Stock Market Volatility Around National Elections

For investors its important to step back put. Historical Stock Market Volatility Around Elections.

Historical Volatility A Timeline Of The Biggest Volatility Cycles

Historical Volatility A Timeline Of The Biggest Volatility Cycles

This paper investigates a sample of 27 OECD countries to test whether national.

Stock market volatility around national elections. This paper investigates a sample of 27 OECD countries to test whether national elections induce higher stock market volatility. We have had several people reach out with three types of concerns. National election induces higher stock market volatility.

This paper investigates a sample of 27 OECD countries to test whether national elections induce higher stock market volatility. This paper investigates a sample of 27 OECD countries to test whether national elections induce higher stock market volatility. This paper investigates a sample of 27 OECD countries to test whether national elections induce higher stock market volatility.

It is found that the countryspecific component of index return variance can easily double during the week around an Election Day which shows that investors are surprised by the election outcome. Stock Market Volatility around National Electionsa. It is found that the country-specific component of index return variance can easily double during the week around an Election Day which shows that investors are surprised by the election outcome.

In a sample of 27 OECD countries this paper investigates whether the event of a. Concern around an election without a clear winner or a candidate not admitting defeat concern around an election result different than their preference and concern around general volatility. This paper investigates a sample of 27 OECD countries to test whether national elections induce higher stock market volatility.

2008 report that variance of stock market return increases considerably around national elections. Market volatility has a track record of rising during election season and I anticipate this contentious election will be no exception. Provide evidence that stock market volatility is substantially raised around national elections.

With the general election approaching many investors are worried about heightened volatility in the stock market. It is found that the country-. This paper investigates a sample of 27 OECD countries to test whether national elections induce higher stock market volatility.

National elections induce higher stock market volatility. Wells Fargo analysts found that Election Day is priced for four times the volatility of a typical trading day in this market based on the difference between at-the-money volatility on two-month. It is found that the country-specific component of index return variance can easily double during the week around an Election Day which shows that investors are surprised by the election outcome.

It is found that the country-specific component of index return variance can easily double during the week around an election which shows that investors are surprised by the election outcome. Market Volatility and the Election Economic and political uncertainty are the most prevalent drivers of market volatility which we saw come into play both early and late in 2016. These are turbulent times in our countrys political life.

It is found that the country-specific component of index return. It is found that the country-specific component of index return variance can easily double during the week around an Election Day which shows that investors are surprised by the election outcome. Historically volatility in the stock market is elevated in the months leading up to an election.

Turmoil around the election would likely increase stock market volatility but the impact on stock market returns is unpredictable. It is found that the country-specific component of index return variance can easily double during the week around an election which shows that investors are surprised by the election outcome. This paper investigates a sample of 27 OECD countries to test whether national elections induce higher stock market volatility.

Franck and Krausz 2009 find that unstable domestic political environments. It is found that the country-specific component of index return variance can easily double during the week around an election which shows that investors are surprised by the election outcome. Since elections are essentially rare events our analysis rests on a multi-country approach and the data set constructed for this study covers 27 industrialized nations.

Jedrzej Bialkowski Katrin Gottschalk Tomasz Piotr Wisniewski. The bulls bears are duking it out at crucial market levels. Several factors such as a narrow margin of victory lack of compulsory voting laws change in the political orientation of the government or the failure to form a.

Presidential election is projected to be unlike any other in recent history and the market is responding accordingly. Historically expected volatility has climbed higher in the months leading up to Election Day but in 2020 that expected volatility has been driven significantly higher than in election years past. Several factors such as a narrow margin of victory lack of compulsory voting laws.

This is logical as the markets hate uncertainty.

The Stock Market Appears To Be Coiling For A Tension Release

The Stock Market Appears To Be Coiling For A Tension Release

Pdf Modeling Stock Market Volatility Using Garch Approach On The Ghana Stock Exchange

Pdf Modeling Stock Market Volatility Using Garch Approach On The Ghana Stock Exchange

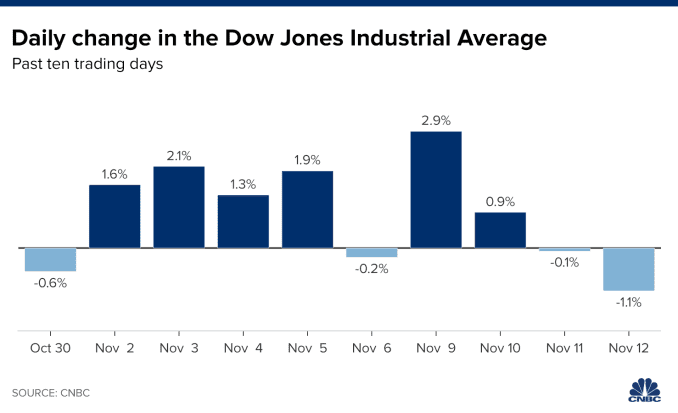

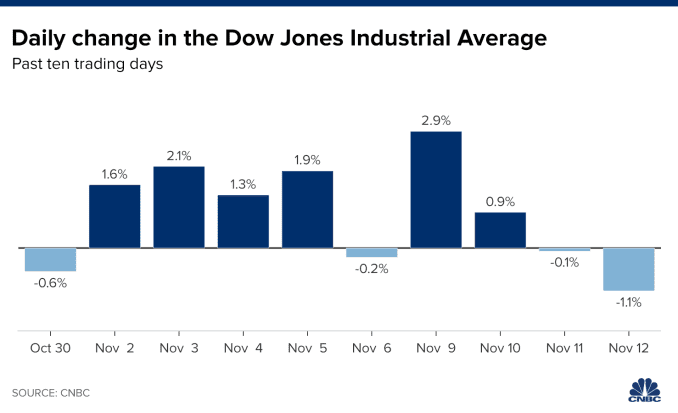

Stocks Fell Sharply In Volatile Trading As The Rout In Tech The Best Performing Sector In The Market Resumed Af In 2020 Stock Market Stock Market Futures Marketing

Stocks Fell Sharply In Volatile Trading As The Rout In Tech The Best Performing Sector In The Market Resumed Af In 2020 Stock Market Stock Market Futures Marketing

Pdf Macroeconomic Volatility And Stock Market Volatility World Wide

Pdf Macroeconomic Volatility And Stock Market Volatility World Wide

Even With Election Year Volatility It Looks Like The Stars Are Aligning For A Fourth Quarter Stock Market Rally Stock Futures Stock Market Wall Street

Even With Election Year Volatility It Looks Like The Stars Are Aligning For A Fourth Quarter Stock Market Rally Stock Futures Stock Market Wall Street

Pdf Relationship Among Political Instability Stock Market Returns And Stock Market Volatility

Pdf Relationship Among Political Instability Stock Market Returns And Stock Market Volatility

How The Presidential Election Could Affect The Stock Ticker Tape

How The Presidential Election Could Affect The Stock Ticker Tape

The Stock Market Rallied On Friday Again As Most Of The Wednesday Weakness Has Been Reversed It S Possible Consumer Price Index Stock Market Labour Department

The Stock Market Rallied On Friday Again As Most Of The Wednesday Weakness Has Been Reversed It S Possible Consumer Price Index Stock Market Labour Department

Https Www Mdpi Com 1911 8074 13 9 208 Pdf

Pdf Stock Market Volatility In Indian Stock Exchanges

Pdf Stock Market Volatility In Indian Stock Exchanges

Want To Make Big Money In Stock Markets Follow These 8 Simple Tips Stock Market Investing Stock Market Stock Trading

Want To Make Big Money In Stock Markets Follow These 8 Simple Tips Stock Market Investing Stock Market Stock Trading

The Stock Market Has Never Been This Big Relative To The Economy Signaling It Could Be Overvalued

The Stock Market Has Never Been This Big Relative To The Economy Signaling It Could Be Overvalued

400 Or 500 Point Days On The Dow Are Normal These Days And They Almost Always Happen For No Particular Reason Dow Jones Stock Market Stock Market Dow

400 Or 500 Point Days On The Dow Are Normal These Days And They Almost Always Happen For No Particular Reason Dow Jones Stock Market Stock Market Dow

Market Ends The Week With Lower Volatilility In 2020 Nasdaq Marketing Dow

Market Ends The Week With Lower Volatilility In 2020 Nasdaq Marketing Dow

Pdf The Impact Of Political Risk On The Volatility Of Stock Returns The Case Of Canada

Pdf The Impact Of Political Risk On The Volatility Of Stock Returns The Case Of Canada

5 Things To Know Before The Stock Market Opens November 13 2020

5 Things To Know Before The Stock Market Opens November 13 2020

Portfolio Manager Commentary Recent Market Volatility

Nyse Market Volatility And The Election

Nyse Market Volatility And The Election

Post a Comment for "Stock Market Volatility Around National Elections"