Indian Stock Fair Value Calculator

With a few simple values you can. Also you can calculate the fair value using the discounted cash flows.

How To Arrive At The Fair Value Estimate Of A Stock

How To Arrive At The Fair Value Estimate Of A Stock

At Morningstar equity analysts calculate what they think the long-term intrinsic value of a stock is helping you see beyond the present market price.

Indian stock fair value calculator. How to use the calculator. This is a simple discounted model calculator to help you find the fair value of a company. Fair value uncertainty rating.

Run queries on 10 years of financial data. Insert the earning per share EPS and revenue growth into the approximate fair value calculator and get the approximate true fair value intrinsic value of the stock. Basic Calculator by Sharekhan.

Uncovering the Fair Value Estimate or FVE Forecasting is hard. It is the expected rate at which the company will grow in the upcoming years. Option trading is a highly rewarding way to supercharge your returns.

If one does not want to go into the complexity of fair price calculations using mathematical models then Ill suggest an easier alternative in this article. Using the Ben Graham Formula we can calculate Relative Graham Value RGV by dividing the stocks intrinsic value by its stock price. Calculate Fair Values of Call options and Put options for Nifty Options and a wide range of other Index and Stock options listed on the National Stock Exchange in India With the SAMCO Option Fair Value Calculator calculate the fair value of call options and put options.

To more accurately determine the true fair value intrinsic value of the stock you can use the advanced calculator. Select value to calculate. For commodities derivatives.

A stock is said to be overvalued when the share price exceeds the fair value. But it doesnt necessarily mean that you would get the required returns. In couple of months market price of this stock fell from Rs100 to Rs80.

The best way to assess the PE is by comparing it to industry PE and with the historic PE of that specific stock. Analysts believe that over time the share price will reflect the intrinsic value of the underlying business. At this price level the stock is said to be trading at a discount of 111 to its intrinsic value 90-8090.

Profit P SP NS - SC - BP NS BC. Suppose a stocks market price is Rs100. Close Home Screens Tools.

Remember though that this is just an approximate valuation and like any complex formula - garbage in garbage out. Calculate option price of NSE NIFTY stock options or implied volatility for the known current market value of an NSE Option. Say you want to buy 100 shares of some company and the last closing price of their stocks was 30.

Click here to use the calculator. If the RGV is above one as per theory the stock is undervalued and is a good buy. The Stock Calculator uses the following basic formula.

Fair Value Calculator This is a simple discounted model calculator that can help you find the fair value of a company using Earnings per share EPS forecast. Upon estimation its intrinsic value comes out to be Rs90. Include earning per share cash flow per share.

With a few simple values you can estimate the intrinsic value of a company. Relative to the current share price of 914 the company appears about fair value at a 43 discount to where the stock price trades currently. This is a simple discounted model calculator to help you find the fair value of a company using Earnings per share EPS forecast.

The calculation consists of the following key values. Screener provides 10 years financial data of listed Indian companies. Create a stock screen.

As a rule of thumb a popular stock which is trading at a discount to its fair price say at 23rd levels can go up within next few months. The fair value of 100 shares would be 100 x 30 3000. What means by discount.

The analyst assigns a fair. Calculate the performance of your financial instruments using Sharekhans tools calculators. With a few simple values you can estimate the rough intrinsic value of a stock.

Use respectable financial news and find the last closing price for the stock you want to buy. For that you need to buy its stocks at the right price MRP and thats what our price calculator helps you to discoverPRICE CALCULATOR is a unique tool which helps you identify the MRP right price of a stock its intrinsic value. Finding a good company for investment is a good start.

Fair Value Based on Price Earnings PE It is easy to calculate the price earnings ratio of any stock by simply dividing its current price with its reported EPS of the last 4 quarters take consolidated EPS. Fair value quality stocks Get updates by Email High growth stocks at reasonable price. It provides tools to find and analyse new stock ideas.

In the final step we divide the equity value by the number of shares outstanding. If the RGV is below 1 then the stock is overvalued and is a good sell. The Risk Disclosure Document issued by SEBI and go through the Rights and Obligations and Dos and Donts issued by Stock Exchanges and Depositories before trading on the Stock Exchanges.

The true value of a stock based on criteria of the users choosing. Once the fair value estimate is established the next step is to determine a level of confidence in the estimate which can vary based on factors such as volatility within the companys industry economic sensitivity and other variables that could affect the stocks price in the future.

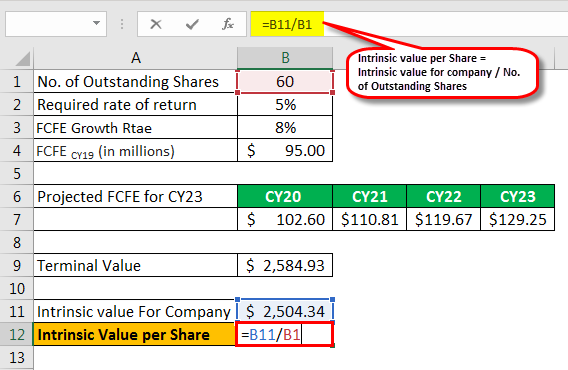

Intrinsic Value Formula Example How To Calculate Intrinsic Value

Intrinsic Value Formula Example How To Calculate Intrinsic Value

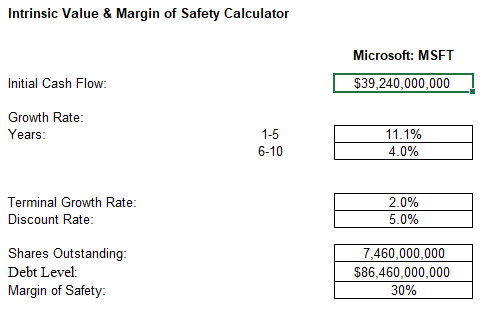

How To Calculate Intrinsic Value Of A Stock Excel

How To Calculate Intrinsic Value Of A Stock Excel

Salvage Value Formula Calculator Excel Template

Salvage Value Formula Calculator Excel Template

Value Shares With Graham S Formula

Value Shares With Graham S Formula

How To Find The Intrinsic Value Of A Stock In Excel Graham Intrinsic Value Formula Youtube

How To Find The Intrinsic Value Of A Stock In Excel Graham Intrinsic Value Formula Youtube

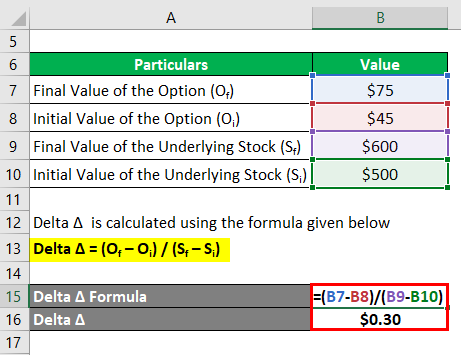

Delta Formula Calculator Examples With Excel Template

Delta Formula Calculator Examples With Excel Template

7 Business Valuation Methods You Should Know Business Valuation Structured Finance Debt Solutions

7 Business Valuation Methods You Should Know Business Valuation Structured Finance Debt Solutions

Check Vehicle Value Used Car Bike Valuation Tool Droom Used Cars Motorcycles And Scooter Used Car Dealer

Check Vehicle Value Used Car Bike Valuation Tool Droom Used Cars Motorcycles And Scooter Used Car Dealer

What Is The Intrinsic Value Formula Try This Online Calculator Ben Graham Getmoneyrich

What Is The Intrinsic Value Formula Try This Online Calculator Ben Graham Getmoneyrich

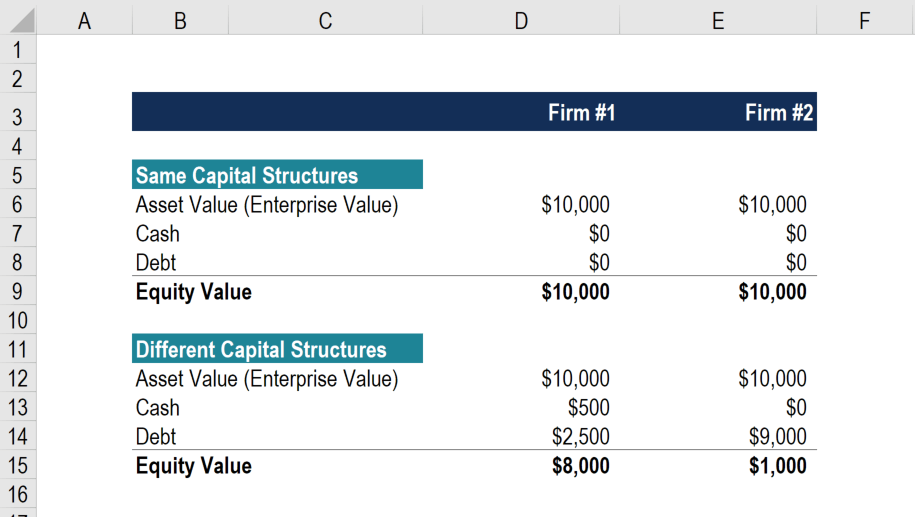

Enterprise Value Vs Equity Value Complete Guide And Examples

Enterprise Value Vs Equity Value Complete Guide And Examples

Book Value Per Share Bvps Overview Formula Example

Book Value Per Share Bvps Overview Formula Example

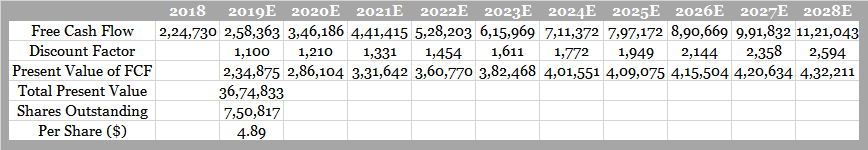

Calculating The Intrinsic Value Of Wal Mart Stock Formula Of Intrinsic Value Total Projected Discounted Operating Ca Market Price Cash Flow Intrinsic Value

Calculating The Intrinsic Value Of Wal Mart Stock Formula Of Intrinsic Value Total Projected Discounted Operating Ca Market Price Cash Flow Intrinsic Value

How To Multiply Money In India Proven Ways Financial Control Financial Mistakes Financial Emergency Fund

How To Multiply Money In India Proven Ways Financial Control Financial Mistakes Financial Emergency Fund

Value Investing Earnings Per Share Eps Formula Value Investing Investing Earnings

Value Investing Earnings Per Share Eps Formula Value Investing Investing Earnings

How To Calculate Terminal Value In A Dcf Analysis

How To Calculate Terminal Value In A Dcf Analysis

Calculation Of Ltcg Tax On Sale Of Shares Equity Mutual Fund Units 10 Ltcg Tax On Sale Of Stocks Equity Mutual Funds Budge Budgeting Mutuals Funds Equity

Calculation Of Ltcg Tax On Sale Of Shares Equity Mutual Fund Units 10 Ltcg Tax On Sale Of Stocks Equity Mutual Funds Budge Budgeting Mutuals Funds Equity

Value Investing What Is Fundamental Analysis Of A Company Or Stock Fundamental Analysis Investment Companies Value Investing

Value Investing What Is Fundamental Analysis Of A Company Or Stock Fundamental Analysis Investment Companies Value Investing

Value Investing Is At Its Core The Marriage Of A Contrarian Streak And A Calculator Seth Klarman Stock Market Quotes Value Investing Investment Quotes

Value Investing Is At Its Core The Marriage Of A Contrarian Streak And A Calculator Seth Klarman Stock Market Quotes Value Investing Investment Quotes

Discount Rate Formula How To Calculate Discount Rate With Examples

Discount Rate Formula How To Calculate Discount Rate With Examples

Post a Comment for "Indian Stock Fair Value Calculator"