Stock Warrant Value Calculator

Lets take a closer look at stock warrants and how to value themThe basics of stock warrants. The date until which you intend to hold the warrant and.

Stock Warrants Finance Investing Accounting And Finance Finance

Stock Warrants Finance Investing Accounting And Finance Finance

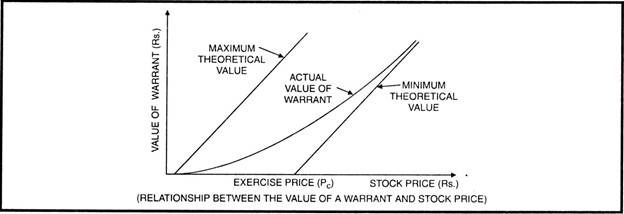

P c Exercise price of warrant.

Stock warrant value calculator. Enter the purchase price per share. The Stock Calculator is very simple to use. Enter the number of shares purchased.

N Exercise ratio ie. More This calculator can be used to compute the theoretical value of an option or warrant by inputting different variables. For example if the exercise price is 20 per share and the stock is selling for 50 per share the warrants needed to buy a share are worth 30.

The calculator will automatically calculate Gearing Premium Cash Settlement ProfitLoss for the Call Warrants. Ii Theoretical Minimum Value of the Warrant P s P c N. To use the Call Warrants Calculator key-in the following informations.

But their intrinsic value will be much higher if the underlying. It also calculates the return on investment for stocks and the break-even share price. Negative premiums show the percentage gain youll achieve by exercising the warrant.

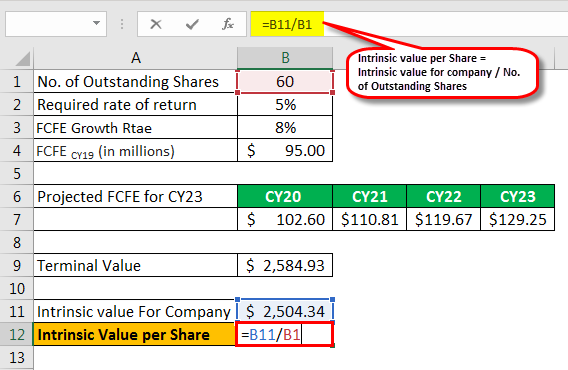

This is called the intrinsic value of the warrants. Chardan Healthcare Acquisition 2 Corp. Warrants entitling the holder thereof to purchase one-half 12 of a share of common stock at a price of 1150 per whole share.

Just follow the 5 easy steps below. The theoretical values of warrants of a more complicated nature eg. Chardan Healthcare Acquisition 2 Corp.

The higher price is usually a good estimate for the theoretical fair value. May be used to calculate an approximate value for American-style call warrants. A premium of zero is the warrants break-even price.

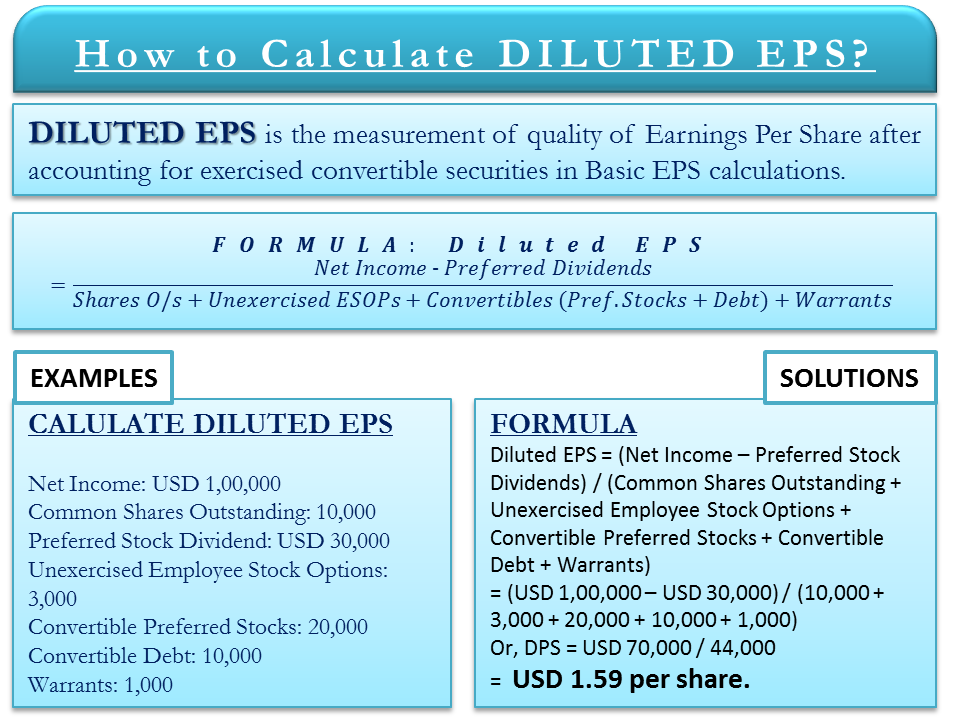

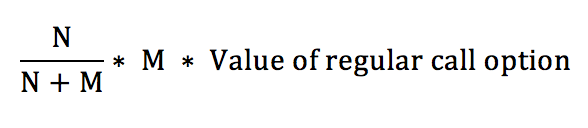

Subtract the exercise price of the warrants from the market price of the stock to find the value of the warrants needed to buy one share. Because of the dilution that warrants represent the value of that call needs to be divided by 1 q where q is the ratio of warrants to outstanding shares assuming each warrant is worth one. Redo the calculation with the expiry date being the business day just prior to the stock going ex-dividend.

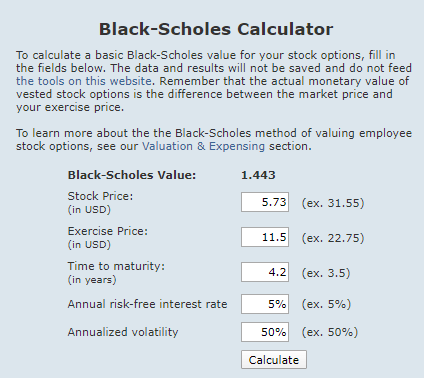

Your view of the warrants implied volatility. By using the OptionsWarrants Calculator you will be able to determine the theoretical value of a warrant and to learn how the factors affect the theoretical value of a warrant. A stock warrant gives holders the option to buy company stock at a fixed price the exercise price until the expiration date and receive newly issued stock from the company.

Exotic warrants may not be determined directly from the calculator. Calculate the warrant price based on the expiry date. We realize you may be surprised that one warrant at C85 is perhaps a better value than when the warrant was selling for C45 There are many great opportunities in stock warrants trading in the United States and Canada in the resource sector bio-techs pharmaceuticals financials restaurants oil and gas companies and many more.

Number of equity shares per warrant. What Is a Stock Warrant. You can use this handy stock calculator to determine the profit or loss from buying and selling stocks.

Your view of where the underlying will move to 2. Divide the intrinsic value by the conversion ratio to find the value of one warrant. In this example if the conversion ratio equals five you have 10 divided by five.

The warrant premium equals what you paid for the warrant plus the strike price minus the current share price all divided by the current share price and then multiplied by 100. A stock warrant is similar to its better-known cousin the stock option. No of Call Warrants.

The warrants are now trading for 641 since they are in-the-money ie the LCA stock is above the exercise price of 1150. Stock warrants offer investors a leveraged opportunity to profit if the underlying stock rises in value but each warrant has different terms that investors have to understand to calculate its true value. The theoretical value of an option is affected by a number of factors such as the underlying stock priceindex level strike price volatility interest rate dividend and time to expiry.

One warrant is thus worth 2. Stock warrants like stock options give investors the right to buy via a call warrant or sell via a put warrant a specific stock at a certain price level strike price before a certain date. Stock warrants offer investors a leveraged opportunity to profit if the underlying stock rises in value but each warrant has different terms that investors have to understand to calculate its.

Move the sliders to estimate the price of the warrant shown under Simulated results based on. Series C Warrant. Where P s Current market price of equity share.

For starters recall that a stock option is a contract between two parties and gives the stockholder the right to buy or. Stock warrants offer investors a leveraged opportunity to profit if the underlying stock rises in value but each warrant has different terms that investors have to understand to calculate its.

Valuation Of Warrants With Formula

Valuation Of Warrants With Formula

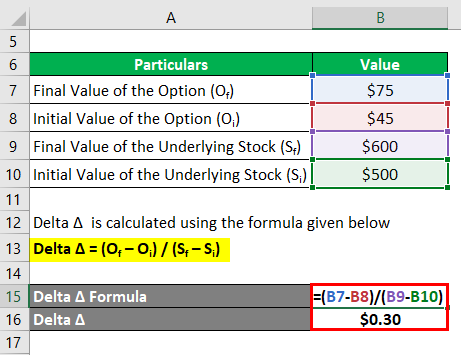

Delta Formula Calculator Examples With Excel Template

Delta Formula Calculator Examples With Excel Template

Factors That Influence Black Scholes Warrant Dilution

How To Calculate Diluted Eps Formula Example Importance Efm

How To Calculate Diluted Eps Formula Example Importance Efm

Understanding The Dilutive Impact Of Warrants Equity Methods

Understanding The Dilutive Impact Of Warrants Equity Methods

You Will Need To Seek Legal Advice Of A Losangelespersonalinjuryattorney In Order To Personal Injury Claims Social Security Disability Benefits Injury Lawyer

You Will Need To Seek Legal Advice Of A Losangelespersonalinjuryattorney In Order To Personal Injury Claims Social Security Disability Benefits Injury Lawyer

Net Change Formula Step By Step Calculation Examples

Net Change Formula Step By Step Calculation Examples

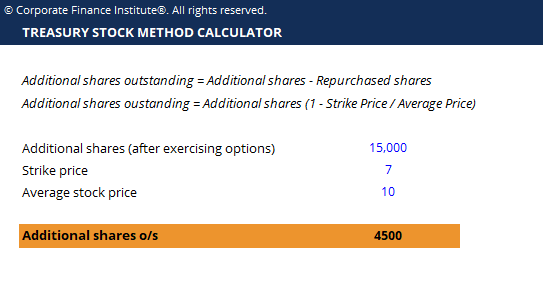

Treasury Stock Method Calculator Download Free Excel Template

Treasury Stock Method Calculator Download Free Excel Template

Mindmed Warrants Looking Like A Good Buy Mmed To Wt Shroomstocks

Mindmed Warrants Looking Like A Good Buy Mmed To Wt Shroomstocks

Factors That Influence Black Scholes Warrant Dilution User Guide Guide Users

Factors That Influence Black Scholes Warrant Dilution User Guide Guide Users

With Peck On The Rise The Warrants Come Into Play Nasdaq Isun Seeking Alpha

With Peck On The Rise The Warrants Come Into Play Nasdaq Isun Seeking Alpha

Convertible Bonds Vs Warrants Meaning Differences Bbalectures Business Articles Convertible Bond

Convertible Bonds Vs Warrants Meaning Differences Bbalectures Business Articles Convertible Bond

Warrant Handbook Warrant Expiry Nagawarrants

Warrant Handbook Warrant Expiry Nagawarrants

Warrants Definition Explanation Examples And Diluted Eps Play Accounting

Warrants Definition Explanation Examples And Diluted Eps Play Accounting

Intrinsic Value Formula Example How To Calculate Intrinsic Value

Intrinsic Value Formula Example How To Calculate Intrinsic Value

Warrants Intrinsic Value Calculator Singapore His Calculator Will Help You To Calculate The Intrinsic Value Of Warrants Sears Sinking Funds Dow Jones Index

Warrants Intrinsic Value Calculator Singapore His Calculator Will Help You To Calculate The Intrinsic Value Of Warrants Sears Sinking Funds Dow Jones Index

Theoretical Warrant Price Calculators

Theoretical Warrant Price Calculators

Post a Comment for "Stock Warrant Value Calculator"