How To Trade Futures Overnight

Futures trading does not depend on a bull or bear market. The price action is a lot cleaner imo but the liquidity is still there at least for smaller.

Trading Gold Futures Price Action L Fibonacci Retracement And Price Action Levels Trade Forex For A Living Gold Futures Learn Forex Trading Fibonacci

Trading Gold Futures Price Action L Fibonacci Retracement And Price Action Levels Trade Forex For A Living Gold Futures Learn Forex Trading Fibonacci

While at the same time you also know that not every futures market will match your trading strategy.

How to trade futures overnight. E-Mini SP 500 futures ES are an excellent middle ground and a good place for day traders to start. Normal stock market hours on the New York Stock Exchange are from 930 am. Because my trading strategy is so robust I want one of those winners to be a full target winner to qualify for my power of quitting goals.

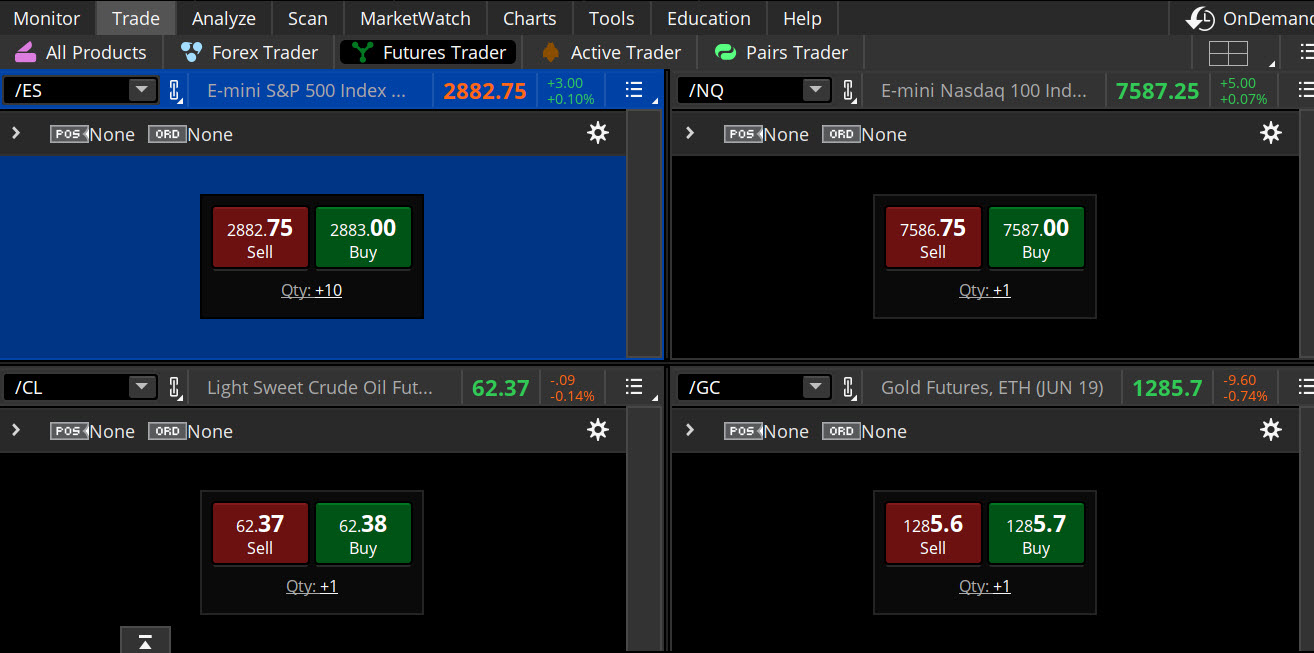

Monitor and close your position. The following shows the performance results for a trading system designed to trade 30-minute bars in the E-mini futures overnight session during the months of Nov to MayThe strategy enters trades using limit prices and exits using a combination of profit targets stop loss targets and MOC orders. EST during the week but outside of normal trading hours premarket and after-hours trading take over and.

The following article on The Best Futures Markets To Day Trade In 2020 is the opinion of Optimus Futures. Since there are futures on the indexes SP 500 Dow 30 NASDAQ 100 Russell 2000 that trade virtually 24 hours a day we can watch the index futures to get a feel for market direction. What to Consider Before Holding a Position Overnight.

When you are day trading an E-Mini Futures markets create a dynamic goal setting strategy that allows you to quit positive on your termsI try to get 2 winners and have a positive result. Futures trading offers tremendous opportunities but it carries high risk. It can be convenient for day traders who dont want to hold their positions overnight.

Understand how futures trading works. Margins are low at 500 and volume is also slightly higher than crude oil. Take Losses at the Close.

A well-thought-out trading process gives you an. Each market stocks forex and futures has different factors to consider. The forex market doesnt close during the week because.

Holding a single contract through a typical trading day could see your profitloss take a 7518 swing 15063 points x 50point. 1 2 Next spectastic. Place your first trade.

Specifically the margin requirement for carrying a position between trading sessions is significantly greater than the margin required to hold a position only during regular trading hours. Understand mark to market. Here you can find premarket quotes for relevant stock market futures eg.

When holding a position for more than one trading session there are additional considerations futures traders must take into account. One strategy suggests that traders should buy the SP 500 at the close every evening and sell the trade on the next open such is the. Discussion in Index Futures started by spectastic Mar 3 2021 at 513 PM.

Theres a lot going on overnight these days. Futures look into the future to lock in a future price or try to predict where something will be in the future. Set your stops and limits.

One word of caution the Globex market the night market moves slowly. Unlike the day market in the E-mini SP which has an average range of about 25 points the night market will move only about seven points on average in a 16-hour periodCompared to the day market which is open only six hours 45 minutes patience is a necessary quality for traders participating in the overnight Globex. Dont Be A Slave To The Emini Market.

This simply means that at the end of each trading day all futures accounts are settled and money is actually transferred between the accounts of all market participants based on their gains and losses during the trading session. The equity in each futures account is marked to market daily. Election and the Brexit vote.

Pick a futures market to trade. Overnight stock trading system. Should You Hold a Day Trading Position Overnight.

Lock In Profits at the Close. And arguably it can be easier to trade overnight sessions. I was surprised to find a relative wealth of research into the effect of overnight returns in the stock market both on SSRN and on the trading strategy resource Quantpedia.

Factors and Risks When Holding Trades. This is where initial margin comes into play or the minimum account balance required to maintain a position of one contract long or short between trading sessions. Decide whether to go long or short.

As a trader you know that not every strategy will suit your style or match your goals. You can trade either way depending on the trend in the futures instrument you are using. Risk and risk.

Dow Jones Futures Nasdaq Futures and SP 500 Futures and world markets indices commodities and currencies. Overnight trading is the trading that takes place outside of normal trading hours provided by the primary exchange the asset is listed on. But even more important than initiating positions in the overnight sessions is the way in which you can use futures as a proxy to manage risk in your equities portfolio.

Create an account and log in. When learning to trade futures it is crucial for new traders to understand futures margin requirements and how these requirements can change depending on how long you hold or carry a position. But with futures you can - and many traders do - as evidenced recently by the massive overnight trading volume surrounding the results of the US.

Pin On Finance Investing And Trading

Pin On Finance Investing And Trading

What Traders Need To Know Mentorship Program Tech Company Logos Marketing

What Traders Need To Know Mentorship Program Tech Company Logos Marketing

Day Trade Scalping 500 Live Scalping 01 Stock Options Trading Scalps Trading

Day Trade Scalping 500 Live Scalping 01 Stock Options Trading Scalps Trading

Exploring A New Road The Basics Of Futures Margin Ticker Tape

Exploring A New Road The Basics Of Futures Margin Ticker Tape

Cz Announces Bitcoin Futures And 20x Leverage Coming To Binance Futures Contract Trading Earn Extra Money Online

Cz Announces Bitcoin Futures And 20x Leverage Coming To Binance Futures Contract Trading Earn Extra Money Online

In My Humble Personal Opinion Before We Get Too Excited From Recent Stock Market Rally We Will Need Commitment Of Traders Streaming Quote Automated Trading

In My Humble Personal Opinion Before We Get Too Excited From Recent Stock Market Rally We Will Need Commitment Of Traders Streaming Quote Automated Trading

T Bond Futures Have Been Extremely Volatile And Affect Many Markets Both On The Futures Side As Well O Commitment Of Traders Streaming Quote Automated Trading

T Bond Futures Have Been Extremely Volatile And Affect Many Markets Both On The Futures Side As Well O Commitment Of Traders Streaming Quote Automated Trading

I M Often Asked What Is The Best Timeframe For Futures Trading Systems The Most Popular Categories Include Day Trading Swing Trading Positive And Negative

I M Often Asked What Is The Best Timeframe For Futures Trading Systems The Most Popular Categories Include Day Trading Swing Trading Positive And Negative

Futures Rally Back From Overnight Lows Now Lets Trade Googl Ba Fb Fdx More Overnight Trading Stock Market

Futures Rally Back From Overnight Lows Now Lets Trade Googl Ba Fb Fdx More Overnight Trading Stock Market

Better Opening Range Breakout The Overnight Gap Setup Breakouts Overnight Day Trading

Better Opening Range Breakout The Overnight Gap Setup Breakouts Overnight Day Trading

Henri Simoes Futures Trader Trading Quotes Stock Market Quotes Forex Trading Training

Henri Simoes Futures Trader Trading Quotes Stock Market Quotes Forex Trading Training

Dow Bleeds Overnight On 50 Chance Of Trump Trade Deal Failure Dow Jones Futures Dow Overnight

Dow Bleeds Overnight On 50 Chance Of Trump Trade Deal Failure Dow Jones Futures Dow Overnight

What Is Futures Trading How To Trade Futures Ig Uk

What Is Futures Trading How To Trade Futures Ig Uk

Trading Robot Thinkorswim Trades E Mini Futures 100 Automatic Trading Quotes Trading Online Trading

Trading Robot Thinkorswim Trades E Mini Futures 100 Automatic Trading Quotes Trading Online Trading

Futures Trading In 2020 A Comprehensive Guide

Futures Trading In 2020 A Comprehensive Guide

Amarkets Trading Stocks Investing Ideas Of Trading Stocks Investing Trading Stocks Investing F Trading Charts Forex Trading Stock Trading Strategies

Amarkets Trading Stocks Investing Ideas Of Trading Stocks Investing Trading Stocks Investing F Trading Charts Forex Trading Stock Trading Strategies

Pre Market Trading Asian London Overnight Marketing Software Marketing Mentorship Program

Pre Market Trading Asian London Overnight Marketing Software Marketing Mentorship Program

How To Trade Index Futures Trade Futures

How To Trade Index Futures Trade Futures

Critical Point For Market Http Www Moneymakeredge Com Blog This Is Where We Were A Year Ago Before The Drop Trading Courses Day Trading Trading

Critical Point For Market Http Www Moneymakeredge Com Blog This Is Where We Were A Year Ago Before The Drop Trading Courses Day Trading Trading

Post a Comment for "How To Trade Futures Overnight"