Could Netflix Stock Split

If it did that. Put another way 1000 invested in the IPO with no sales over.

For example a 1000 share position pre-split became a 2000 share position following the split.

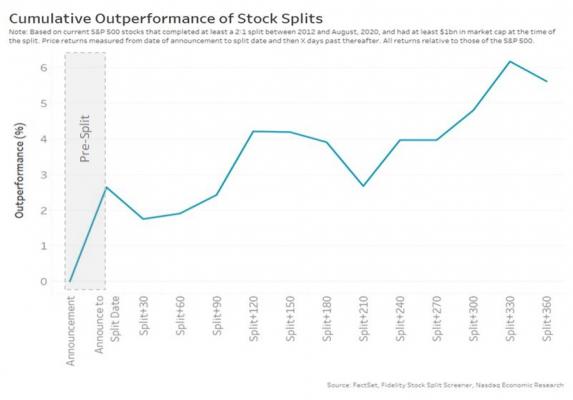

Could netflix stock split. In a 31 split the outstanding shares would increase to 3000000 while the price per share would be reduced to 20 keeping the market cap the same. Jim Cramer has identified 10 stocks that look like they are due for splits in 2020. The streaming giant has had two stock splits since going public.

Netflix has already executed two splits for a total ratio of 14-for-1. In all cases the market capitalization does not change. Investors should not expect another stock split until shares have risen quite a bit further.

The leading premium service went public at 15 in the springtime of 2002 but after a 2-for-1 and then a 7-for-1. Trading at 524 per share today the stock is edging closer to the 700 range where the last 7-for-1 split was done in 2015. 12 2004 Netflix issued a two-for-one stock split so those 66 shares would double to become 132 shares.

Amazon now has returned over 165000 from its initial public offering IPO price of 18 adjusted for subsequent stock splits. The Apple and Tesla splits will soon make those stocks more affordable for average investors. Of all the stocks mentioned streaming video leader Netflix has the most recent stock split.

Rumor became reality yesterday for Netflix NFLX as the companys board approved a head-turning 7-for-1 stock split. Though the streaming market leader disappointed Wall Street on some metrics in the Q2 results the stocks consensus estimate is overweight Netflix NASDAQNFLX stock recently hit a record high of nearly 550. Prices shown are actual historical values and are not adjusted for either splits or dividends.

5 The investment of 990. The last time Netflix shares split was in 2015 when the company performed a 7-for-1 stock split. Stock split history for Netflix since 2021.

But Netflix had underwent a whopping 7-for-1 split in 2015. That subscriber base could produce 50 in earnings per share which could translate into a 1000 stock in five years says Mahaney. Netflixs 2015 stock split dropped its stock price from around 700 to about 100.

Stock owners of record at the July 2 close will be. The stock is a 465-bagger since going public at a split-adjusted price of 107. The leading premium service went public at 15 in the springtime of 2002 but after a 2-for-1 and then a 7-for-1 stock split the cost basis is whittled down to a little more than a buck.

This was a 2 for 1 split meaning for each share of NFLX owned pre-split the shareholder now owned 2 shares. In a 32 split the number of shares would increase to 1500000 and the price per share would become 40. The leading streaming service has been a big winner in odd-numbered years but next year could be different.

Amazon and Chipotle both have quadruple digit stock prices while Netflix is trading near 500 a share. 6 There is some belief that Netflix could split again but there is also some skepticism as to whether the company will continue to add subscribers and see revenues rise at the same rate. 12 2004 Netflix closed at 3730 per share.

The nitty gritty details. The first split for NFLX took place on February 12 2004. Please see the Historical Prices tab for adjusted price values.

But Netflix might be waiting for a high price to justify more than a 2-for-1 split. Netflix NFLX has 2 splits in our Netflix stock split history database. Netflixs stock recently hit a five-year high of nearly 550 raising the possibility of a stock split.

Will Netflix Stock Crash in 2021. At that point a 2-for-1 split prevented Netflix shares from climbing into triple-digit territory safely leaving them in the 40s. Netflix Stock Could Decline By 50 Per Our Downside Scenario.

He just upped his 12-month price target to 610 from 500. Netflix stock got pushed up and down for various reasons over the. The Mad Money host listed Amazon Alphabet Chipotle Netflix Nvidia Adobe Costco Wholesale Home Depot.

We value Netflix at a multiple of 65x projected 2020 earnings considering its high earnings growth rates EPS up 10x in.

3 Compelling Reasons For Companies To Split Stocks Nasdaq

3 Compelling Reasons For Companies To Split Stocks Nasdaq

Here S Why Netflix Is Ripe For A Stock Split

Here S Why Netflix Is Ripe For A Stock Split

If You Invested Right After Netflix S Ipo Nflx

Apple Shares Rise As Trading Begins Following Four For One Stock Split Apple S Four For One Stock Split Takes Effect Today With In 2020 Share Prices Apple Shares Apple

Apple Shares Rise As Trading Begins Following Four For One Stock Split Apple S Four For One Stock Split Takes Effect Today With In 2020 Share Prices Apple Shares Apple

What Happens In A Reverse Stock Split If You Don T Have Enough Shares Quora

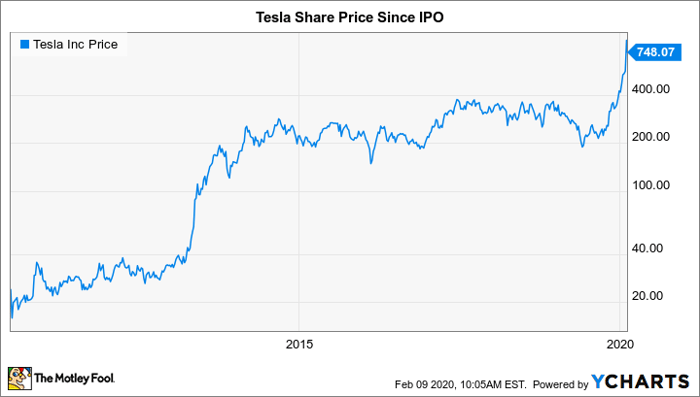

Will Tesla Finally Do A Stock Split Now Nasdaq

Will Tesla Finally Do A Stock Split Now Nasdaq

Splitting Stocks Changes Them Fundamentally Nasdaq

Splitting Stocks Changes Them Fundamentally Nasdaq

Amazon Stock Split History What You Need To Know Ig En

Amazon Stock Split History What You Need To Know Ig En

Baba Stock Split 8 1 Buy July 15th 2020 For Nyse Baba By Masonbahl24 Tradingview

Baba Stock Split 8 1 Buy July 15th 2020 For Nyse Baba By Masonbahl24 Tradingview

Tesla Plans 5 For 1 Stock Split After Shares Soar In 2020

:max_bytes(150000):strip_icc()/ScreenShot2020-05-14at11.00.41AM-db13978279d7495f83f3d6b6a5075e0c.png) If You Invested Right After Amazon S Ipo

If You Invested Right After Amazon S Ipo

Netflix Align Technology Charter Are These Stocks Next In Line For A Split

Netflix Align Technology Charter Are These Stocks Next In Line For A Split

Will A Tesla Stock Split Ever Happen Nasdaq

Will A Tesla Stock Split Ever Happen Nasdaq

These 4 Companies Should Split Their Stocks Nasdaq

These 4 Companies Should Split Their Stocks Nasdaq

Apple Stock Split History Everything You Need To Know Ig En

Apple Stock Split History Everything You Need To Know Ig En

Pepsico Inc S Stock Split History Nasdaq

Pepsico Inc S Stock Split History Nasdaq

:max_bytes(150000):strip_icc()/dotdash_v2_Understanding_Stock_Splits_Aug_2020-012-b223f723115044d5897cdda57e1be4b7.jpg)

Post a Comment for "Could Netflix Stock Split"