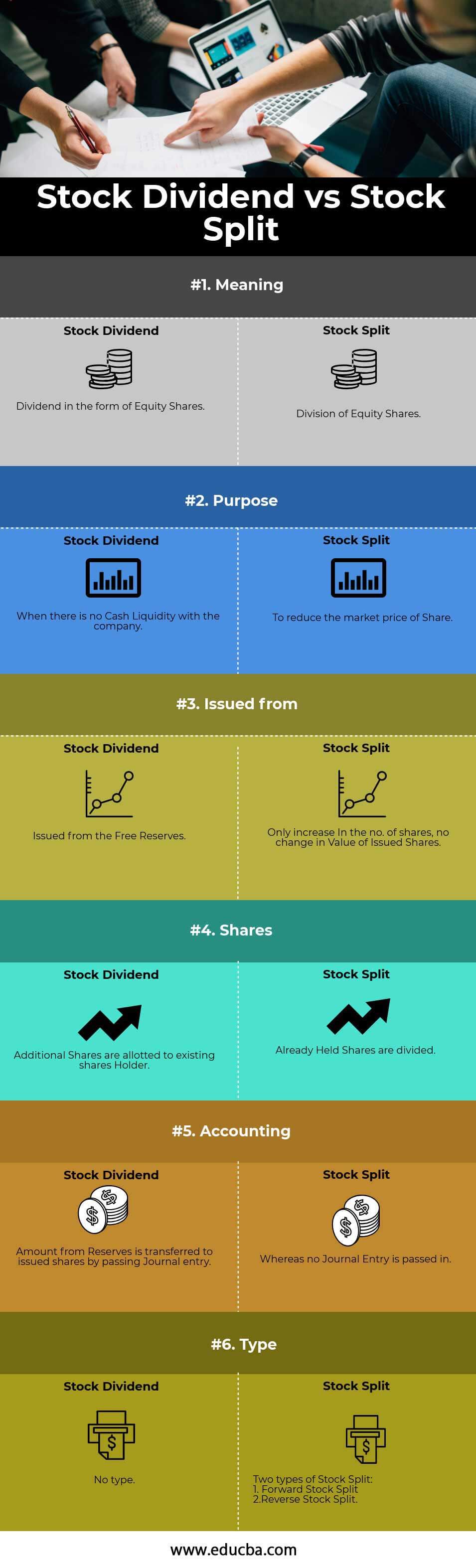

For example a 2-for-1 stock split would double the number of shares outstanding and halve the par value per share. The company doing the stock split is effectively increasing the number of outstanding shares by a predetermined ratio while decreasing the share price proportionally. Stock split is a corporate strategy to divide each share of the company into a particular number of shares by reducing the share price proportionately without changing the market capitalization or companys net worth.

If a company issued a stock split ratio with a 21 split the value of each share would be cut in half. Stock splits are events that increase the number of shares outstanding and reduce the par or stated value per share. I A stock split is a good buying indicator signalling that the prices of shares of the company are increasing.

Since Apple just announced a 41 stock split effective August 28 2020 you will receive 4 shares for each 1 share of Apple you own. A stock split is a decision by the companys board to increase the number of outstanding shares. A stock split divides existing shares into more shares.

A stock split is when a company divides the existing shares of its stock into multiple new shares to boost the stocks liquidity. A stock dividend is a fixed amount of shares paid to existing shareholders in lieu of cash dividends. As a result you will now own 400 shares and the stock price will be divided by 4 to equal 10225.

When a company declares a stock split the number of shares of that company increases but the market cap remains the same.

7 Points Comparison Bonus Share Vs Stock Split Yadnya Investment Academy

7 Points Comparison Bonus Share Vs Stock Split Yadnya Investment Academy

Things You Must Know About Stock Splits Asaninvestor Personal Finance Quotes Money Management Personal Finance Books

Things You Must Know About Stock Splits Asaninvestor Personal Finance Quotes Money Management Personal Finance Books

What Is A Stock Split Frequently Asked Questions Investing Dividend Investing Value Investing

What Is A Stock Split Frequently Asked Questions Investing Dividend Investing Value Investing

7 Things To Do Before You Start Investing Investing Stock Market Investing Stock Market

7 Things To Do Before You Start Investing Investing Stock Market Investing Stock Market

Netchange Can Be Displayed As Either A Positive Or Negative Or On Rare Occasions Neutral Depending On The Direction Of The Smart Money Finance Positivity

Netchange Can Be Displayed As Either A Positive Or Negative Or On Rare Occasions Neutral Depending On The Direction Of The Smart Money Finance Positivity

How Investors Can Gain From Company Stock Splits

How Investors Can Gain From Company Stock Splits

Splitting Stocks Changes Them Fundamentally Nasdaq

Splitting Stocks Changes Them Fundamentally Nasdaq

What Is A Stock Split Definition Types Example Objectives Advantages Disadvantages The Investors Book

What Is A Stock Split Definition Types Example Objectives Advantages Disadvantages The Investors Book

Reverse Stock Splits Good Or Bad For Shareholders Youtube

Reverse Stock Splits Good Or Bad For Shareholders Youtube

Stock Dividend Vs Stock Split Top 6 Best Differences With Infographics

Stock Dividend Vs Stock Split Top 6 Best Differences With Infographics

What Is Stock Split Yadnya Investment Academy

What Is Stock Split Yadnya Investment Academy

Apple Stock Split History Everything You Need To Know Ig En

Apple Stock Split History Everything You Need To Know Ig En

Samsung Improves Shareholder Value By Approving Stock Split And Year End Dividend Samsung Samsung Galaxy Global Tv

Samsung Improves Shareholder Value By Approving Stock Split And Year End Dividend Samsung Samsung Galaxy Global Tv

Stock Splits And Stock Dividends Accountingcoach

Stock Splits And Stock Dividends Accountingcoach

Apple Tesla Stock Splits 2020 Td Ameritrade Singapore

Apple Tesla Stock Splits 2020 Td Ameritrade Singapore

Stock Splits Explained Youtube

Stock Splits Explained Youtube

How To Invest Into The Stock Market Udemy Free Download In 2020 Stock Market Investing Investing Strategy

How To Invest Into The Stock Market Udemy Free Download In 2020 Stock Market Investing Investing Strategy

:max_bytes(150000):strip_icc()/dotdash_v2_Understanding_Stock_Splits_Aug_2020-012-b223f723115044d5897cdda57e1be4b7.jpg)

Post a Comment for "What Is The Impact Of Stock Split"