How To Avoid Capital Gains Tax On Stocks In India

Undistributed capital gains Form 2439 boxes 1a1d Schedule D. Also use Form 8949 Schedule D and the Qualified Dividends and Capital Gain Tax Worksheet or the Schedule D Tax Worksheet.

Calculation Of Ltcg Tax On Sale Of Shares Equity Mutual Fund Units 10 Ltcg Tax On Sale Of Stocks Equity Mutual Funds Budge Budgeting Mutuals Funds Equity

Calculation Of Ltcg Tax On Sale Of Shares Equity Mutual Fund Units 10 Ltcg Tax On Sale Of Stocks Equity Mutual Funds Budge Budgeting Mutuals Funds Equity

Gain or loss from exchanges of like-kind investment property.

How to avoid capital gains tax on stocks in india. Gain or loss from sales of stocks or bonds. The tax traps wealth in an investment vehicle requiring special techniques to free the capital without penalty. Foreign investors had bought equities worth Rs 222316 crore on net basis in Indian capital markets on Tuesday exchange data showed.

Sectorally all indices closed with gains barring auto. Capital gains taxes such as Greeces are generally not considered financial transaction taxes. The capital gains tax is economically senseless.

A properly set up complex trust allows you to avoid capital gains tax and also eliminates probate and inheritance taxes at the same time while also increasing your tax efficiency overall. In case of insufficient or no tax is deducted at source TDS individuals need to pay the deficit amount themselves to avoid getting query andor notice from the Income Tax Department. Multiple ways are available to.

Since 1 October 2004 India levies a Securities Transaction Tax STT. Listed shares acquired as of 1 January 2013 will no longer be subject to the sales tax. Rather any capital gains received will be added to the taxpayers total income.

Tax On Capital Gains In Equity In Various Countries Indian Stock Market Hot Tips Picks In Shares Of India Capital Gain Equity Money Plan

Tax On Capital Gains In Equity In Various Countries Indian Stock Market Hot Tips Picks In Shares Of India Capital Gain Equity Money Plan

11 Ways To Reduce Your Capital Gains Tax Bill Face To Face Finance

11 Ways To Reduce Your Capital Gains Tax Bill Face To Face Finance

How To Avoid Capital Gains Tax On Your Investments Investor Junkie

How To Avoid Capital Gains Tax On Your Investments Investor Junkie

How Do Capital Gains And Losses Affect Your Income Tax

How Do Capital Gains And Losses Affect Your Income Tax

Capital Gains Tax Guide For Nri

Capital Gains Tax Guide For Nri

All About Capital Gain Tax In India Infographic Capital Gains Tax Capital Gain Financial Education

All About Capital Gain Tax In India Infographic Capital Gains Tax Capital Gain Financial Education

How To Reduce Or Avoid Capital Gains Tax On Property Or Investments Capital Gains Tax Capital Gain Investing

How To Reduce Or Avoid Capital Gains Tax On Property Or Investments Capital Gains Tax Capital Gain Investing

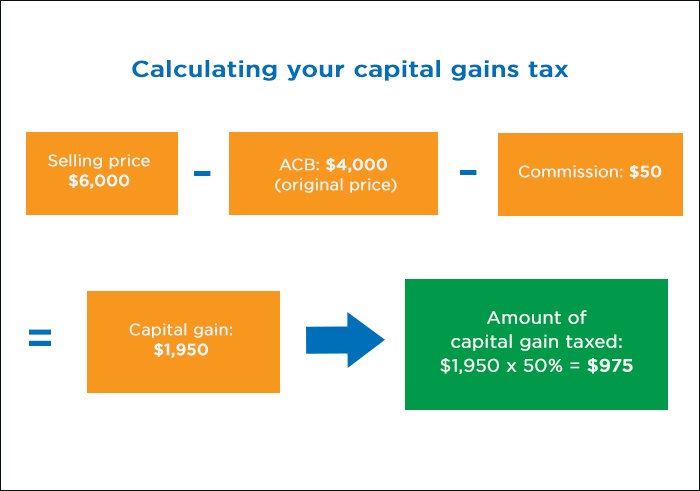

How To Calculate Capital Gains Tax H R Block

How To Calculate Capital Gains Tax H R Block

Details Of Capital Gain Capital Gain What Is Capital Capital Gains Tax

Details Of Capital Gain Capital Gain What Is Capital Capital Gains Tax

Capital Loss Set Off Rules On Sale Of Stocks Equity Mutual Fund Schemes Mutuals Funds Fund Budgeting

Capital Loss Set Off Rules On Sale Of Stocks Equity Mutual Fund Schemes Mutuals Funds Fund Budgeting

Taxation Of Income Earned From Selling Shares Do I Need To Pay Tax

Taxation Of Income Earned From Selling Shares Do I Need To Pay Tax

12 Ways To Beat Capital Gains Tax In The Age Of Trump

12 Ways To Beat Capital Gains Tax In The Age Of Trump

How To Reduce Or Avoid Capital Gains Tax On Property Or Investments

How To Reduce Or Avoid Capital Gains Tax On Property Or Investments

How To Save Capital Gains Tax On Property Sale Capital Gain Capital Gains Tax Tax

How To Save Capital Gains Tax On Property Sale Capital Gain Capital Gains Tax Tax

Tax On Capital Gains For Non Resident Of India Nri Capital Gain Legal Services Capital Gains Tax

Tax On Capital Gains For Non Resident Of India Nri Capital Gain Legal Services Capital Gains Tax

Three Different Routes To Save Tax On Long Term Capital Gains Ltcg Just Like You Pay Tax On Income Earned Selling Y Capital Assets Capital Gain Paying Taxes

Three Different Routes To Save Tax On Long Term Capital Gains Ltcg Just Like You Pay Tax On Income Earned Selling Y Capital Assets Capital Gain Paying Taxes

How High Are Capital Gains Taxes In Your State Tax Foundation

How High Are Capital Gains Taxes In Your State Tax Foundation

Equity Long Term Capital Gain Tax Grandfathering Google Search Capital Gains Tax Capital Gain Budgeting

Equity Long Term Capital Gain Tax Grandfathering Google Search Capital Gains Tax Capital Gain Budgeting

Post a Comment for "How To Avoid Capital Gains Tax On Stocks In India"