How To Calculate Npv Of A Stock

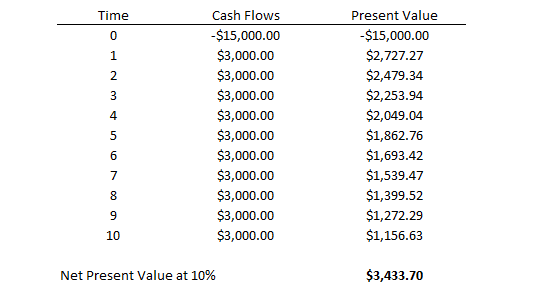

Calculation of NPV can be done as follows NPV 291510. Plug the numbers into the formula to complete your calculation.

Npv Vs Irr In Real Estate Investing Break Into Cre

Npv Vs Irr In Real Estate Investing Break Into Cre

The profitability index is calculated with the following formula.

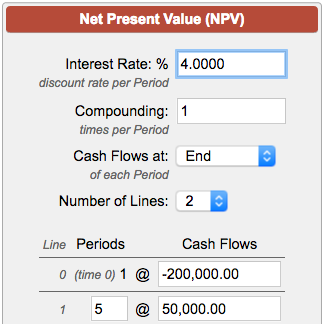

How to calculate npv of a stock. Steps to Calculate NPV in Excel There are two methods to calculate the NPV in the Excel sheet. If you wonder how to calculate the Net Present Value NPV by yourself or using an Excel spreadsheet all you need is the formula. The target rate of return is 12.

Calculate an average annual earnings per share EPS growth figure for the company in question for say the last five years. Sum up the present values to obtain the intrinsic value of the stock. This article explains how you can value a stock ie.

103 divided by 102 yields a positive NPV of 10098. With a 3 percent profit the NPV today equals 103 divided by one plus the amount of inflation or one plus 002. The regular NPV function NPV assumes that all cash flows in a series occur at regular intervals ie.

Type in the expected return keeping the information sequential. 1 2 1 2 7 0. Calculate its intrinsic value using the Discounted Cash Flow DCF Model with Apple stock as a case study example.

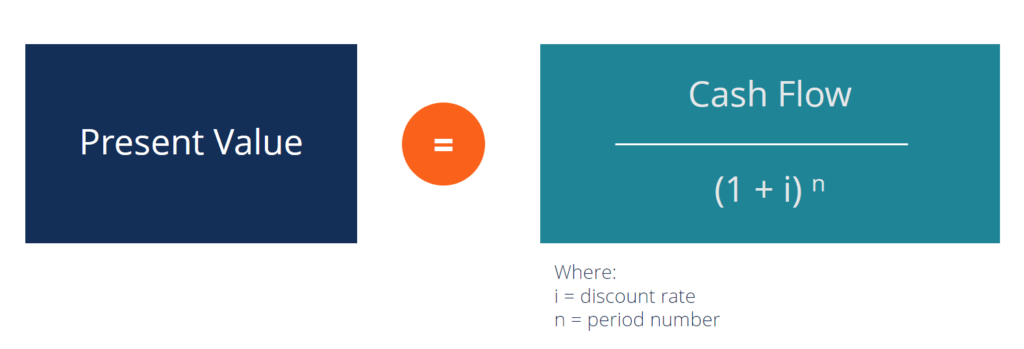

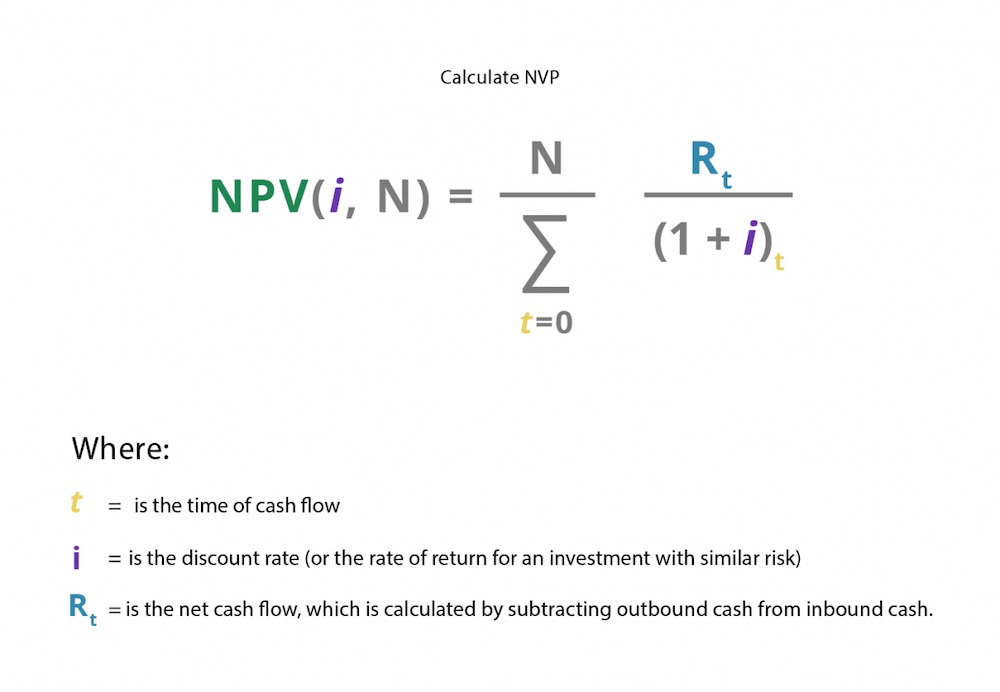

NPV Net Present Value PV Present Value Discount rate is key to managing the relationship between an investor and a company as well as the relationship between a company and its future self. Do this by subtracting. The two functions use the same math formula shown above but save an analyst the time for calculating it in long form.

N P V o f p r o j e c t X 1 0 0 0 0 1 0. In this example we are getting a positive net present value of future cash flows so in this example also we will accept the project. Where r is the discount rate and t is the number of cash flow periods C0 is the initial investment while Ct is the return during period t.

Calculate the present value of each of these future cash flows. The formula is DE 1RY where D is any dividends expected to be paid during the period E is the expected stock price Y is the number of years down the line and R is the real rate of return you estimated. Lets learn more about the DCF model.

Profitability index present value of future cash flows initial investment We calculated that the net present value of all of. The first step is the toughest by far. When you have the chart filled out use the following formula to calculate the NPV of each investment.

First is to use the basic formula calculate the present value of each component for each year. Calculate the future value FV of the EPS say five years hence knowing the current EPS. WACC formula WeCeWdCd 1-tax rate 20358015 1-32 WACC 1516.

Excel offers two functions for calculating net present value. Growth Rate in the Present Value of Stock Formula The growth rate used for calculating the present value of a stock with constant growth can be estimated as Multiplying the retention ratio by the return on equity can then be reduced to retained earnings divided average stockholders equity. NPV can be calculated for any number of years.

In an empty cell type NPV cell with discount ratetime period sum of returns. Years quarters month and doesnt allow for any variability in those time period. Since the cash inflows are uneven the NPV formula is broken out by individual cash flows.

Stock valuation methods are important to investors who want to gauge if they are buying a stock at a discount or a premium. Net Present Value NPV Cash Flow 1rate of return number of time periods The outcomes for NPV can be positive or negative which correlates to whether a project is ideal a positive. This calculation is applied by estimating all future cash flows and then discounting them by the cost of capital to derive the present value PV of all future cash flows.

Use a simple formula to determine the present value of the stock price. A common period used by analysts is 30 years. The Net Present Value NPV is the sum of all future cash flows incoming and outgoing.

NPV can be calculated with the formula NPV P 1it C where P Net Period Cash Flow i Discount Rate or rate of return t Number of time periods and C Initial Investment. Allows the intrinsic value of a company to be estimated. Present Value of Stock With Constant Growth calculator uses Price of StockEstimated Dividends for Next Period Rate of Return-Growth Rate to calculate the Price of Stock Present Value of Stock With Constant Growth is the price of a security that signifies ownership in a corporation and represents a claim on part of the corporations assets and earnings when there is constant growth.

Present Value Future Value And Discount Rates The Divergent View

Present Value Future Value And Discount Rates The Divergent View

Calculate The Cash Flow Value By Net Present Value Calculator Npv Calculator Is The Calculator By Which You Can Cash Flow Financial Decisions Opportunity Cost

Calculate The Cash Flow Value By Net Present Value Calculator Npv Calculator Is The Calculator By Which You Can Cash Flow Financial Decisions Opportunity Cost

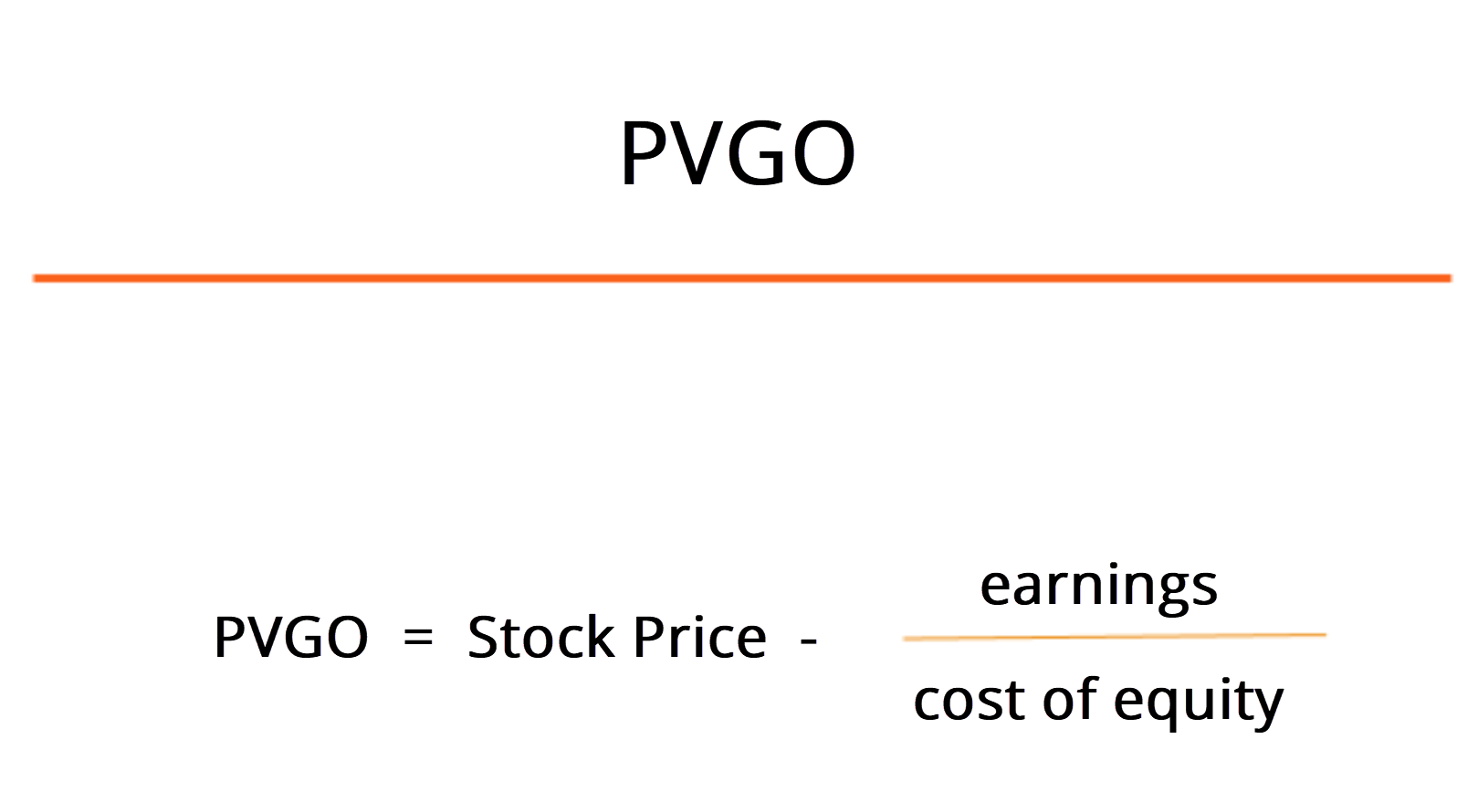

Pvgo Present Value Of Growth Opportunities Formula Examples

Pvgo Present Value Of Growth Opportunities Formula Examples

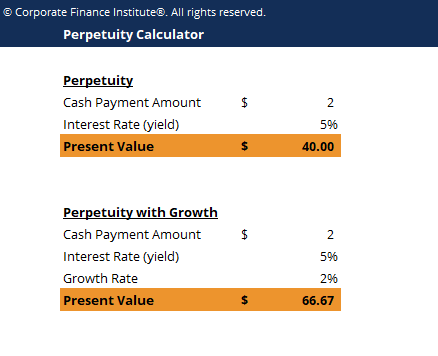

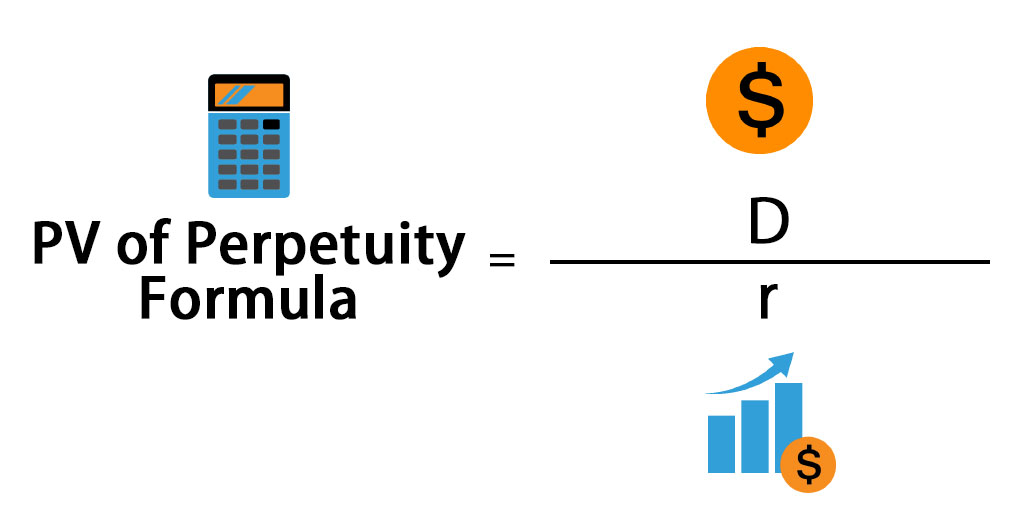

Perpetuity Definition Formula Examples And Guide To Perpetuities

Perpetuity Definition Formula Examples And Guide To Perpetuities

Discount Rate Formula How To Calculate Discount Rate With Examples

Discount Rate Formula How To Calculate Discount Rate With Examples

/net-present-value-785bef0bd7e840438ada6e8abadadb97.jpg) What Is The Formula For Calculating Net Present Value Npv

What Is The Formula For Calculating Net Present Value Npv

Perpetuity Formula Calculator With Excel Template

Perpetuity Formula Calculator With Excel Template

How To Calculate Npv Stock Market Financial Decisions How To Find Out

How To Calculate Npv Stock Market Financial Decisions How To Find Out

Why Do Not Include Loan Payments In Npv Quantitative Finance Stack Exchange

Why Do Not Include Loan Payments In Npv Quantitative Finance Stack Exchange

How To Calculate Npv Formula And Example Study Help Formula Learning

How To Calculate Npv Formula And Example Study Help Formula Learning

Npv Formula Learn How Net Present Value Really Works Examples

Npv Formula Learn How Net Present Value Really Works Examples

What Are The Advantages And Disadvantages Of The Net Present Value Method The Motley Fool

What Are The Advantages And Disadvantages Of The Net Present Value Method The Motley Fool

How To Calculate Npv Using Xnpv Function In Excel

What Is The Formula For Calculating Net Present Value Npv In Excel

Net Present Value Definition Example Investinganswers

Net Present Value Definition Example Investinganswers

Npv Calculator Excel Template Calculate Npv Irr In Excel

Npv Calculator Excel Template Calculate Npv Irr In Excel

/dotdash_Final_Net_Present_Value_NPV_Jul_2020-01-4cf181815e2741debb4174301e1b4b99.jpg)

Post a Comment for "How To Calculate Npv Of A Stock"