How To Calculate Momentum Stocks

1 estimate idiosyncratic return as the part of total return not explained by Fama-French 3-factor market size and book-to-market model betas determined from the prior 36 months. M Price TodayPrice Five Days.

Opinion Momentum Is Becoming A Less Profitable Strategy In The Stock Market Marketwatch

Opinion Momentum Is Becoming A Less Profitable Strategy In The Stock Market Marketwatch

That means that the distance between the current price and the 52 week low will be the same or getting bigger.

How to calculate momentum stocks. Trade Stocks With Momentum History. One of the strategies that investors can use the Richard Dreihaus strategy. For example you can look back five days.

There are just a few steps when it comes to finding momentum stocks. Thus it is possible to identify momentum stocks by scanning for those whose averages are stacked according to their timespan. We can use the Momentum indicator in several ways.

A momentum value above zero indicates that prices are moving up and below zero indicates moving down. Investors dont need to calculate financial indicators for individual stocks they can simply put more money into stock index exchange-traded funds ETFs when the overall market is doing well. Momentum investing is an investment strategy Stock Investment Strategies Stock investment strategies pertain to the different types of stock investing.

For example a stocks six-month momentum is equivalent to its performance over the past six months. To calculate momentum returns are measured over time to determine the rate of momentum over a specific time period. This applies the momentum investing strategy of riding trends in a broader sense.

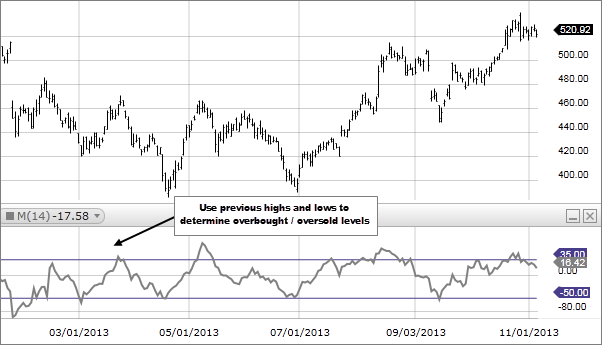

Searching for positive and negative divergences. Market momentum is measured by continually taking price differences for a fixed time interval. To create a 10 day period momentum line you would subtract the closing price from 10 days ago from the last closing price.

How you define momentum matters a lot. The calculation of Momentum is quite simple n is the number of periods the technical trader selects. I normally use a minimum of 70.

In Finviz you can sort all stocks by their distance from the 52 week low. The strategy gets its name from Richard Dreihaus who is the pioneer in momentum investing. There are couple different versions of the formula but whichever one is used the momentum M is a comparison between the current closing price CP and a closing price n periods ago CPn.

The other possible ways of using it are as follows. Eg Ken French data But why use 12_2 momentum. To calculate idiosyncratic momentum for each stock each month they.

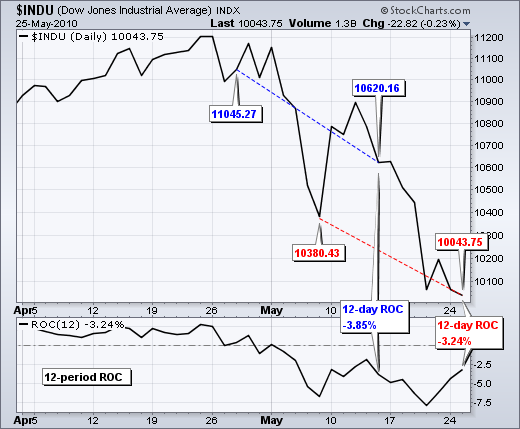

If they made a big move in the past it is likely to do so again if it sets up correctly. To calculate the ROC one takes the current value of a stock and divides it by the value from a previous period then subtracts one and multiplies by 100 for the percentage figure. The academic research response is to focus on so-called 12_2 momentum which measures the total return to a stock over the past twelve months but ignores the previous month.

The strategy an investor chooses is affected by a number of factors such as the investors financial situation investing goals and risk tolerance. When a stock is consistently trending upward as a momentum stock should its short-term moving price averages should consistently be higher than its long-term moving price averages. There are great indicators out there such as the RSI Relative strength index and Stochastic Oscillator which are good as leading momentum indicators whereas again you have MACD and moving averages which are good lagging momentum indicators.

The most common one is to Buy when the Momentum crossed its Zero line upwards the trend is stronger and rising and to Sell when the Momentum crossed Zero line downwards. Rate of Change. The Momentum indicator compares where the current price is in relation to where the price was in the past.

Generally speaking momentum measures the rate-of-change of a securitys price. You determine the value of n M CP CPn or M CP CPn 100. These strategies are namely value growth and index investing.

And 2 calculate idiosyncratic momentum as the volatility-adjusted sum of monthly idiosyncratic returns from 12 months ago to one month ago. Once you have a shortlist of momentum picks the next step is to look at these stocks more closely from a technical perspective. This result is then plotted around a zero line.

As to how far in the past the price comparison is made is up to the technical analysis trader. Multiply that number by 100. What is Momentum Investing.

To construct a 10-day momentum line simply subtract the closing price 10 days ago from the last. The first step is in using a series of methods to pick momentum stocks. Stock prices tend to revert to the mean over periods of several years - in other words momentum isnt a long-term phenomenon.

Look at stocks daily chart to see if it has a large range daily candles in the past where high relative volume comes in. You do not need to manually calculate the momentum of a stock. The momentum indicator most technical traders use and software packages offer calculates momentum using the rate-of-change method.

What is the best way to measure momentum for stock picking purposes. Good performing momentum stocks hold their acceleration. Stocks tend to have self-fulfilling prophecies.

The reason is simple. The momentum of a price is very easy to calculate. Divide todays close by the close a certain number of days ago.

Momentum is measured by continually taking price differences for a fixed time period. However the momentum philosophy can also be applied in a general way.

Momentum Strategy From Stocks On The Move In Python Teddy Koker

A Framework For Evaluating Momentum Etfs Morningstar

A Framework For Evaluating Momentum Etfs Morningstar

How To Track Trading Momentum With Macd Dummies

How To Track Trading Momentum With Macd Dummies

Dynamic Momentum Index Definition And Uses

What Are Momentum And Price Change Fidelity

What Are Momentum And Price Change Fidelity

Equity Investing Using Momentum Indicators To Invest In Stocks The Financial Express

Equity Investing Using Momentum Indicators To Invest In Stocks The Financial Express

Best Momentum Indicators For Day Trading Warrior Trading

Best Momentum Indicators For Day Trading Warrior Trading

Momentum Overview How To Calculate Absolute Vs Relative

Momentum Overview How To Calculate Absolute Vs Relative

:max_bytes(150000):strip_icc()/dotdash_INV_final_Chande_Momentum_Oscillator_Definition_Jan_2021-01-4ee103ff898b480f8acdc457df7f6018.jpg) Chande Momentum Oscillator Definition Calculation And Example

Chande Momentum Oscillator Definition Calculation And Example

Introduction To Technical Indicators And Oscillators Chartschool

Introduction To Technical Indicators And Oscillators Chartschool

Rate Of Change Roc Chartschool

Rate Of Change Roc Chartschool

Momentum Trading How To Find The Best Stocks To Trade

Momentum Trading How To Find The Best Stocks To Trade

Momentum Stock Screener Best Momentum Stocks Today

Momentum Stock Screener Best Momentum Stocks Today

Momentum Day Trading Strategies For Beginners A Step By Step Guide

Momentum Day Trading Strategies For Beginners A Step By Step Guide

A Volatility Based Momentum Indicator For Traders By Steve Roehling Medium

:max_bytes(150000):strip_icc()/dotdash_Final_Momentum_Indicates_Stock_Price_Strength_Dec_2020-01-1539372a0ff94d8ab08a8d11d91d063c.jpg) Momentum Indicates Stock Price Strength

Momentum Indicates Stock Price Strength

Momentum Factor Effect In Stocks Quantpedia

Momentum Factor Effect In Stocks Quantpedia

Post a Comment for "How To Calculate Momentum Stocks"