How To Calculate Reverse Stock Split

Making sense of a strange split ratio. Look up the exchange rate.

Stock Split Meaning Examples Formula Advantages Reasons

Stock Split Meaning Examples Formula Advantages Reasons

To calculate your adjusted basis in the 20 shares you now own you will take your original purchase price of 250 10 shares x 25 per share and.

How to calculate reverse stock split. Lets do a quick example. The rate is normally a ratio such as 110 or 1 for 10. If a reverse split ratio is 15 then the company takes four shares for every five shares you own.

Shares after the splitshares AB. Lets say for instance a company were to execute a 1 to 5 reverse stock split. By 522001 the market price for the stock had fallen to 200 per share a.

For example if a company declares a one for ten reverse stock split every ten shares that you own will be converted into a single share. With a reverse stock split you end up owning fewer shares but each share is worth more that the original. Reverse stock splits decrease the number of shares you own.

Using the example above divide 40 by two and we get the new trading price of 20. Calculating the effects of a reverse stock split is easy. Dividing Number of.

An easy way to determine the new stock price is to divide the previous stock price by the split ratio. Checking the Exchange Rate. Determine the original share price.

Enter your data separately for each tax lot ie. Promoters try to remove this notion by announcing reverse stock splits. Total the number of stocks you own in the company.

Assume that you bought 1000 shares of XYZ Corp on 422000 at 2000 per share for a total cost of 2000000. Total cost basis of stock including commissions fees total not per share adjusted for previous spinoffs or other corporate actions. Number of shares of stock before this split.

For example if you own 1000 shares of a stock priced at 50 a share your position is. But first lets provide the simple formula. This determines the revised number of outstanding shares.

In this case you would own 20 shares of stock. How to Calculate a Reverse Stock Split Totaling Your Stocks. Reverse Stock Splits When a company completes a reverse stock split each outstanding share of the company is converted into a fraction of a share.

Calculate the number of shares you have after the reverse stock split by dividing the number of shares you originally owned by the number of old shares that are equal to one new share. A reverse stock split while rare usually occurs when a companys stock price is too low or and the company wants to artificially boost the stock price to remain listed on an exchange. There is no formula for calculating how many shares you receive in a split.

For example a reverse split of 21 would mean every 2 shares now equals 1. Common share swap ratios used in a reverse stock split are 12 1-for-2 110 150 and even 1100. For example in March 2015 pest-termite-and-rodent-killer Rollins made a 3-for-2 stock splitIts common stock share count rose by one-half from 146 million.

The typical math in a reverse stock split is performed by a companys brokerage firm. The reverse split trades a specific number of. Next determine the original price.

Simply divide the number of shares you own by the split ratio and multiply the pre-split share price by the same amount. There is no set standard or formula for determining a reverse stock split ratio. Locate the net income for the period.

Reverse Stock Split Example First determine the reverse split ratio. Finally calculate the new share price. Motivation for reverse stock split is opposite to stock split as here promoters want to increase the price of shares.

Recalculate the outstanding shares of common stock after the reverse stock split. Stocks may be trading at a very low price leading to conclusion that its a penny stock. Stock price after the splitstock price BA.

Reverse stock splits are rarely beneficial for shareholders because the stock price starts off at a higher price and you have fewer shares making it more. Divide the number of outstanding shares by the multiple of the reverse stock split. Calculate the new share price using the.

Here is an example of how to record a reverse stock split.

How Does A 3 2 Stock Split Work If You Have An Uneven Number Of Shares Tradersfly

How Does A 3 2 Stock Split Work If You Have An Uneven Number Of Shares Tradersfly

What Happens In A Reverse Stock Split If You Don T Have Enough Shares Quora

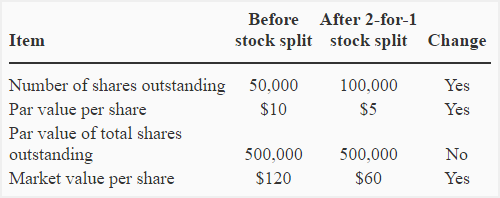

Stock Split Explanation Example And Memorandum Entry Accounting For Management

Stock Split Explanation Example And Memorandum Entry Accounting For Management

Companies Turn To Reverse Stock Splits Ahead Of Ipos Wsj

Companies Turn To Reverse Stock Splits Ahead Of Ipos Wsj

The Comprehensive Guide To Stock Price Calculation Quandl Blog

The Comprehensive Guide To Stock Price Calculation Quandl Blog

Reverse Stock Splits Good Or Bad For Shareholders Youtube

Reverse Stock Splits Good Or Bad For Shareholders Youtube

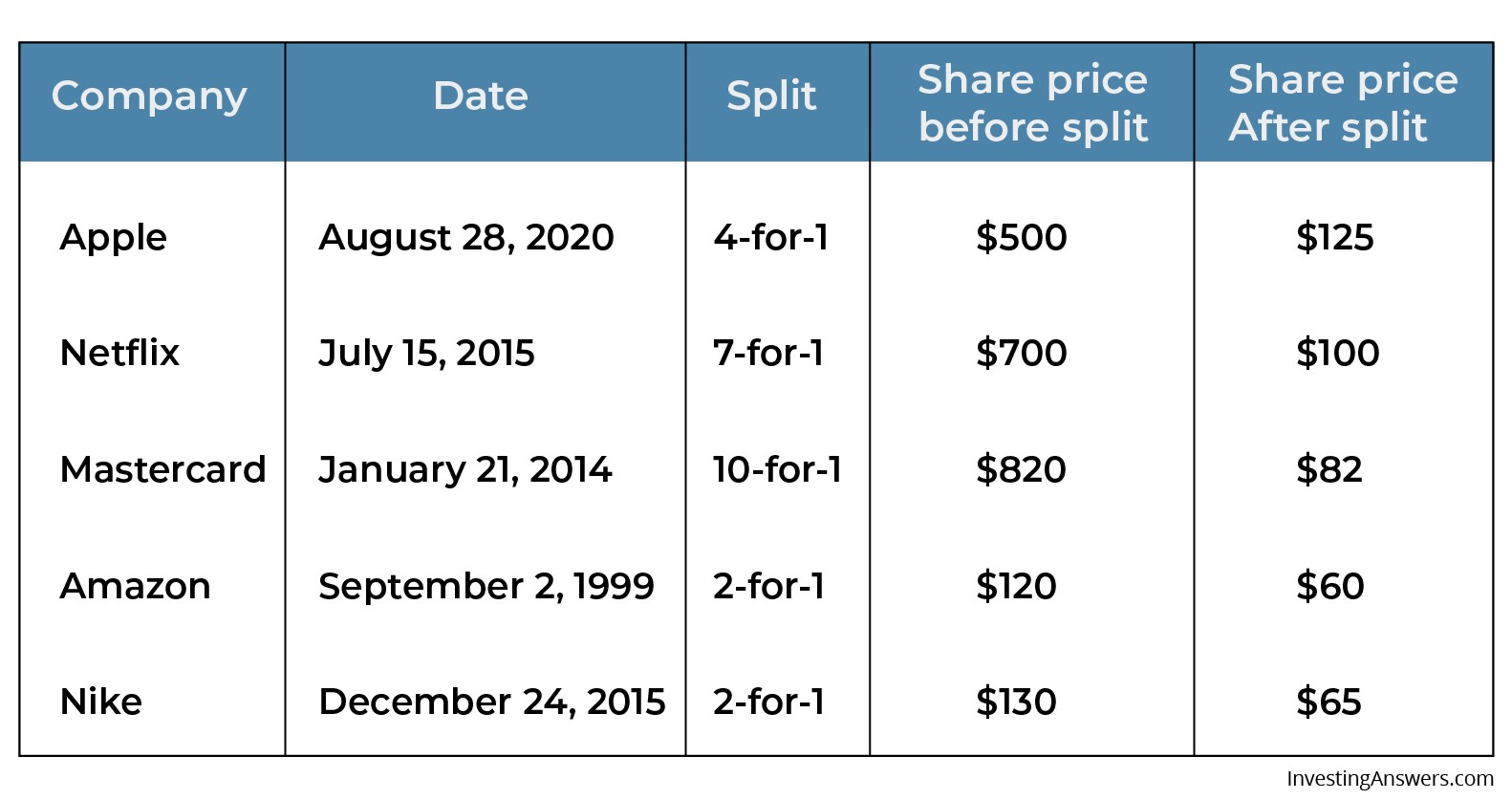

How To Benefit From A Stock Split Investinganswers

How To Benefit From A Stock Split Investinganswers

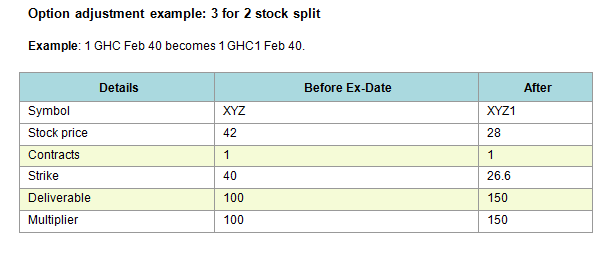

What Happens To Options While Stock Is Doing Reverse Split Reinis Fischer

What Happens To Options While Stock Is Doing Reverse Split Reinis Fischer

Option Contract Adjustments Fidelity

Option Contract Adjustments Fidelity

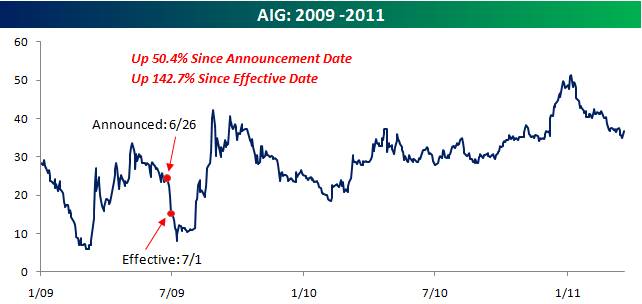

The Impact Of A Reverse Stock Split Seeking Alpha

The Impact Of A Reverse Stock Split Seeking Alpha

What Investors Need To Know About Stock Splits Sharesight

What Investors Need To Know About Stock Splits Sharesight

Math Of A Reverse Stock Split Investmentbank Com

Math Of A Reverse Stock Split Investmentbank Com

Stock Splits Did You Know What Stock Splits Were Before This Post Let Me Know In The Comment Section B Business Mentor Business Money Business Networking

Stock Splits Did You Know What Stock Splits Were Before This Post Let Me Know In The Comment Section B Business Mentor Business Money Business Networking

Reverse Stock Split What It Is What You Should Know Stockstotrade

Reverse Stock Split What It Is What You Should Know Stockstotrade

Stock Splits Explained Youtube

Stock Splits Explained Youtube

:max_bytes(150000):strip_icc()/symbol-1757582_1920-bf9423ed95d84812910b7298caad746c.png)

Post a Comment for "How To Calculate Reverse Stock Split"