How Are Warrants Treated For Tax Purposes

If you exercise the options before the stock goes public you do not recognize any additional income. For example when a partnership or limited liability company that is treated as a partnership for income tax purposes issues penny warrants to a lender as a sweetener in a financing transaction these warrants could.

Https Www Iasplus Com En Ca Publications Cpa Canada Oil And Gas Cpa Canada Viewpoints Accounting For Share Purchase Warrants Oil And Gas At Download File Viewpoint Accounting For Share Purchase Warrants Issued Oil Gas May 2014 Pdf

This is because the tax treatment becomes the same for regular tax and AMT purposes.

How are warrants treated for tax purposes. Company A a domestic corporation. And Company C a foreign corporation owned by Company A and B. Upon exercising the warrant the investor would pay the purchase price for the shares but unlike options no tax would be due.

Options and warrants are treated differently for tax purposes because the latter is not compensatory. The IRS ruled in private letter ruling 201610006 PLR that a taxpayer may recognize the tax consequences of warrants issued for services when the warrants are exercised rather than when they become exercisable. Issuing Penny Warrants Could Make You a Partner for Tax Purposes.

Gains and losses are calculated when the positions are closed or when they expire unexercised. Such as a stock purchase warrant. When you exercise the warrant the excess of the fair market value of the shares received over the exercise price would be taxed the same way as regular income.

When you exercise however any spread is taxable as ordinary income. Both long and short options for the purposes of pure options positions receive similar tax treatments. Since the exercise of the warrantoption occurred outside the Roth IF the mere exercising of the warrantoption resulted in a reportable taxable event an ISO exercise tax is paid by the individual since it is outside the Roth.

The basis for that conclusion can be found in the tax law itself at Section 1223 5. Remember the share matching rules prevent you from selling shares and buying them back for 30 days. Issuers can use them and pay lower interest rates.

Tax Treatment of Warrants and Rights to Purchase Additional Shares Income Tax Act s. The taxpayer entered into multiple service contracts with three companies. This section provides regulations under section 1504 a 5 A and B regarding the circumstances in which warrants options obligations convertible into stock and other similar interests are treated as exercised for purposes of determining whether a corporation is a member of an affiliated group.

Question for tax purposes is whether the exchange or modification is treated as the. Warrants were treated as a separate fee the fair market value of the New Warrants generally would be recognized as ordinary income. If you receive a compensatory warrant you are not taxed on the receipt of the warrant as long as the warrant is priced at fair market value.

Regulations the debt modification regulations that address the circumstances under which an existing DI will be treated as surrendered. Only warrants issued in connection with the performance of services are subject to Sec. 83 does not apply warrants are taxable to the recipient on the date of the grant.

Using the Annual CGT Exemption Options and warrants allow you to take profits to utilise your annual CGT exemption worth up to 2968 per year in saved tax and avoid falling foul of the taxmans share matching rules. The difference between the strike price and the price of a share. Tax at Exercise When you exercise warrants to buy the underlying stock you pay the stated strike price to the issuing company.

If it is determined that Sec. If you have to make an AMT adjustment increase the basis in the stock by the AMT adjustment. The warrant should have an exercise price equal to the fair market value of the underlying stock on the date of grant in order to avoid additional taxes under Section 409A.

Generally warrants are not compensatory for tax purposes. You generally treat this amount as a capital gain or loss. The compensatory warrant is a warrant issued for services.

Income tax laws and regulations may have significant unintended consequences on investors or lenders if non-compensatory options or warrants are issued in connection with a financing transaction. However if you dont meet special holding period requirements youll have to treat income from the sale as ordinary income. Warrants issued for services are taxed just like compensatory stock options.

Company B a foreign corporation. The federal income tax issues discussed in this article are limited to those. However some options may be incorrectly referred to as warrants Depending upon the facts and circumstances the warrants are actually issued in exchange for performance of services and should be subject to taxation under IRC 83.

Holder has a capital loss arising from a worthless stock. 83 and the readily ascertainable valuation requirements of Regs. Add these amounts which are treated as wages to the basis of the stock in determining the gain or loss on the stocks disposition.

49 3 b This information is regarding investments which are received outside of RRSPs or other registered accounts.

Understanding Passive Activity Limits And Passive Losses 2021 Tax Update Stessa

Understanding Passive Activity Limits And Passive Losses 2021 Tax Update Stessa

Https Www Ubs Com Content Dam Static Wmamericas Importantinformationaboutstructuredproducts Pdf

Warrants The Tax Story The Startup Law Blog

Warrants The Tax Story The Startup Law Blog

Tax Treatment Of Options And Warrants

Tax Treatment Of Options And Warrants

Https Www Jstor Org Stable 2328891

Military Taxes How To Pay Your Taxes While Deployed

Military Taxes How To Pay Your Taxes While Deployed

Stock Warrants Why Do Companies Issue Stock Warrants

Stock Warrants Why Do Companies Issue Stock Warrants

Https Www Irs Gov Pub Irs Utl Am2007014 Pdf

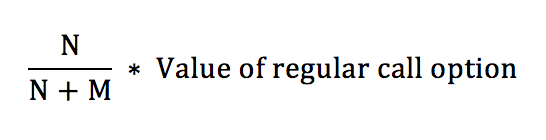

Factors That Influence Black Scholes Warrant Dilution

Https Www Jud Ct Gov Lawlib Notebooks Pathfinders Delinquent Property Taxes Pdf

Using Warrants In Your Private Placement Offering Advisors To The Ultra Affluent Groco

Using Warrants In Your Private Placement Offering Advisors To The Ultra Affluent Groco

Http Openscholarship Wustl Edu Cgi Viewcontent Cgi Article 3132 Context Law Lawreview

Understanding The Dilutive Impact Of Warrants Equity Methods

Understanding The Dilutive Impact Of Warrants Equity Methods

Https Www Paulhastings Com Docs Default Source Pdfs Stay Current Irs Releases Final Regulations On The Tax Treatment Of Noncompensatory Partnership Options Pdf

![]() Penny Warrant Tax Implications Tax Planning Richmond Cpa

Penny Warrant Tax Implications Tax Planning Richmond Cpa

Https Www Morganstanley Com Amps Docs Sp 500 Partially Protected Factsheet Final Pdf

Post a Comment for "How Are Warrants Treated For Tax Purposes"