Xle Stock Technical Analysis

Using my preferred technical indicator of medium-term trend the 200-day moving average it is possible to time an entry into the XLE ETF. For the last week the fund has had a daily average volatility of 386.

Xle Energy Sector Breaking Out For Amex Xle By Normanalwyn Tradingview

Xle Energy Sector Breaking Out For Amex Xle By Normanalwyn Tradingview

XLE closed up 147 percent on Wednesday March 3 2021 on 13 times normal volume.

Xle stock technical analysis. The Technical Summary and Trading Plans for XLE help you determine where to buy sell and set risk controls. For example a 9-period moving average is the average of the. Technical analysis is based on the principle that all relevant information is expressed through the stock price movements.

The data is best used in conjunction with our Market Analysis and Stock Correlation Filters too because those help us go with the flow of the market as well. The Moving Average is the average price of the security or contact for the Period shown. The bulls were able to push the stock to a new 52-week high.

XLE XLE Energy Select Sector SPDR Fund stock technical analysis with charts breakout and price targets support and resistance levels and more trend analysis. Posted by pugsma on February 8 2017. XLE price has reached a critical support area here at 7065 if the Inverse Head and Shoulders IHS pattern is play out to significantly higher highs into the end of year 2017.

Profit is made from the lags and overreactions in the market. XLE looks poised to continue its uptrend and make a new regional high. Compared to other energy options XLE is impressive in terms of both cost efficiency and liquidity.

February 27 2021 - The year-to-date YTD performance of Energy XLE ETF is up 2704 and is outperforming the overall stock market by 2425. XLE A complete Energy Select Sector SPDR ETF exchange traded fund overview by MarketWatch. XLE price has already bounced from 7065 up to 7185 turning positive for the day.

QA about XLE projections. Analysis of XLE based on EMA MACD RSI Stochastic Fibonacci trends and gaps. Stock Charts Performance Trend Analysis for XLE.

The price action carved out a bearish shooting star candlestick pattern. XLE fund predictions are updated every 5 minutes with latest exchange prices by smart technical market analysis. Look for price to trade beneath the low of the shooting star for confirmation.

View the latest ETF prices and news for better ETF investing. I personally think that production cuts will eventually cause supply shocks when demand will pick up. XLE Fund Risk This fund may move much during a day volatility and with a large prediction interval from the Bollinger Band this fund is considered to be high risk.

The Technical Analysis page contains the results of 12 common technical analytics over different periods of time. During the last day the fund moved 102 between high and low or 208. Nevertheless using fundamental analysis in addition to technical analysis may make you more confident about your investments.

The analytics used are. The MSCI ESG Fund Rating measures the resiliency of portfolios. PUG Stock Market Analysis LLC is an educational service not an advisory or stock recommendation service.

At times PUG will analyze the technical structure chart of various stocks or financial markets but he is in no way compensated by the companies he analyzes either in reports or daily commentaries. Find the latest SPDR Select Sector Fund - Energ XLE stock quote history news and other vital information to help you with your stock trading and investing. XLE Technical Analysis To access.

Moving Average Price Change Percent Change Average Volume. XLE Energy Select Sectr SPDR - Stock quote performance technical chart analysis SmartSelect Ratings Group Leaders and the latest company headlines. Recently the weekly returns of Energy XLE is up 427 and is outperforming the overall market by 713.

That may indicate a downside reversal. XLE MSCI ESG Analytics Insight Energy Select Sector SPDR Fund has an MSCI ESG Fund Rating of BBB based on a score of 545 out of 10. Its currently being supported by higher crude prices and a dollar which looks to be losing footing on its previous bounce.

But like many funds offering exposure to the energy sector XLE maintains some concentration issues as a few stocks account for big chunks of the total portfolio. Investors can generally expect to execute at penny wide spreads. February 3 2021 200 pm ET.

Wedge Chart Pattern Stock Charts Chart Wave Theory

Wedge Chart Pattern Stock Charts Chart Wave Theory

Xle Kmi Eog Psx Large Inflows Detected At Etf Nasdaq

Xle Kmi Eog Psx Large Inflows Detected At Etf Nasdaq

![]() Xle Etf Performance Weekly Ytd Daily Technical Trend Analysis Stock Charts And Quote Energy Spdr Today 12stocks Com

Xle Etf Performance Weekly Ytd Daily Technical Trend Analysis Stock Charts And Quote Energy Spdr Today 12stocks Com

The Revival Of Energy Xle On The Rise For Amex Xle By Dailychartist Tradingview

The Revival Of Energy Xle On The Rise For Amex Xle By Dailychartist Tradingview

Xle Stock Price And Chart Amex Xle Tradingview India

Xle Stock Price And Chart Amex Xle Tradingview India

Xlc Stock Price And Chart Amex Xlc Tradingview

Xlc Stock Price And Chart Amex Xlc Tradingview

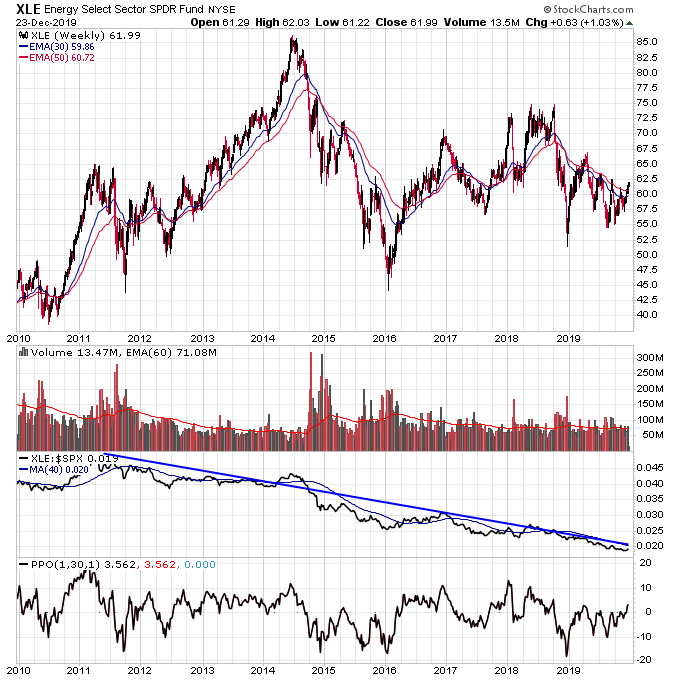

Xle Pug Stock Market Analysis Llc Technical Analysis Blog

Xle Pug Stock Market Analysis Llc Technical Analysis Blog

Xle Slb Eog Psx Etf Outflow Alert Nasdaq

Xle Slb Eog Psx Etf Outflow Alert Nasdaq

Are Higher Energy Prices The Next New Normal A Look At The Xle Breakout Realmoney

Are Higher Energy Prices The Next New Normal A Look At The Xle Breakout Realmoney

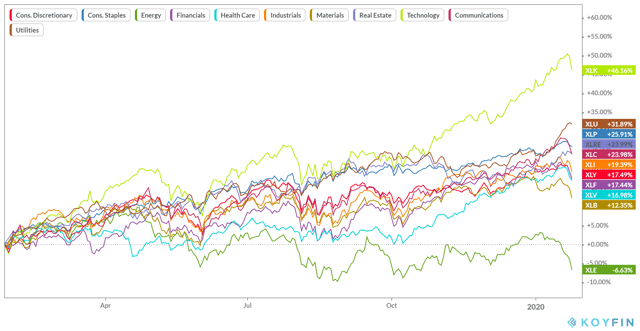

Study Of Sector Rotation During 2020 Market Crash For Amex Xlc By Drewby4321 Tradingview

Study Of Sector Rotation During 2020 Market Crash For Amex Xlc By Drewby4321 Tradingview

Year End Thoughts My 2020 Outlook For Amex Xle By Tangman Tradingview

Year End Thoughts My 2020 Outlook For Amex Xle By Tangman Tradingview

Xle Time To Go Hard On Energy And Secure Big Oil S Juicy Yields Nysearca Xle Seeking Alpha

Xle Time To Go Hard On Energy And Secure Big Oil S Juicy Yields Nysearca Xle Seeking Alpha

Xle Stock Price And Chart Amex Xle Tradingview Uk

Xle Stock Price And Chart Amex Xle Tradingview Uk

Long Xle For Amex Xle By Shkspr Tradingview

Long Xle For Amex Xle By Shkspr Tradingview

Energy Select Sector Index Etf Xle Analysis What Is Happening With The Price Currency Com

Energy Select Sector Index Etf Xle Analysis What Is Happening With The Price Currency Com

Xle Crowded With Sellers Nasdaq

Xle Crowded With Sellers Nasdaq

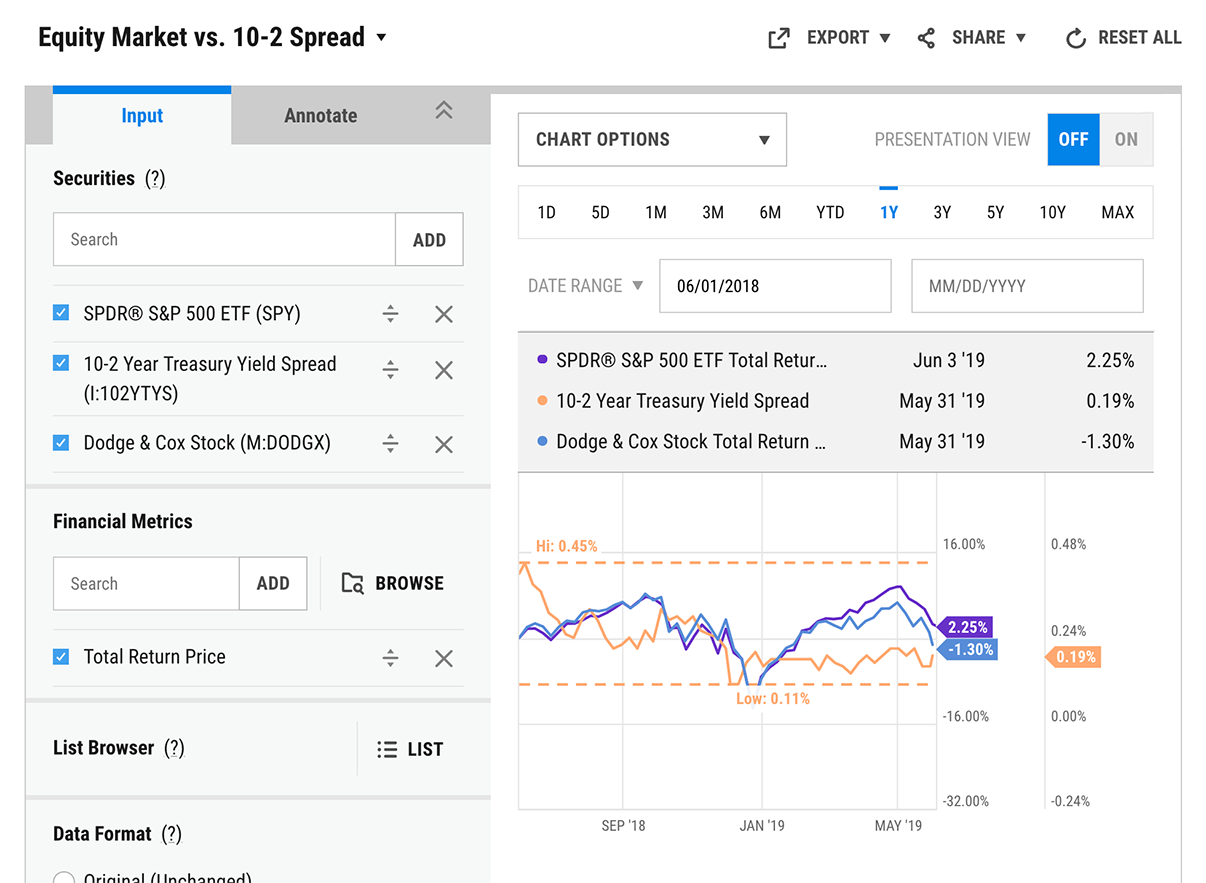

The Ten Year Bear Market In Oil And Gas Could Be A Huge Opportunity In 2020 Nog Xle Next Big Trade

The Ten Year Bear Market In Oil And Gas Could Be A Huge Opportunity In 2020 Nog Xle Next Big Trade

Post a Comment for "Xle Stock Technical Analysis"