How To Calculate The Value Of My Shares

Today we run through a full example on calculating share value for FacebookEquity Growth Rate Cal. Par value of shares also known as the stated value per share is the minimal shares value as decided by the company which is issuing such shares to the public and the companies then will not sell such type of shares to the public below the decided value.

Simply Safe Dividends Safe Growing Income For Retirement Dividend Investing Income Investing

Simply Safe Dividends Safe Growing Income For Retirement Dividend Investing Income Investing

For example lets say you own 35 shares of stock for Company A.

How to calculate the value of my shares. According to the Gordon Growth Model the shares are correctly valued at their intrinsic level. To calculate an individuals shareholder value we start by subtracting a companys preferred dividends from its. To value a shareholding you will need to multiply the number of shares owned by the price per share.

To arrive at this figure the stock calculator multiplies dividend per share times the number of dividends paid per year and then multiplies that result by the number of years and finally multiplies that result by the number of shares. Calculate the value of your holdings and its change over time. The intrinsic value p of the stock is calculated as.

Example of CGT on shares. The pricing method used by the calculator is based on the current dividend and the historical growth percentage. In other words it is the share nominal amount 1 01 or 0001 mentioned on the stock.

London Stock Exchange feed. Calculate the value of your holding. You take the value for NAV or shareholders equity from the latest company balance sheet and divide it by the number of shares in issue which you will tend to find in the notes to the accounts.

Then work out what proportion of shares you are selling to work out your cost. Stock Price Calculator to Calculate Purchase Price Based on Your Required Rate of Return This free online Stock Price Calculator will calculate the most you could pay for a stock and still earn your required rate of return. Then divide that cost by the proportion of shares you are selling.

Use the Calculate button to work out the value of your holding. Using the quarter up price. Simplifying finances and making them accessible to everyone is important to us.

2 005 - 003 100. The final part of my mini series on share price valuation. Calculating NAV per share is very easy to do.

Taking the same example of a law firm suppose the profits were 40000. The book value per share is determined by dividing the book value by the number of outstanding shares for a company. Finally to solve for the ratio divide the share price by the book value per.

Divide the total value of your investment in the company by the current value of the stock. You can also look up historical share price data. The current share price is.

Use the Barclays share price calculators to calculate the current value of your holding as well as its change in value over time. The higher the value the better for shareholders. Simply multiply your share price by the number of shares you own.

For example If the deceased person owned 1000 shares and the closing price on the day was 236p then the value of the shareholding would be 2360. Business Value Based on Profits Owners Salary. This is the number of shares you own of the stock.

Share Portal Standard Life Aberdeen Standard Investments search close Menu menu close. Our calculator will also give you an approximate value for your business by taking the annual profit and multiplying it by the appropriate industry multiplier. If you own 10000 shares your equity stake would be worth approximately.

View the current share price or use our tools to compare data and calculate the value of your holding. New York Stock Exchange Feed. Calculate the companys earnings by share by dividing the companys available income by its total number of.

Enter the number of shares that you own. There might be a short delay while the share price calculator loads correctly. Some investors like to focus on only the tangible net assets.

You search Company A stock price and see that at this moment each share is worth 85. If your company had earnings of 2 per share you would multiply it by 15 and would get a share price of 30 per share. If you own 500 worth of stock and the current share price of the stock is 50 then you own 100 shares of stock 50050.

Information and resources on managing your shareholding. The value of your holding currently stands at. Now calculate 35 shares times 85 and youll get a total value of 2975.

Add together all the money you spent on the shares. Walk through an example. Calculate the value of your Barclays shares based on the current share price.

How To Calculate Your Net Worth The Right Way What Currencies Are Or Aren T Doesn T Matter When Calculating The Real Value O Smart Money Money Today Net Worth

How To Calculate Your Net Worth The Right Way What Currencies Are Or Aren T Doesn T Matter When Calculating The Real Value O Smart Money Money Today Net Worth

What Is My Net Worth And How Do I Calculate It Net Worth Finance Goals Worth

What Is My Net Worth And How Do I Calculate It Net Worth Finance Goals Worth

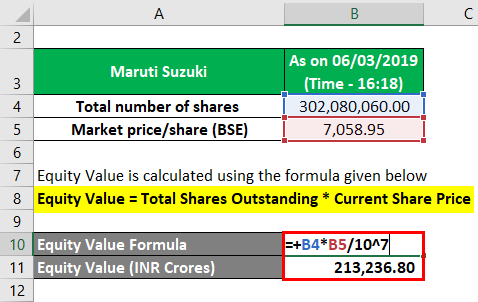

Equity Value Formula Calculator Excel Template

Equity Value Formula Calculator Excel Template

How To Calculate The Value Of Your Pension Pensions The Value Calculator

How To Calculate The Value Of Your Pension Pensions The Value Calculator

How To Calculate Pv Of A Different Bond Type With Excel

Common Stock Formula Calculator Examples With Excel Template

Common Stock Formula Calculator Examples With Excel Template

Investing For Beginners Annual Dividends In 2020 Dividend Investing Finance Investing Investing

Investing For Beginners Annual Dividends In 2020 Dividend Investing Finance Investing Investing

Financial Ratios Analysis Dividend Investing Financial Ratio Investing

Financial Ratios Analysis Dividend Investing Financial Ratio Investing

The 100 Best Stocks To Buy In 2020 Paperback December 10 2019 Best Stocks To Buy Best Stocks Buy Stocks

The 100 Best Stocks To Buy In 2020 Paperback December 10 2019 Best Stocks To Buy Best Stocks Buy Stocks

How To Calculate Dividend Yield 5 Critical Lessons Dividend Dividend Investing Investing

How To Calculate Dividend Yield 5 Critical Lessons Dividend Dividend Investing Investing

Investing 101 The Stuff You Re Not Taught At School R E A D I T B U S I N E S S Value Investing Investing Investing 101

Investing 101 The Stuff You Re Not Taught At School R E A D I T B U S I N E S S Value Investing Investing Investing 101

Calculate The Present Value Of A Future Value Lump Sum Of Money Using Pv X3d Fv X2f 1 I N The Present Value I Investing Calculator Basic Calculators

Calculate The Present Value Of A Future Value Lump Sum Of Money Using Pv X3d Fv X2f 1 I N The Present Value I Investing Calculator Basic Calculators

The Complete Step By Step Guide On How To Calculate Terminal Value Click To Read The Full Article On Website Htt Investing Strategy Investing Start Investing

The Complete Step By Step Guide On How To Calculate Terminal Value Click To Read The Full Article On Website Htt Investing Strategy Investing Start Investing

How To Calculate Value At Risk Var In Excel

Save Money First Investing For Beginners Investing Stock Market For Beginners Stock Market

Save Money First Investing For Beginners Investing Stock Market For Beginners Stock Market

How To Calculate Rsi In Google Sheets Or Excel Stock Trader Jack Google Sheets Excel Rsi

How To Calculate Rsi In Google Sheets Or Excel Stock Trader Jack Google Sheets Excel Rsi

How To Calculate Loan To Value Ratio Homebuyer Guide Loan Real Estate Terms

How To Calculate Loan To Value Ratio Homebuyer Guide Loan Real Estate Terms

How To Calculate Share Pricing Using Fair Market Value Small Business Strategy Marketing Small Business

How To Calculate Share Pricing Using Fair Market Value Small Business Strategy Marketing Small Business

Do You Understand Market Capitalization You Need To Learn How To Calculate This Metric In Order To Make Smart Inv Investing Value Stocks Investing Strategy

Do You Understand Market Capitalization You Need To Learn How To Calculate This Metric In Order To Make Smart Inv Investing Value Stocks Investing Strategy

Post a Comment for "How To Calculate The Value Of My Shares"