Stock Market Index Calculation + Example

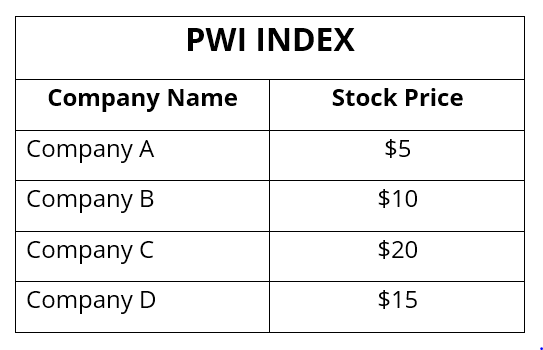

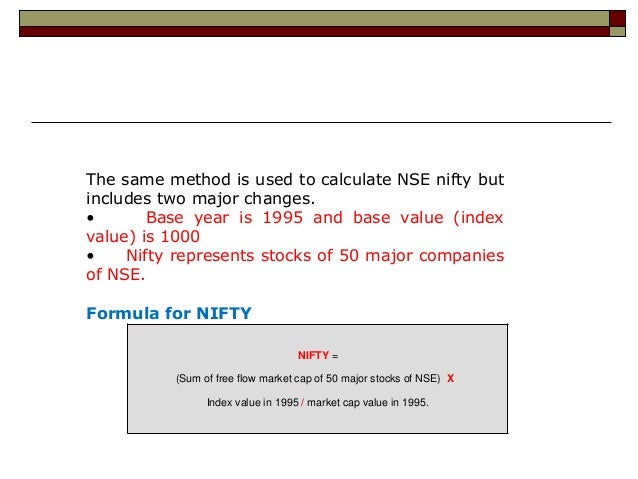

For example if a share is 5 and there are 500000 of them then 5 x 500000 25 million market cap. Composition of a stock market index such as the SP BSE Sensex Sensex SP Nifty 50 Nifty the Bank Nifty etc is not constant.

Capitalization Weighted Index Overview And How To Calculate

Capitalization Weighted Index Overview And How To Calculate

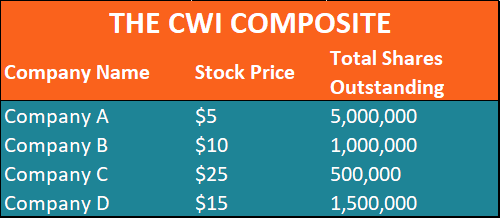

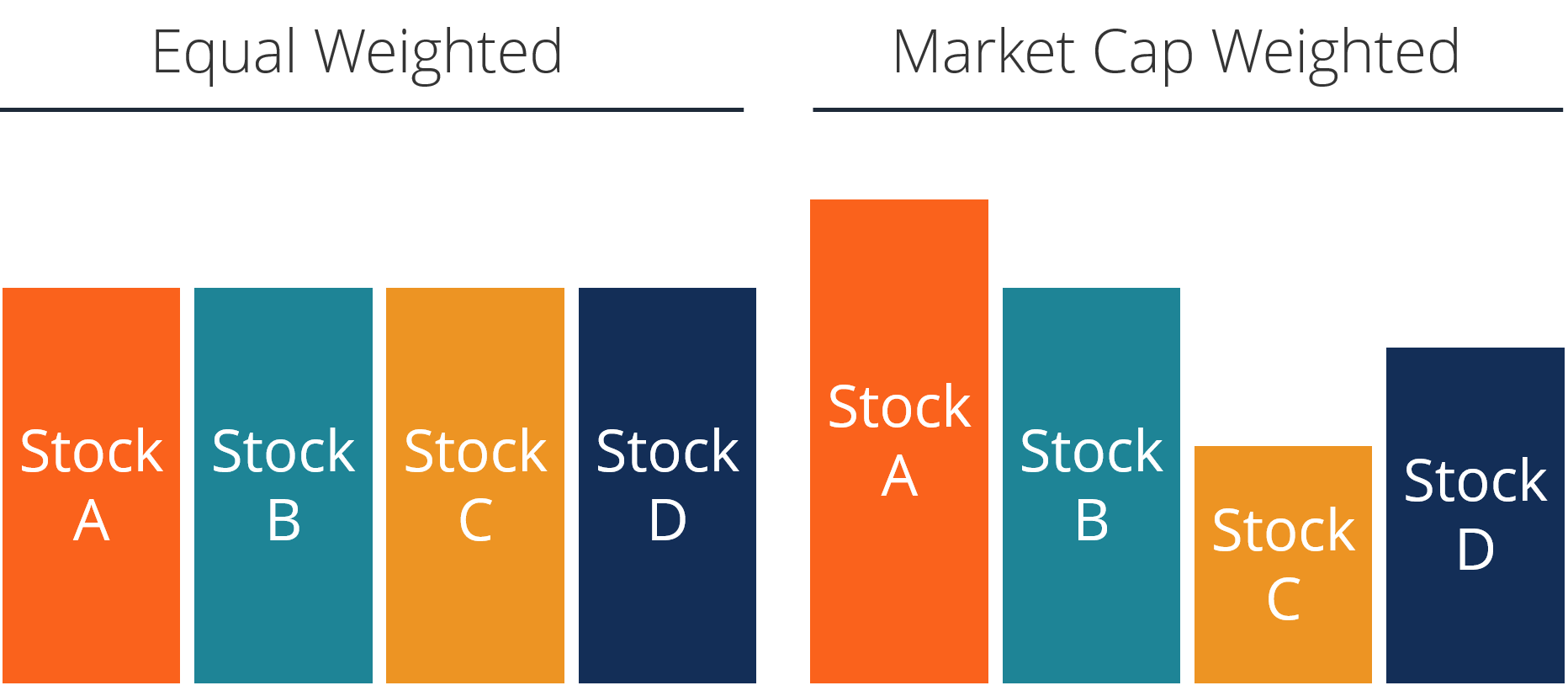

Capitalization-weighted Index also called cap-weighted or value-weighted index is a capital market index in which the constituent securities are weighted based on their market capitalization which equals the product of its price per share and total number of common shares outstandingThe weight of each security is calculated by the ratio of its market capitalization to the sum of market.

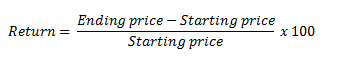

Stock market index calculation + example. They will say for example that the SP 500 index was at the same level as it was at some time in the past - so therefore investing in the index was a waste of time. Most of well-known stock market indices of the major stock markets in developed countries are still considered as highly representative since their constituent stocks comprise a high percentage of total value of the market. The market value for each stock is calculated by multiplying its price by the number of shares included in the index and each stocks weight in the index is determined based on its market value relevant to the total market value of the index.

A value-weighted index is an index where each stock is given a weight equal to its value. Stock A for example has a share price of 3 and there are 50 shares of this stock in the index. For example the Hang Seng Index Hong Kong is composed of 33 constituent stocks comprising approximately 70 of total value.

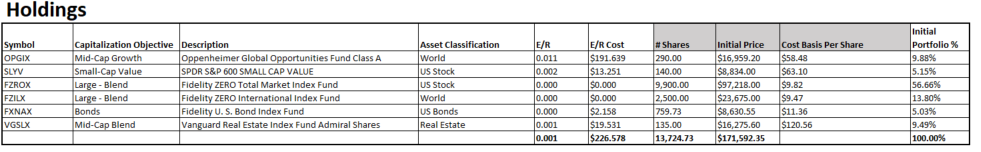

The financial value of each. Heres the key to this SP 500 return calculator. An example Lets say that you want to calculate the return of the SP 500 index during the month of October 2015.

So if it is at 1000 on the start and end date this will be 0. Find the market capitalization of each stock in the index by multiplying the price of the stock by the overall number of shares. Note that Company Cs weight has gone from 4 to 6 since the stock price had a big jump but when we divide the total market capitalization by the divisor to get the new index value we get.

It is a stock market Index in which companies stocks are weighted according to their share price. Investment Date Original Shares Original Value Current Shares Current Value Percent Return. Signals can also be generated by looking for divergences.

Welles Wilder the Relative Strength Index RSI is a momentum oscillator that measures the speed and change of price movements. Stock with fewer prices has less influence on the index. The best example of a price weighted index is the Dow Jones Industrial Average DJIA which is a price-weighted average of 30 well-known industrial stocks in the US.

First using an accurate price chart determine the starting and ending price. Hello How is a Stock Market Index Calculated Introduction. Add the market caps together.

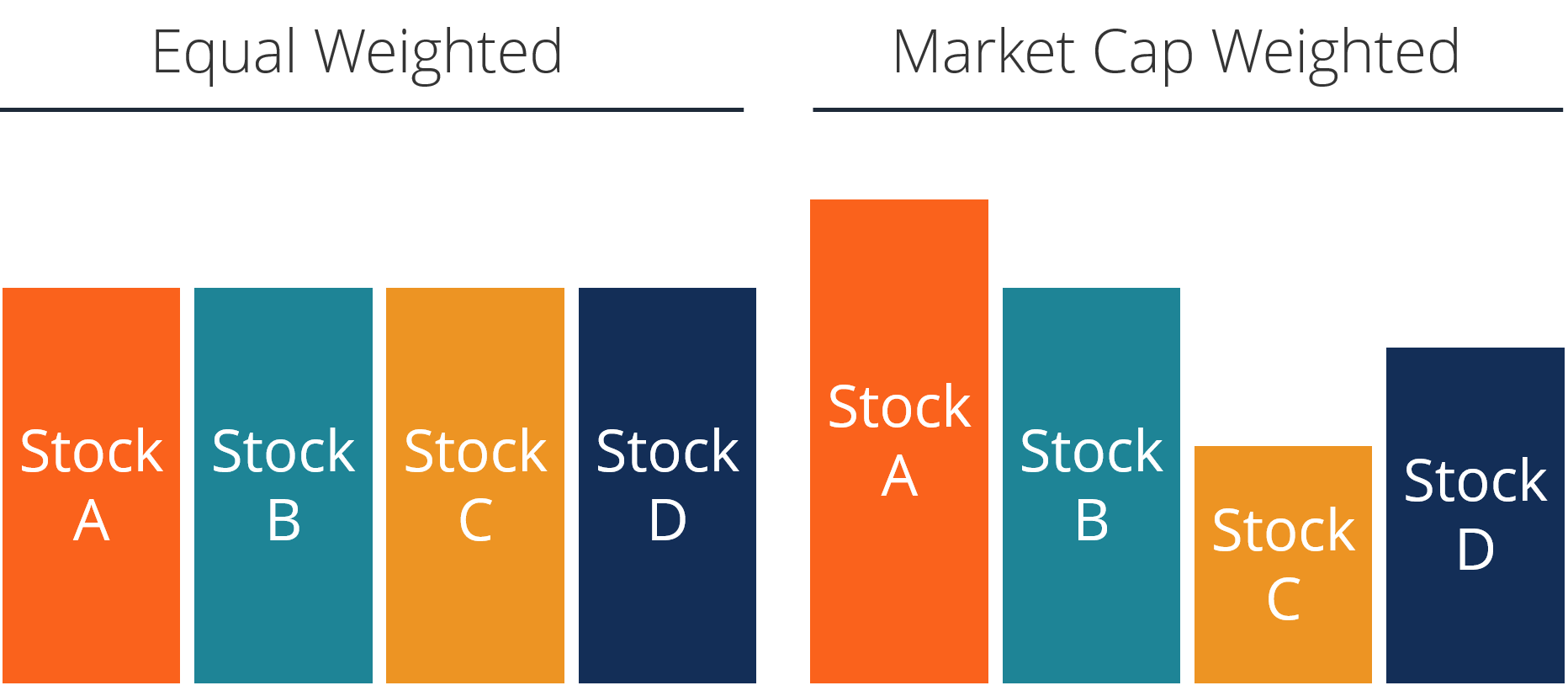

No importance is given to the market capitalization of the. As an example of an indirect stock index calculation which is much more likely a stock index might consist of 25 underlying individual stocks whose prices are added together then divided by 25 the number of underlying individual stocks the result of which is multiplied by the average trading turnover of each of the underlying individual stocks ie. The equal-weighted index is one of the stock indices that assign or give equal value to all the stocks in the index and therefore the total value of the index is determined by the value of each stock as if all of them carry equal importance or value in the calculation of the index.

SP 500 Index Return - The total price return of the SP 500 Index. Calculating Market Weights. Market capitalization is the stock price times the number of stocks outstanding and it represents the market value of the company.

For example Apple reported 4801589000 basic common shares in its fourth-quarter 2018 earnings report and it has a current market price of 14826. For example in a hypothetical index made up of three stocks with share prices of 70 20 and 10 the 70 stock would make up 70 of the total index regardless of the relative size of the company. This index is mostly influenced by stock which has a higher price and such stock receives greater weight in the index regardless of companies issuing size or number of outstanding Shares.

There is no weighted market index in Sri Lanka. RSI oscillates between zero and 100. Market Cap Weighted Index.

A composite index is a grouping of equities indexes or other factors combined in a standardized way providing a useful statistical measure of overall market or sector. According to Wilder RSI is considered overbought when above 70 and oversold when below 30. You must have come across a news item like NMDC a.

Calculating a market-capitalization-weighted index involves first calculating the market cap of each stock in the index.

/GettyImages-496030068-29ec863cca36413ab111277d250fe964.jpg) Dow Jones Industrial Average Vs S P 500 What S The Difference

Dow Jones Industrial Average Vs S P 500 What S The Difference

:max_bytes(150000):strip_icc()/dotdash_Final_Use_Options_Data_To_Predict_Stock_Market_Direction_Dec_2020-01-aea8faafd6b3449f93a61f05c9910314.jpg) Use Options Data To Predict Stock Market Direction

Use Options Data To Predict Stock Market Direction

How To Calculate The Historical Variance Of Stock Returns The Motley Fool

How To Calculate The Historical Variance Of Stock Returns The Motley Fool

:max_bytes(150000):strip_icc()/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-01-1ff6e59964b9408d9ac7d175f8ad1292.jpg) Calculating The Equity Risk Premium

Calculating The Equity Risk Premium

How Do You Calculate Volatility In Excel

How I Invested 170 000 In The Stock Market By John Cook Educated And Broke Medium

How I Invested 170 000 In The Stock Market By John Cook Educated And Broke Medium

Market Index Overview Functions And Examples

Market Index Overview Functions And Examples

:max_bytes(150000):strip_icc()/dotdash_Final_What_Is_the_Best_Measure_of_Stock_Price_Volatility_Nov_2020-01-a8e356925bcb472194445af0b566336b.jpg) What Is The Best Measure Of Stock Price Volatility

What Is The Best Measure Of Stock Price Volatility

:max_bytes(150000):strip_icc()/dotdash_Final_CBOE_Volatility_Index_VIX_Definition_Aug_2020-02-c820dbe721f84e37be0347edb900ba5b.jpg) Cboe Volatility Index Vix Definition

Cboe Volatility Index Vix Definition

:max_bytes(150000):strip_icc()/dotdash_final_Market_Breadth_Jan_2021-01-2870dd401b204df389c38419712ad546.jpg) Market Breadth Definition And Uses

Market Breadth Definition And Uses

How To Calculate Return On Indices In A Stock Market The Motley Fool

How To Calculate Return On Indices In A Stock Market The Motley Fool

:max_bytes(150000):strip_icc()/tesla-b2b7e254720442248700b97e303b201d.jpg) What Is The Formula For Calculating Capm In Excel

What Is The Formula For Calculating Capm In Excel

Stock Exchange All Ordinaries Index Parliament Of Australia

Stock Exchange All Ordinaries Index Parliament Of Australia

/index-5bfc37334cedfd0026c3f9fd.jpg) An Introduction To U S Stock Market Indexes

An Introduction To U S Stock Market Indexes

Price Weighted Index Overview How To Calculate Weights

Price Weighted Index Overview How To Calculate Weights

Equal Weighted Index Definition Advantages And Disadvantages

Equal Weighted Index Definition Advantages And Disadvantages

:max_bytes(150000):strip_icc()/dotdash_Final_Market_Indicators_Jun_2020-01-4781d74d7d664d1eadd64d5079e7515b.jpg)

/dotdash_Final_High-Low_Index_Jun_2020-01-2899b846629f448fbe7400d69f65a22b.jpg)

Post a Comment for "Stock Market Index Calculation + Example"