Stock Price And Market Cap Correlation

The stock price is a relative and proportional value of a companys worth. As you can see the correlation between US Large Cap and US Small Cap Value rarely drops below 080.

The Stock Market Has Never Been This Big Relative To The Economy Signaling It Could Be Overvalued

The Stock Market Has Never Been This Big Relative To The Economy Signaling It Could Be Overvalued

During a bond market rally the stock market drops.

Stock price and market cap correlation. I included charts of the most and least correlated companies 50B market cap below along with links to the Google Sheets to all the data. The most basic way is to look at the companys market value also known as market capitalization or market cap. Stock news by MarketWatch.

The market cap is the share price multiplied by the number of shares outstanding so it represents the amount you would pay to buy up all of the companys shares not necessarily its true value. Next youll calculate a daily deviation for each stock. ET by Tomi Kilgore Boyd Gaming stock price target raised to 35 from 28 at Truist.

For instance IBMs stock price actually mimicked the price movement of Gold quite closely. Market capitalization is simply the value you get when you multiply all the outstanding shares of a stock by. Liquidity can have a profound impact on just how violently stock prices can move in either direction and the reasons have to do with the nature of the market in a stocks shares.

The relationship between a companys earnings and its stock price can be complicated. After a split the stock price will be reduced since the number of shares outstanding has increased. Market capitalization is the total dollar value of all of a companys outstanding shares.

Choose a time period then add up each stocks daily price for that time period and divide by the number of days in the period. Its determined by multiplying the companys stock price by its total number of outstanding shares. The size of a businesss market cap determines which broad category of publicly traded company it falls under.

As the exercise of the warrants is typically done below the market price of the shares it could potentially impact the companys market cap. Stock markets and bond markets usually go in opposite directions. But market cap typically is not altered as the result of a stock split or a dividend.

You can determine a companys value and thus the value of its stock in many ways. Utilities is by far the least correlated sector to all others. For the Bitcoin price to double the market capitalization has to double which will take more time.

Bookmark the Price page to get snapshots of the market and track nearly 3000 coins. Thats the average price. Correlation Statistical measure of the degree to which the movements of two variables stock option convertible prices or returns are related.

TGT Complete Target Corp. Consider Bitcoin price now which is 11887 and its market cap is 200069545325. A companys market cap can be determined by multiplying the companys stock price by the number of shares outstanding.

And since correlations are generally higher than 080 different styles of US Stocks are generally best considered all part of the same asset class. High profits dont necessarily mean a high stock price and big losses dont always lead to a low stock price. To find the correlation between two stocks youll start by finding the average price for each one.

In addition a brief explanation of the correlation coefficient is pasted below as quick reference. Circulating supply is. Although 4 of 9 sectors have a correlation of 093-094 with SP 500 no pair of individual sectors exceeds 087.

Smaller market cap coins can easily double than coins with larger market cap. Both ETFs and Futures tend to deviate from the underlying SP 500 with the former only deviating by a matter of basis points. Photo used here under Flickr Creative Commons.

Market Cap Price x Circulating Supply. Small cap mid cap or large cap. Empirically this paper finds that this relationship is also consistent with the evidence found on SGX.

The theory is that a combination of analyzing futures and index prices can yield insight into market price-action. 15 2020 at 640 am. Use the social share button on our pages to engage with other crypto enthusiasts.

Boyd Gaming stock price target raised to 38 from 27 at Deutsche Bank Oct. View real-time stock prices and stock quotes for a full financial overview. Both theoretical and empirical literatures indicate that higher stock prices tend to correlate with better liquidity or market quality.

To make matters more confusing the higher the price paid for a bond with a.

S P 500 Sectors Correlation Matrix Market Risk Financial Services Common Stock

S P 500 Sectors Correlation Matrix Market Risk Financial Services Common Stock

:max_bytes(150000):strip_icc()/dotdash_Final_How_does_the_performance_of_the_stock_market_affect_individual_businesses_Nov_2020-01-acba7f0a342b4f29aa6cc0bb246d2dd3.jpg) How Does The Performance Of The Stock Market Affect Individual Businesses

How Does The Performance Of The Stock Market Affect Individual Businesses

Cyclical Rebound 2020 Vs 2002 2009 Rebounding Economic Activity Value Stocks

Cyclical Rebound 2020 Vs 2002 2009 Rebounding Economic Activity Value Stocks

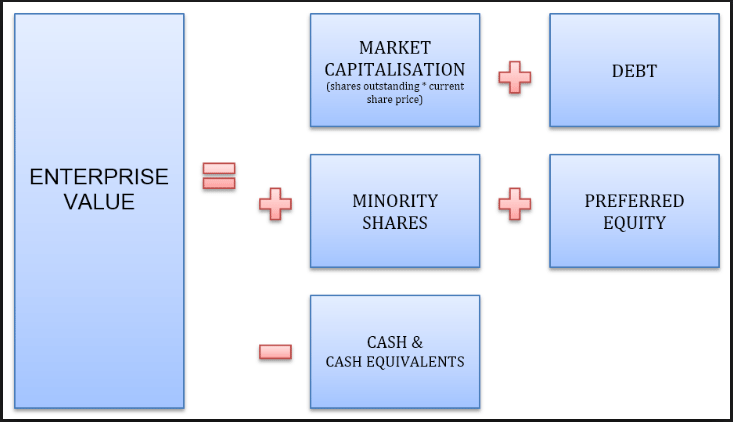

Market Cap Vs Enterprise Value Same Or Different

Market Cap Vs Enterprise Value Same Or Different

Secret Profit Matrix Best Forex Guide Trading Strategy Forex Nadex Itrade Stock Market Trading Strategies Stock Prices

Secret Profit Matrix Best Forex Guide Trading Strategy Forex Nadex Itrade Stock Market Trading Strategies Stock Prices

How Patents Impact Stock Prices Of Companies Greyb

How Patents Impact Stock Prices Of Companies Greyb

Small Cap Vs Large Cap Vs Value Vs Growth Economic Research Personal Savings Stock Market

Small Cap Vs Large Cap Vs Value Vs Growth Economic Research Personal Savings Stock Market

While Many Market Pundits Seemed To Grow Very Concerned About The 10 Year Treasury Yield Tnx Rising To 7 Year Highs At Its Recent Stock Market High Strength

While Many Market Pundits Seemed To Grow Very Concerned About The 10 Year Treasury Yield Tnx Rising To 7 Year Highs At Its Recent Stock Market High Strength

Global Market Cap To Gdp Gni Ratios 2021 Siblis Research

Global Market Cap To Gdp Gni Ratios 2021 Siblis Research

Finding Correlations In Crypto Coin Market Data Steemit Business Intelligence Steemit Marketing Data Business Intelligence Coin Market

Finding Correlations In Crypto Coin Market Data Steemit Business Intelligence Steemit Marketing Data Business Intelligence Coin Market

How Are Book Value And Market Value Different

Relationship Between Stock Market And Economy Economics Help

Relationship Between Stock Market And Economy Economics Help

Evidence Of A Near Perfect Correlation Between Growth In The Fed S Balance Sheet And Gold Prices Talk About A Crisis Stock Charts Balance Sheet Hyperinflation

Evidence Of A Near Perfect Correlation Between Growth In The Fed S Balance Sheet And Gold Prices Talk About A Crisis Stock Charts Balance Sheet Hyperinflation

Don T Let Stocks Prices Fool You Focus On Market Cap Instead Nasdaq

Don T Let Stocks Prices Fool You Focus On Market Cap Instead Nasdaq

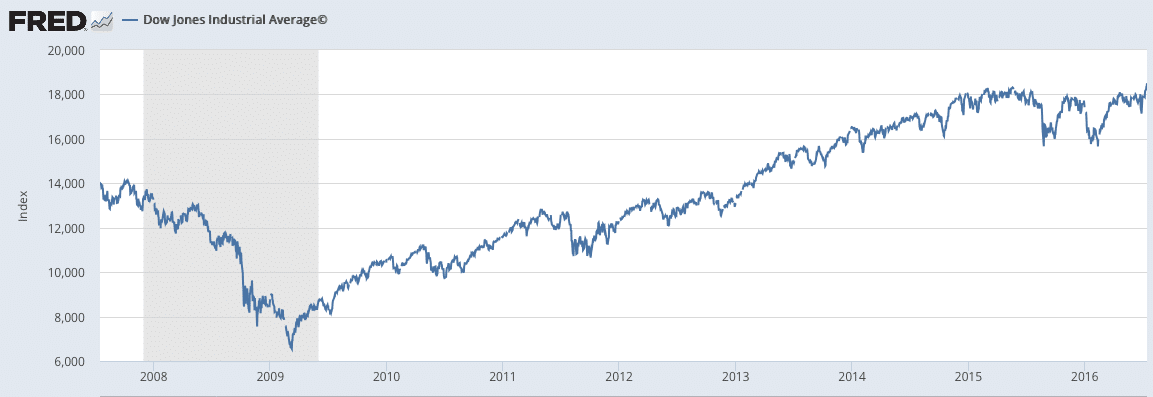

Stock Market Capitalization To Gdp For United States Dddm01usa156nwdb Fred St Louis Fed

Stock Market Capitalization To Gdp For United States Dddm01usa156nwdb Fred St Louis Fed

Guide To Market Capitalization Everything You Need To Know About Market Cap Capital Market Marketing Cryptocurrency Market Capitalization

Guide To Market Capitalization Everything You Need To Know About Market Cap Capital Market Marketing Cryptocurrency Market Capitalization

Post a Comment for "Stock Price And Market Cap Correlation"