Short European Stock Market Etf

41 Best Inverse ETFs Short ETFs Bear ETFs When you invest in the stock market you can bet on both sides of the market using an online broker account. The average expense ratio is 050.

How To Short The Vix Without Blowing Up Your Entire Portfolio Backtesting A Hedged Short Vxx Portfolio Nasdaq

How To Short The Vix Without Blowing Up Your Entire Portfolio Backtesting A Hedged Short Vxx Portfolio Nasdaq

For Europe that means the.

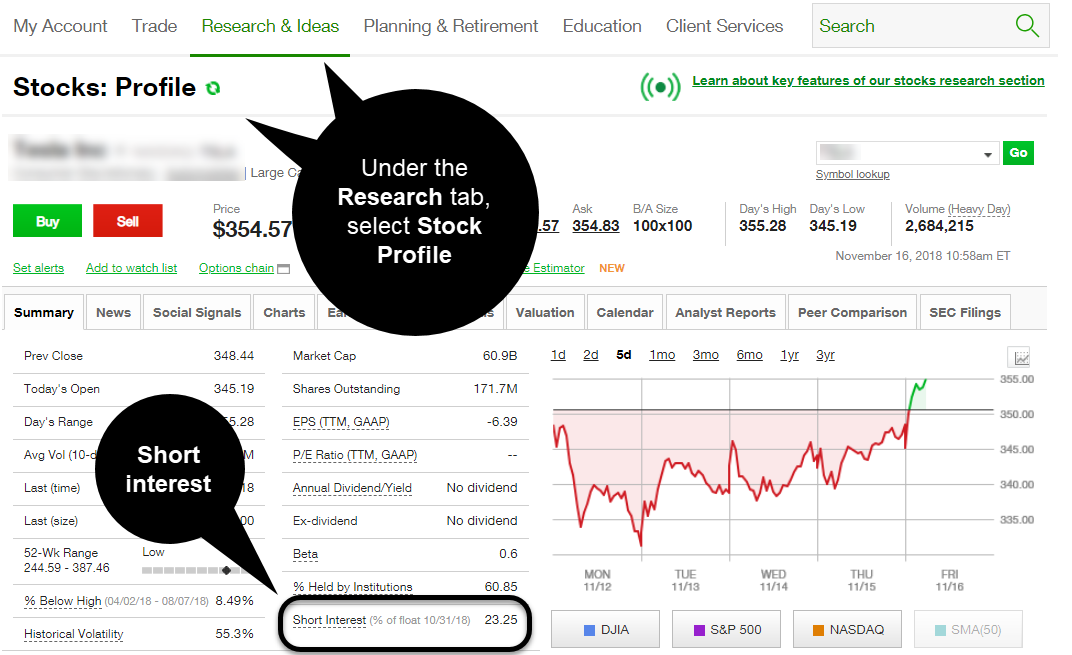

Short european stock market etf. This hedge fund-like approach makes the ETF much more agile than a typical blue-chip stock fund. This short ProShares ETF seeks a return that is -2x the return of its underlying benchmark target for a single day as measured from one NAV calculation to the next. A basic inverse ETF such as the ProShares Short SP500 SH 012 delivers the daily inverse performance.

Unlike inverse ETFs tied to a generic index like the SP 500 at times this ETF even manages to squeak out a gain when the broader stock market is rising because of its focus on the least. Another approach is simply to. Dollar would increase the index value by 2 and vice versa.

The ETFs that make shorting the easiest are the inverse funds ETFs that are designed from the outset to give the inverse or short returns of an index on a daily basis. In contrast short ETFs seek to perform as the inverse of a specific index which they accomplish through short-selling stocks trading derivatives or using futures contracts. Total Market ETFs can be found in the following asset classes.

Buying put options on an index or on the individual stocks in a portfolio is another. Bottom line the following ETFs go up in value as the underlying. IShares Core MSCI Europe ETF.

This means that 1 weakening of the euro relative to the US. Dollar would increase the index value by 2 and vice versa. Suppose you thought the overall market will decline in the short term.

Short sales of futures contracts linked to stock market indexes is one method. Franklin FTSE Europe ETF. JPMorgan BetaBuilders Europe ETF.

Nasdaq Nordic Foundation. SPDR Portfolio Europe ETF. This ETF tracks the Double Short Euro Index which is two-times leveraged.

The inverse ETF universe is comprised of about 10 ETFs excluding leveraged ETFs and ETFs with less than 50 million in assets under management AUMThe last bear market took place from February. Here are the best Europe Stock ETFs. The largest Total Market ETF is the Vanguard Total Stock Market ETF VTI with 21859B in.

For some traders that means embracing inverse and inverse leveraged exchange traded funds. This short ProShares ETF seeks a return that is -2x the return of its underlying benchmark target for a single day as measured from one NAV calculation to the next. This means that 1 weakening of the euro relative to the US.

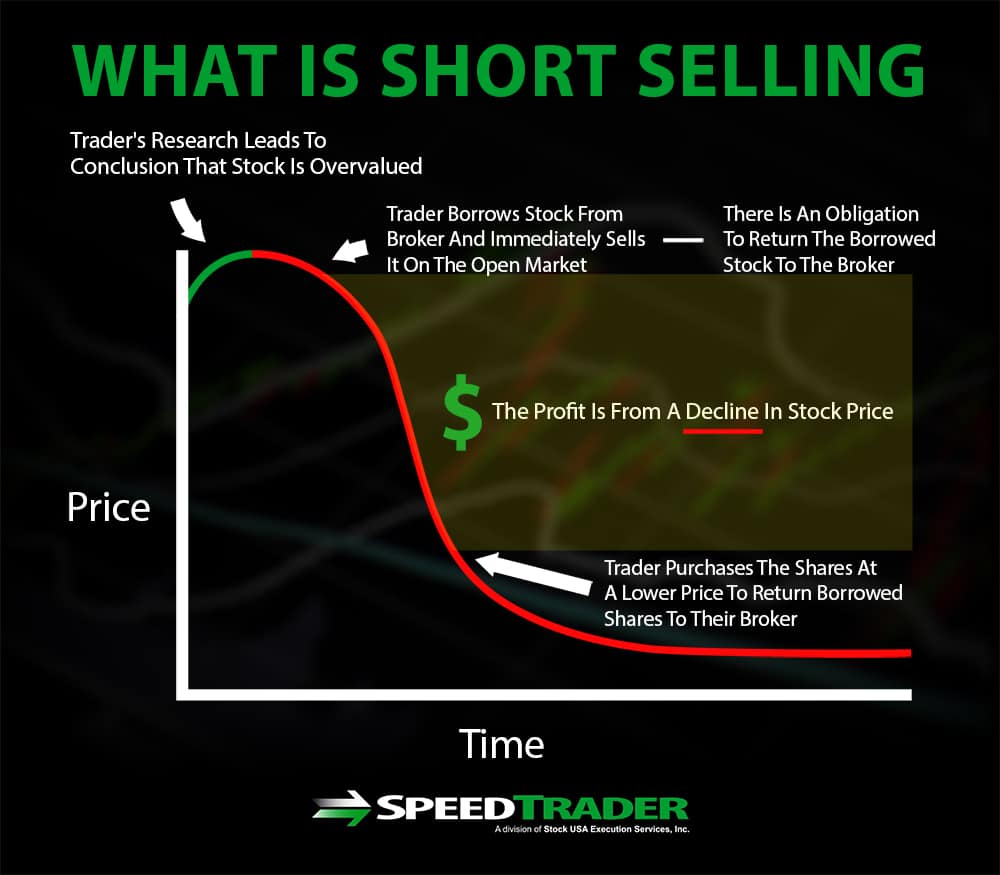

The SP 500 the Dow Jones the Nasdaq Composite and the Russell 2000 lost about 49 59 47 and 64 respectively on. Inverse ETFs exchange traded funds are an easy way to place bearish bets without physically shorting shares of stock. InverseShort ETFs seek to provide the opposite return of an index.

Xtrackers MSCI Europe Hedged Equity ETF. Due to the compounding of daily returns holding periods of greater than one day can result in returns that are significantly different than the target return and ProShares returns over periods other than one day will likely differ in amount and possibly direction from the target return for the same period. Introduced in 2014 First Trust LongShort Equity ETF has a robust investor base with 260 million.

This ETF tracks the Double Short Euro Index which is two-times leveraged. Some of these ETFs do not use benchmarks to short against but rather create their own models to perform in an inverse manner. ETF Stock Gainers.

European Short ETFs Most ETFs hold assets such as stocks bonds or commodities of a given index with a price thats closely tied to the net value of those assets.

The History Of Stock Market Short Selling In America

The History Of Stock Market Short Selling In America

Market Volatility Has Changed Immensely Bloomberg Business Marketing Change

Market Volatility Has Changed Immensely Bloomberg Business Marketing Change

Short Term Up Trend Buy Signal Gprk 11 08 17 Free Stock Pick Gprk Stocks Trading Daytraders Options Optionstrading Nas Stock Symbols Stock Picks Nasdaq

Short Term Up Trend Buy Signal Gprk 11 08 17 Free Stock Pick Gprk Stocks Trading Daytraders Options Optionstrading Nas Stock Symbols Stock Picks Nasdaq

The Gold Currency Investment Strategy Summary Of Our Gold Etf Vs Strategy Development Wealth Management Croc Gold Investments Investing Wealth Management

The Gold Currency Investment Strategy Summary Of Our Gold Etf Vs Strategy Development Wealth Management Croc Gold Investments Investing Wealth Management

Profit From Short Term Momentum Of Possibletrend Reversal In Natural Gas Etf Ung Click Chart To See Our Technical Analysis Of This S Analisi Tecnica Finanza

Profit From Short Term Momentum Of Possibletrend Reversal In Natural Gas Etf Ung Click Chart To See Our Technical Analysis Of This S Analisi Tecnica Finanza

Why Shares Of Apple Are Technically In Trouble This Time Aapl Qqq Swing Trading Moving Average Trouble

Why Shares Of Apple Are Technically In Trouble This Time Aapl Qqq Swing Trading Moving Average Trouble

Utilities Select Sector Spdr Stock Charts Dominion Marketing Leads

Utilities Select Sector Spdr Stock Charts Dominion Marketing Leads

:max_bytes(150000):strip_icc()/ShortSellingvs.PutOptions-eff3cf41a5f549978c295eef47fbc2bd.png) Short Selling Vs Put Options What S The Difference

Short Selling Vs Put Options What S The Difference

Euro Stocks Citigroup Stock Market Tuesday Motivation

Euro Stocks Citigroup Stock Market Tuesday Motivation

Short Term Up Trend Buy Signal Crc 12 04 17 Free Stock Pick Crc Stocks Trading Options Optionstrading Nasdaq Daytradin Swing Trading Stock Picks Nasdaq

Short Term Up Trend Buy Signal Crc 12 04 17 Free Stock Pick Crc Stocks Trading Options Optionstrading Nasdaq Daytradin Swing Trading Stock Picks Nasdaq

Playing Opposites Why And How Some Pros Go Short On Ticker Tape

Playing Opposites Why And How Some Pros Go Short On Ticker Tape

Europe Asia Stocks Offer Biggest Bargains To U S Growth Europe Growth Offer

Europe Asia Stocks Offer Biggest Bargains To U S Growth Europe Growth Offer

A Deceivingly Strong Trading Session As Small Cap Stocks Break Out Click The Chart Above To Read My Technical Analysi In 2020 Small Cap Stocks Small Caps Etf Trading

A Deceivingly Strong Trading Session As Small Cap Stocks Break Out Click The Chart Above To Read My Technical Analysi In 2020 Small Cap Stocks Small Caps Etf Trading

Uranium Etf Ready To Break A Long Slumber Stock Charts Canadian Dollar Supportive

Uranium Etf Ready To Break A Long Slumber Stock Charts Canadian Dollar Supportive

Presidential Cycle Warns Of September Stock Market Weakness Http Rplg Co 6d5f2780 Valueinvesting Stockmarket Stock Market Investing Stock Market Investing

Presidential Cycle Warns Of September Stock Market Weakness Http Rplg Co 6d5f2780 Valueinvesting Stockmarket Stock Market Investing Stock Market Investing

Here S The Only Thing Investors Need To Know About The Stock Market Right Now Says 50 Year Veteran Marketwa In 2020 Results Quotes Stock Quotes Competitive Analysis

Here S The Only Thing Investors Need To Know About The Stock Market Right Now Says 50 Year Veteran Marketwa In 2020 Results Quotes Stock Quotes Competitive Analysis

Vcsh Etf Guide Stock Quote Holdings Fact Sheet And More Stock Quotes Fact Sheet Corporate Bonds

Vcsh Etf Guide Stock Quote Holdings Fact Sheet And More Stock Quotes Fact Sheet Corporate Bonds

How Do You Short A Stock Learn With Examples Ig Uk

How Do You Short A Stock Learn With Examples Ig Uk

Post a Comment for "Short European Stock Market Etf"