Lmt Stock Intrinsic Value

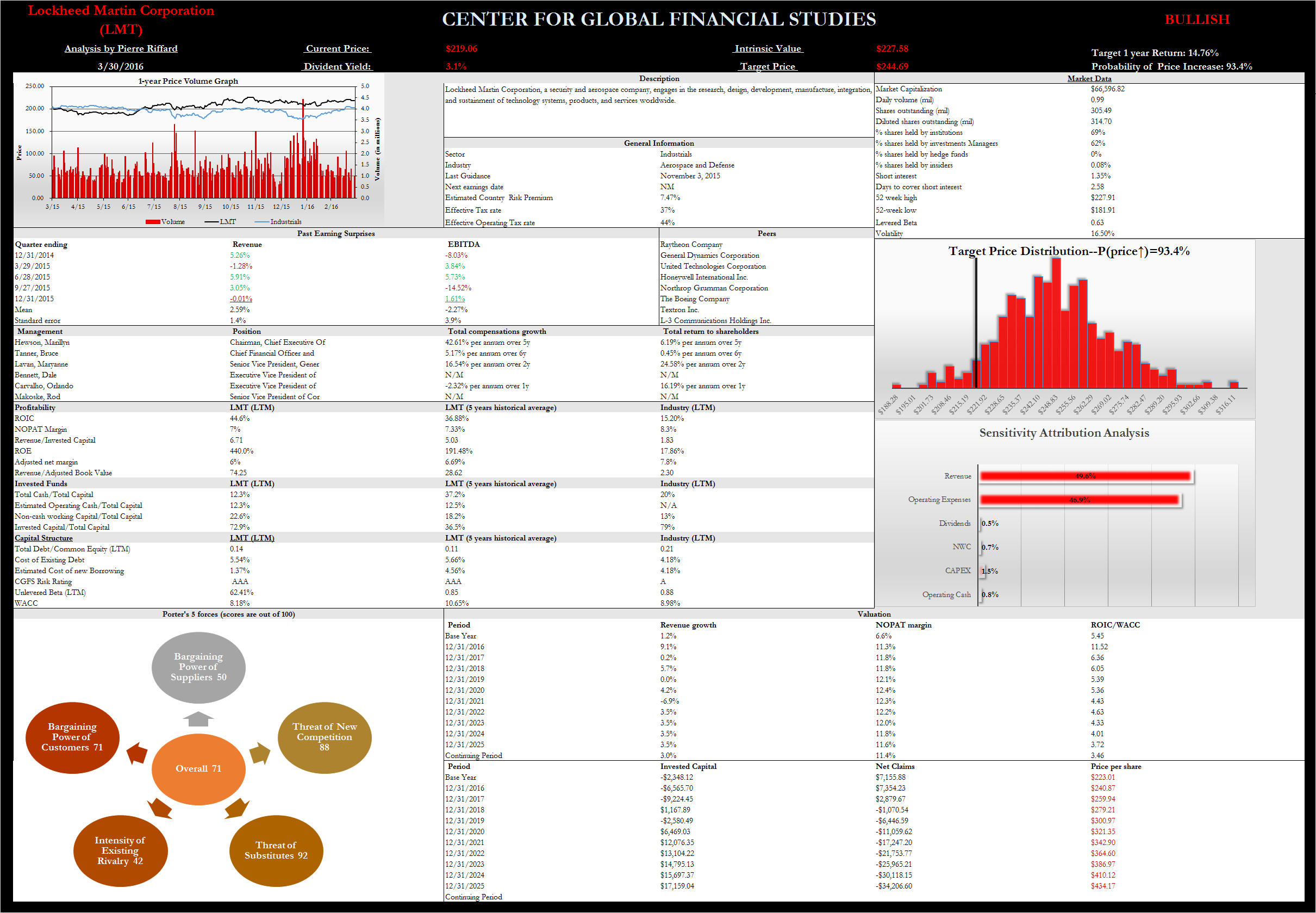

LMT Stock valuations - Lockheed Martin Corp. After running my DCF model I have concluded that there is a conservative upside of 105 in LMT through to 2023 not including dividends.

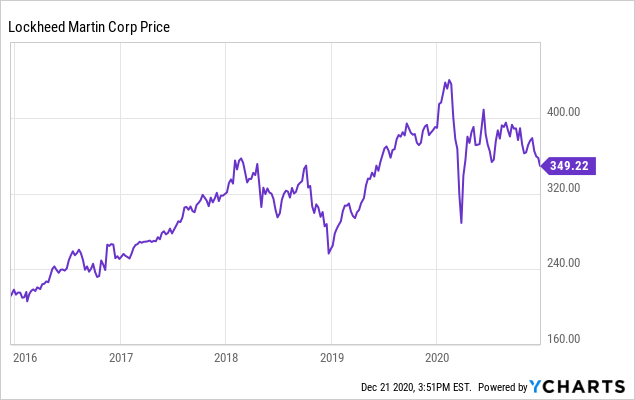

Lockheed Martin Stock Chart Analysis Lmt Stock Target Entry Price Aerospace And Defense Stock Youtube

Lockheed Martin Stock Chart Analysis Lmt Stock Target Entry Price Aerospace And Defense Stock Youtube

As of today 2021-03-03 Lockheed Martins Intrinsic Value.

Lmt stock intrinsic value. 10 market return 25 perpetual growth WACC 901 risk free rate 114. We review Lockheeds Key Ratios perform a Discounted Cash. The beta of 061 implies lower volatility of the stock with respect to the SP 500.

In such a case the real stock value may differ significantly form the estimated. An Intrinsic Calculation For Lockheed Martin Corporation NYSELMT Suggests Its 25 Undervalued. A situation like this will not last.

Therefore Lockheed Martins Price-to-Intrinsic-Value-Projected-FCF of today is 13. Lockheed Martin Corp stock was originally listed at a price of 4925 in Dec 31 1997. This results in an intrinsic value of 27540 which compared to the current share price of 31803 we see that Lockheed Martin is fair value maybe slightly overvalued at the time of writing.

If you want to use the estimated intrinsic stock value in investment decision making process do so at your own risk. Lets put Lockheed Martin Corporation LMT stock into this equation and find out if it is a good choice for value-oriented investors right now or if investors subscribing to this methodology. We will take advantage of the Discounted Cash Flow DCF model for this purpose.

The details of how we calculate the intrinsic value of stocks are described in detail here. In the final step we divide the equity value by the number of shares outstanding. Investors use this metric to determine how a.

Lets put Lockheed Martin Corporation LMT stock into this equation and find out if it is a good choice for value-oriented investors right now or if investors subscribing to this methodology. The stock price of Lockheed Martin is 338590000. Projected FCF is 25966.

If you want to use the estimated intrinsic stock value in investment decision making process do so at your own risk. Lets put Lockheed Martin Corporation LMT Quick Quote LMT - Free Report stock into this equation and find out if it is a good choice for value-oriented investors right now or if investors. In this video we look at the Lockheeds Fundamentals.

The intrinsic value of the stock based on Peter Lynch Fair Value DCF Earnings and more. Intrinsic value refers to some fundamental objective value contained in an object asset or financial contract. The stock is currently trading below its intrinsic value of 24484 this suggests that the stock is currently undervalued at these levels.

Expected rate of return on market portfolio 2. LMT Lockheed Martin Corp currently has 279783747 outstanding shares. There may exist specific factors relevant to stock value and omitted here.

2021 - Investing in Lockheed Martin LMT. In this article we are going to estimate the intrinsic value of Lockheed Martin Corporation NYSELMT by estimating the companys future cash flows and discounting them to their present value. Essentially when you look into the future LMT has been allocating capital that drives up the intrinsic value per share while most investors have ignored it.

Rate of return on LT Treasury Composite 1. Valuation is based on standard assumptions. If the market price is below that value it may be a good buy and if above a good.

Required Rate of Return r Assumptions. Present Value of Terminal Value PVTV TV 1 r 10 US171b 1 71 10 US86b The total value is the sum of cash flows for the next ten years plus the discounted terminal value which results in the Total Equity Value which in this case is US137b. Systematic risk of Lockheed Martin Corps common stock.

NYSELMT Intrinsic value March 16th 2020 The assumptions We would point out that the most important inputs to a discounted cash flow are the discount rate and of course the actual cash flows. With Lockheed Martin Corp stock trading at 34169 per share the total value of Lockheed Martin Corp stock market capitalization is 9560B. Book value is defined as total assets minus liabilities preferred stocks and intangible assets In short this is how much a company is worth.

LMT has shown favorable earnings consistency over the last five years.

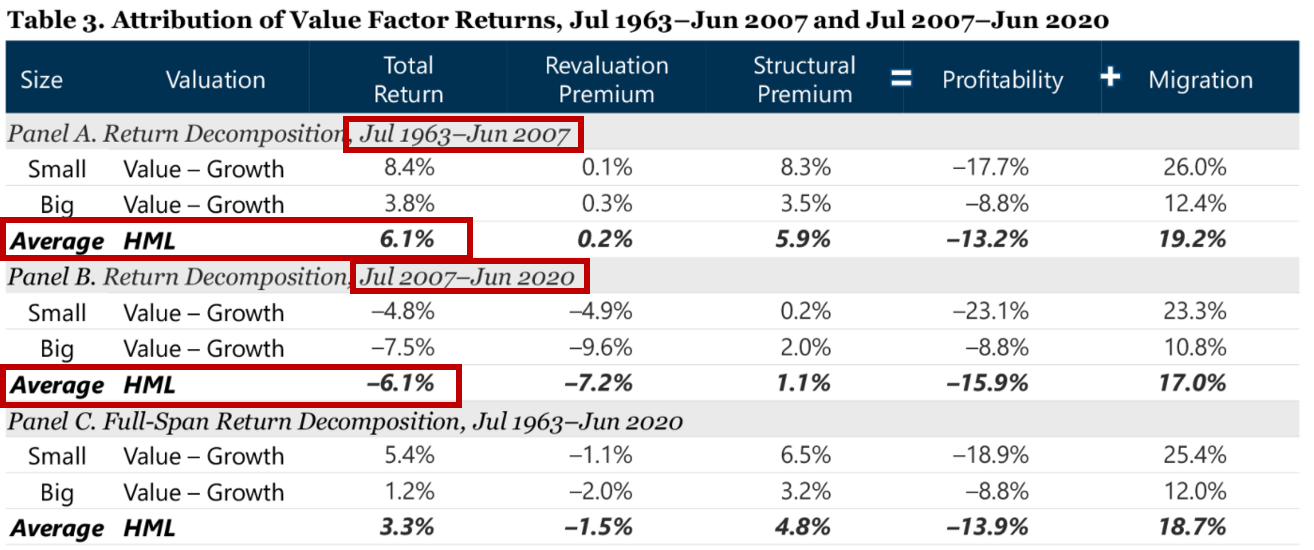

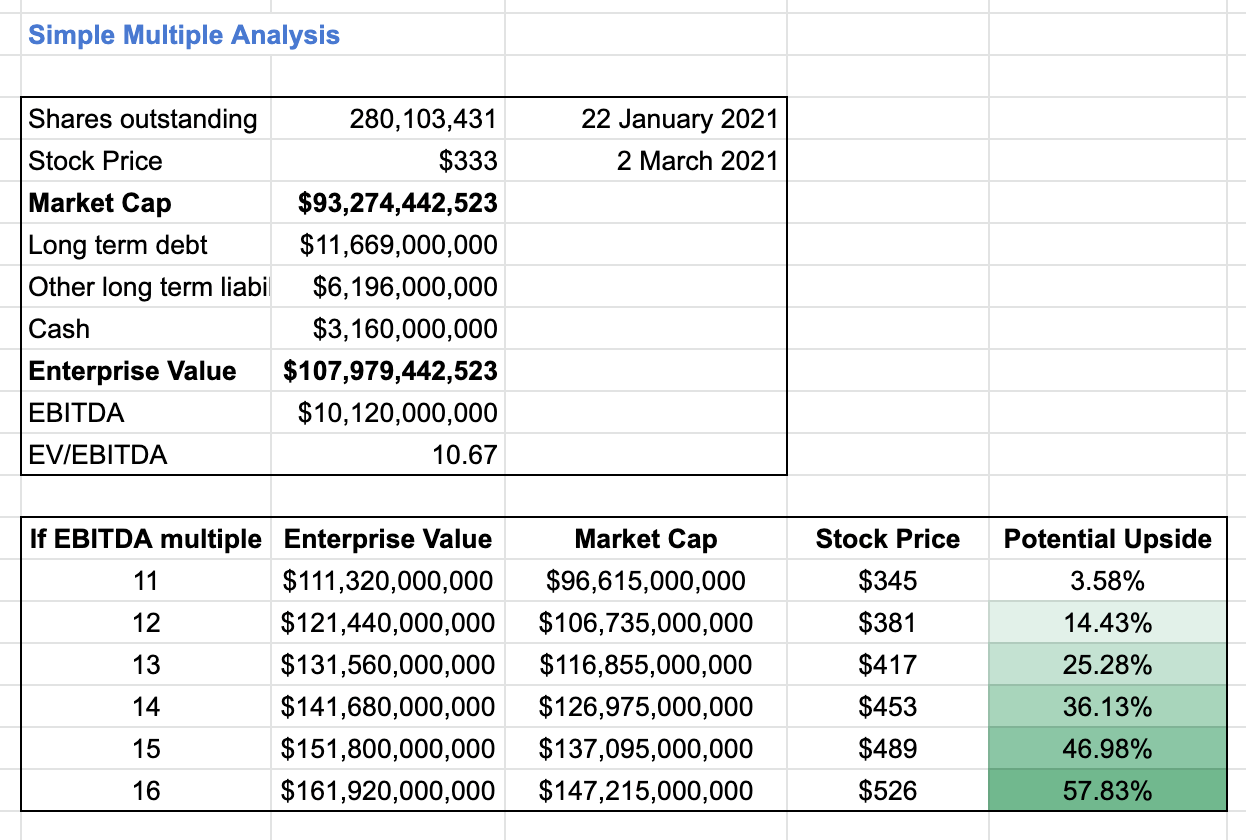

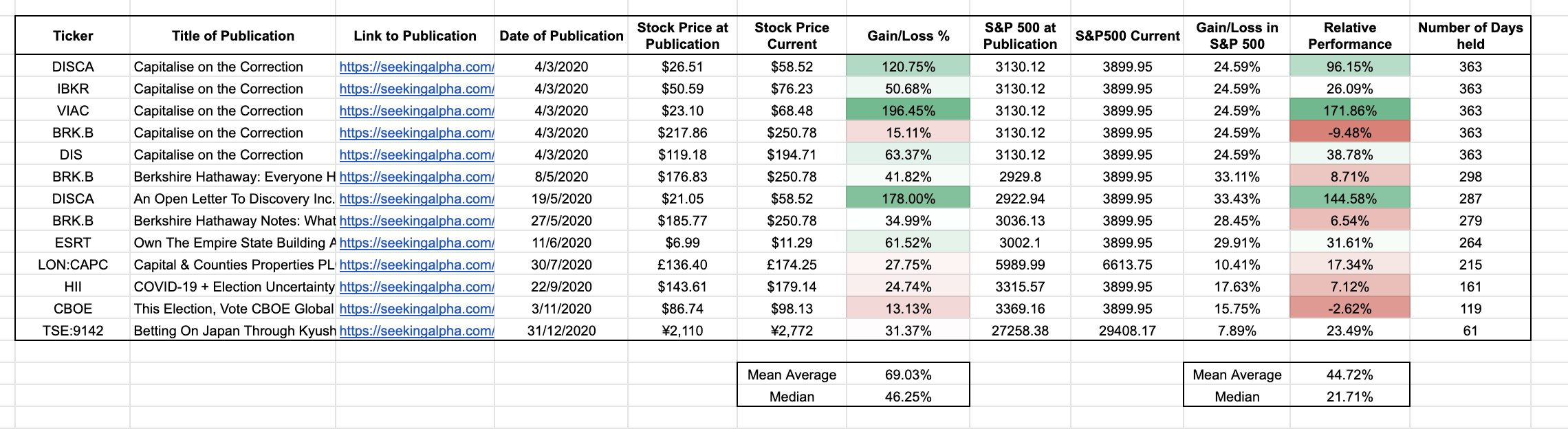

Value Investing Is A Long Term Strategy And Should Be Judged Accordingly Seeking Alpha

Value Investing Is A Long Term Strategy And Should Be Judged Accordingly Seeking Alpha

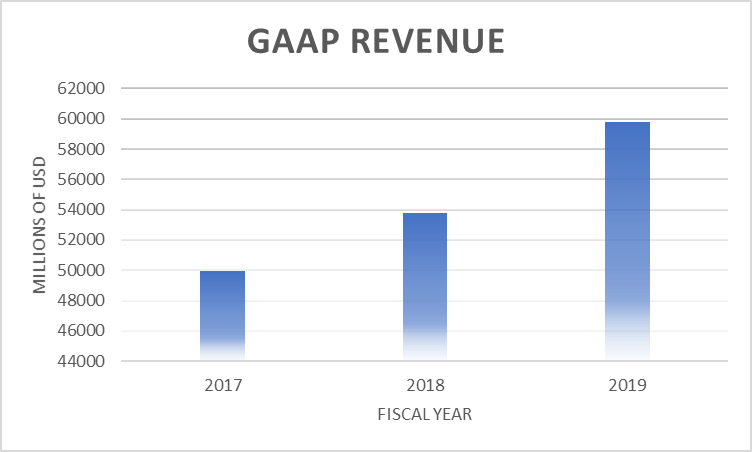

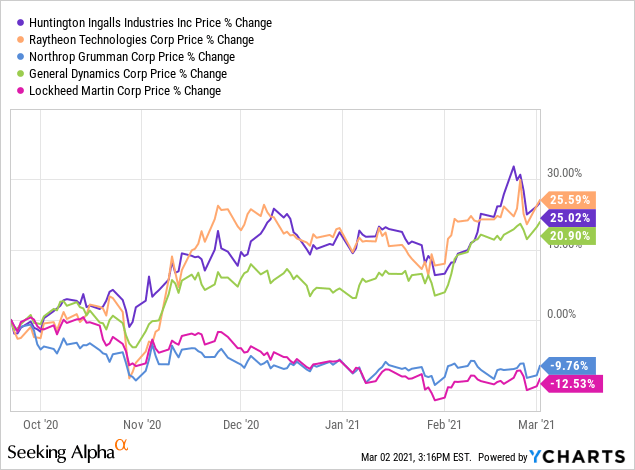

Lockheed Martin S Huge Potential Nyse Lmt Seeking Alpha

Lockheed Martin S Huge Potential Nyse Lmt Seeking Alpha

Is Lockheed Martin Corporation Nyse Lmt An Attractive Dividend Stock Simply Wall St News

Lockheed Martin Is A Great Company Nyse Lmt Seeking Alpha

Lockheed Martin Is A Great Company Nyse Lmt Seeking Alpha

Successful Value Investing Changes Drastically In 2020 Seeking Alpha

Successful Value Investing Changes Drastically In 2020 Seeking Alpha

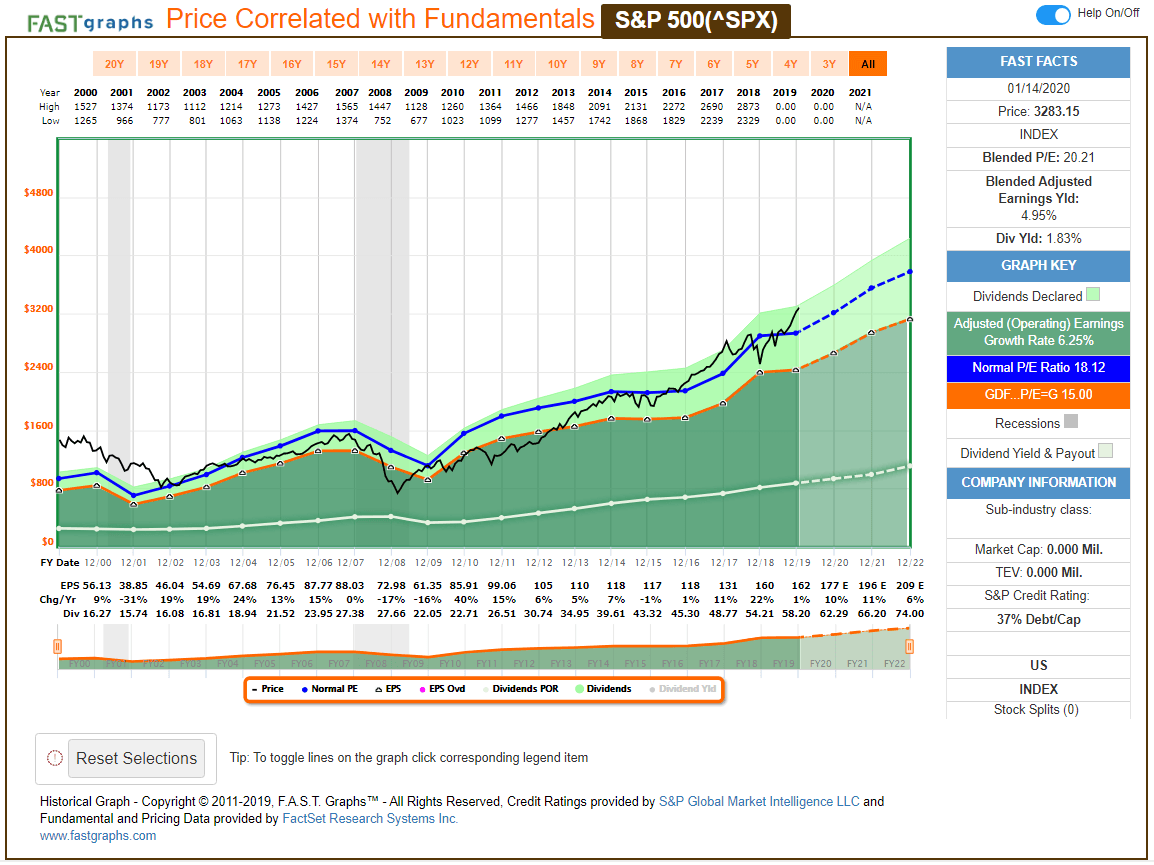

The Essence Of Valuation Is Soundness Not Rate Of Return Part 1 F A S T Graphs

The Essence Of Valuation Is Soundness Not Rate Of Return Part 1 F A S T Graphs

Why Value Investing Works For All Stock Categories F A S T Graphs

Why Value Investing Works For All Stock Categories F A S T Graphs

10 Fairly Valued Dividend Growth Stocks For Total Return Part 4 F A S T Graphs

10 Fairly Valued Dividend Growth Stocks For Total Return Part 4 F A S T Graphs

Brookfield Asset Management To Take Property Unit Private In 5 9b Deal Nasdaq

Brookfield Asset Management To Take Property Unit Private In 5 9b Deal Nasdaq

Lockheed Martin A Dividend Contender With Increasing Dividend Income For 19 Years Nyse Lmt Seeking Alpha

Lockheed Martin A Dividend Contender With Increasing Dividend Income For 19 Years Nyse Lmt Seeking Alpha

Lockheed Martin Corporation Stock Value Analysis Nyse Lmt

Lockheed Martin Corporation Stock Value Analysis Nyse Lmt

Best In Class Lockheed Martin Remains A Buy Gurufocus Com

Best In Class Lockheed Martin Remains A Buy Gurufocus Com

Lockheed Martin The Low Yielder In My High Yield Portfolio Still Far Under Intrinsic Value Nyse Lmt Seeking Alpha

Lockheed Martin The Low Yielder In My High Yield Portfolio Still Far Under Intrinsic Value Nyse Lmt Seeking Alpha

General Dynamics A History Of Value Creation Gurufocus Com

Is Lockheed Martin Lmt Stock A Buy Fundamental Analysis Key Ratios Intrinsic Value And Irr Youtube

Is Lockheed Martin Lmt Stock A Buy Fundamental Analysis Key Ratios Intrinsic Value And Irr Youtube

Post a Comment for "Lmt Stock Intrinsic Value"