Reverse Stock Split Fractional Shares

IAU which will be effective on May 24 2021 at market open. On the companys support site it says If a stock experiences a forward stock split or a reverse stock split youll receive the relevant amount of fractional.

Any fractional shares of common stock resulting from the reverse stock split will be paid in cash based on a valuation of 212000 per post-split share.

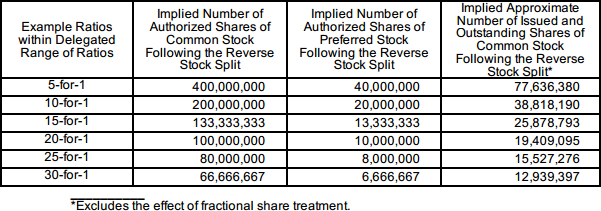

Reverse stock split fractional shares. Sometimes a reverse stock split means a shareholder has fractional shares. For example if you have 100 shares before a reverse stock split and the split is one-for-three your shares will be 3333. There are two reasons to do a reverse split.

You profit 450 with almost no risk. I would assume the value of the fractional share whether its a loss or gain can be used to adjust the cost basis. This is your cost basis per share.

You will end-up with an exact integer number of shares. On Line 1 or Line 3 Column A enter the name of the company or its symbol and the fractional number of shares. More broadly in stock split cases where CIL is not offered but fractional shares are either rounded up or down the stock holder is either gaining or losing part of a share.

Instead shareholders who otherwise would be entitled to a fraction of a. I suspect theyll keep rounding once they catch their breaths. No fractional shares of common stock will be issued.

Once implemented the reverse stock split will raise the share price of IAU and decrease the number of outstanding shares. The 1-for-1000 reverse stock split will reduce the number of outstanding shares of the companys common stock from approximately 790000. If the 100 shares underwent a 13 reverse split you would have 33333 new shares.

Once you understand them trading reverse splits that round up fractional shares is easy. With a reverse stock split you end up owning fewer shares but each share is. Sign up for notifications.

As were learning reverse splits are fairly low priority for brokers and fractional share round ups are extremely low priority. A reverse stock split reduces the number of issued shares but without changing the total value of all shares issued. Robinhood is one such brokerage.

This is reverse split arbitrage. The 1-for-1000 reverse stock split will. The other reason is to get rid of small investors.

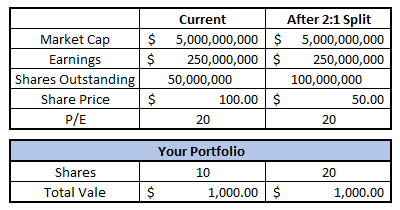

When a company splits its stock it boosts its share count by giving shareholders additional shares of stock. There are four steps. In most cases the company will enter your shares at 33 and you will get the remainder in cash.

After a reverse stock split where fractional shares are rounded up no CIL payment is offered how do I account for the value of the received fractional share. The total value of shares outstanding and the total value of a. Divide the total cost basis by the total number of shares you received in the reverse split including fractions.

Divide the total cost basis of 1510 by 33333 to get a per share basis of 4530. When they round up the share you had bought for 050 is now worth around 5. BlackRock announced today a 1 for 2 reverse stock split for the iShares Gold Trust NYSE Arca.

When the reverse split is done all fractions are turned into cash. No fractional shares will be issued. In a 32 stock split for example you receive.

A reverse stock split is when a company decreases the number of shares outstanding in the market by canceling the current shares and issuing fewer new shares based on a predetermined ratio. The simple answer is no. I suspect theyll keep rounding once they catch their breaths.

For example if a stock split results in 21 shares worth 10 per share youll receive 2 shares and 1 the cash equivalent of 01 shares. The first is to get the share price over a hard limit that is set by the stock exchange. Any fractional shares of common stock resulting from the reverse stock split will be paid in cash based on a valuation of 212000 per post-split share.

If a stock experiences a reverse stock split youll receive the cash equivalent of any fractional non-whole share amounts resulting from the split in lieu of shares. As a result of the reverse stock split the Companys issued and outstanding shares of common stock will decrease to approximately 15811760 million post-split shares prior to effecting the rounding of fractional shares into whole shares as described below from approximately 2687999095 pre-split shares. Skip Column B and in Column C enter the date you purchased the stock.

No fractional shares of common stock would be issued as a result of a proposed Reverse Stock Split. Stock splits or reverse stock splits.

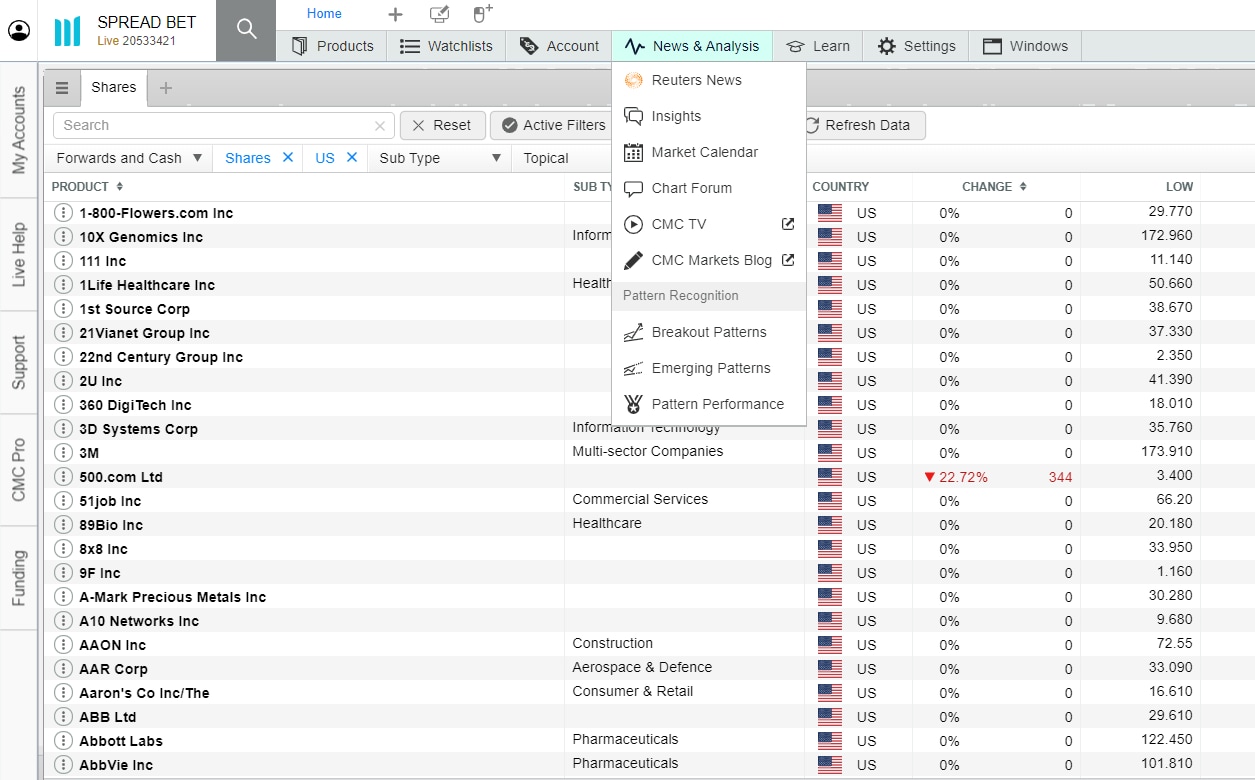

Stock Splits Fractional Shares In Trading Cmc Markets

Stock Splits Fractional Shares In Trading Cmc Markets

California Resources Corporation The Reverse Split Effect Otcmkts Crcqw Seeking Alpha

California Resources Corporation The Reverse Split Effect Otcmkts Crcqw Seeking Alpha

Https Infomemo Theocc Com Infomemos Number 48242

What Happens To Fractional Shares In A Stock Split

What Happens To Fractional Shares In A Stock Split

Tesla And Apple Did It Is It Time For A Google Stock Split

Tesla And Apple Did It Is It Time For A Google Stock Split

Here S How Fractional Shares Work On Robinhood Investing Simple

Here S How Fractional Shares Work On Robinhood Investing Simple

What Happens In A Reverse Stock Split If You Don T Have Enough Shares Quora

Https Infomemo Theocc Com Infomemos Number 47920

Stock Exchange Deficiency Notices And Reverse Stock Split Considerations

Stock Exchange Deficiency Notices And Reverse Stock Split Considerations

Math Of A Reverse Stock Split Investmentbank Com

Math Of A Reverse Stock Split Investmentbank Com

Https Investor Tenethealth Com Files Doc Downloads Reverse Stock Split Faq Pdf

Fractional Shares Definition What Are Fractional Shares Forbes Advisor

Fractional Shares Definition What Are Fractional Shares Forbes Advisor

Reverse Stock Split Problem Random Alpaca Community Forum

Reverse Stock Split Problem Random Alpaca Community Forum

Https Materials Proxyvote Com Approved 563771 20111114 Nps 109203 Pdf Mannatech Smproxy2012 0010 Pdf

Stock Splits Explained Equityzen

Stock Splits Explained Equityzen

Https Theocc Com Webapps Infomemos Occprod0pubsession Da8d0123fe41d51c63bf6b9786dded33 Occ Ppube4l Number 40640 Date 201702 Lastmodifieddate 02 2f10 2f2017 13 3a46 3a07

Post a Comment for "Reverse Stock Split Fractional Shares"