Total Stock Market Etf Vs Mutual Fund

A total stock market index fund is a mutual fund or exchange-traded fund ETF that tracks an equity index such as the Russell 3000 Index the SP 500 or the Wilshire 5000 Total Market Index as. Small cap stocks have a high correlation with US.

Index Funds Vs Mutual Funds Top 9 Best Differences With Infographics Mutuals Funds Stock Exchange Fund

Index Funds Vs Mutual Funds Top 9 Best Differences With Infographics Mutuals Funds Stock Exchange Fund

Using this correlation calculator by BuyUpside the correlation between VTI Vanguards Total Stock Market ETF and VOO Vanguards SP 500 ETF is 9996.

Total stock market etf vs mutual fund. Examples of total stock indexes include the Wilshire 5000 Index and the Russell 3000 index. DODGX large active stock fund. The investment seeks to track the performance of a benchmark index that measures the investment return of the overall stock market.

And you can specify any dollar amount you wantdown to the penny or as a nice round figure like 3000. With an ETF you buy and sell based on market priceand you can only trade full shares. With an expense ratio of just 0015 FSKAX is currently the leader for lowest expense ratio among total stock index funds.

In fact over the long-run most ETFs outperform actively-managed mutual funds simply because mutual fund managers cant beat the market every time. Mutual fund shares price only once per day at the end of the trading day. Fidelity Total Market Index Fund.

The fund tracks the Dow Jones US. 004 versus SWAGX fund 004. The most significant difference between mutual funds and ETFs is the tradeability of shares.

Unfortunately many advocates of total market funds dont realize. The various fees of active mutual funds can be much higher sometimes outrageous. With a mutual fund you buy and sell based on dollars not market price or shares.

Funds that claim to be total stock market index funds typically track an index that includes between 3000 and 5000 small- mid- and large-cap US. For a mutual fund SWTSX has an extremely low expense ratio of 003. Investors can place trade.

VTI Total stock market ETF. The largest Total Market ETF is the Vanguard Total Stock Market ETF VTI with 21859B in assets. Aggregate Bond Market ETF.

A total stock market fund is just slightly superior. ETF costs and see how costs impact investment growth. ETFs are more tax efficient than mutual funds.

While Im willing to bet that the total stock market fund will outperform the SP 500 over the next decade Id also put the odds of me being. See Mutual funds and fees for more details. Total Stock Market Index which includes approximately 3000 US.

003 versus VTSAX Admiral shares fund at 004. Schwab Total Stock Market Index. Assuming an ETF and a mutual fund have the same total return the ETF will grow at a faster pace due to its tax advantage.

This is because approximately 75 of the total stock market portfolio is the SP 500 and US. In the last trailing year the best-performing Total Market ETF was FNGU at 42657. Schwabs SP 500 index fund also has an extremely low expense ratio of 002 while Vanguards Total Stock Market Index Fund Admiral Shares has an expense ratio of 004.

The fund employs an. Another cost to look. In this article well look.

Mutual funds have higher fees. The Vanguard Total Stock Market Index Fund VTSAX tracks the CRSP US Total Stock Market Index which. How this is different from buying selling mutual funds.

More and more lately Im hearing the praises of total market funds as alternatives to SP 500 index SPX -131 funds. This mutual fund tracks the Dow Jones US. Vanguards Total Market Fund can be purchased as both an Index Fund Vanguard VTSAX or as an Exchange Traded Fund ETF Vanguard VTI.

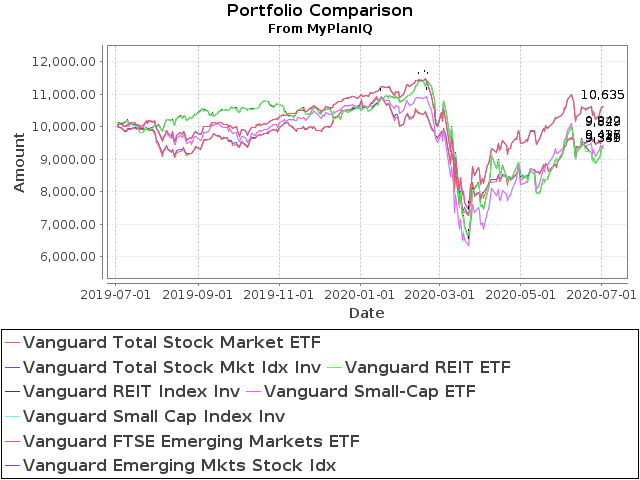

The companys fund flows report for 2020 found that ETFs had record inflows of 502 billion for the calendar year while mutual funds saw record outflows of 289 billion. The Vanguard Total Stock Market Index Fund tracks the performance of the CRSP US Total Market Index. Compare Vanguard exchange-traded funds and the corresponding mutual funds to determine which investment has the lower costs in your situation and how those costs impact investment growth.

It held more than 11 trillion in net assets as of the end of 2020. According to Vanguard in a study of index funds vs active funds 87 of Vanguard. About Vanguard Total Stock Market ETF.

Total Stock Market Index Fund Holdings. The advantage of an index fundETF over an actively managed fund is its ability to outperform individual stocks over time. Compare Vanguard mutual fund vs.

Total Stock Market Index which represents approximately 3000 US.

Etf Vs Mutual Fund Daveramsey Com

Etf Vs Mutual Fund Daveramsey Com

Benefits Of Investing In Mutual Funds Mutuals Funds Fund Management Investing

Benefits Of Investing In Mutual Funds Mutuals Funds Fund Management Investing

What Is An Etf And Are Etfs A Good Investment In 2020 Money Sense Investing Investing Money

What Is An Etf And Are Etfs A Good Investment In 2020 Money Sense Investing Investing Money

Swppx Schwab S P 500 Index Fund Mutual Fund Quote Cnnmoney Com Funds Quotes S P 500 Index Quotes

Swppx Schwab S P 500 Index Fund Mutual Fund Quote Cnnmoney Com Funds Quotes S P 500 Index Quotes

The 8 Best Vanguard Funds Worth Buying Right Now In February 2021 Finance Investing Personal Finance Finance

The 8 Best Vanguard Funds Worth Buying Right Now In February 2021 Finance Investing Personal Finance Finance

What Are Index Funds Why Would You Use One Index Funds Are The Building Blocks Of A Simple Investment Portfolio Learn A Money Lessons Investing Money Fund

What Are Index Funds Why Would You Use One Index Funds Are The Building Blocks Of A Simple Investment Portfolio Learn A Money Lessons Investing Money Fund

Etf Vs Mutual Fund Which Is Best For Your Portfolio Business Talks Mutuals Funds Personal Financial Planning Fund

Etf Vs Mutual Fund Which Is Best For Your Portfolio Business Talks Mutuals Funds Personal Financial Planning Fund

Mutual Funds Vs Index Funds In Stock Market Investing Stock Market Investing Investing Stock Market

Mutual Funds Vs Index Funds In Stock Market Investing Stock Market Investing Investing Stock Market

Top Index Funds For Consumer Staples Investment Tips Investment Tools Index

Top Index Funds For Consumer Staples Investment Tips Investment Tools Index

Etf Vs Mutual Fund What S The Difference Ally

Etf Vs Mutual Fund What S The Difference Ally

Bond Etfs Vs Bond Mutual Funds Use A Mix Of Both Seeking Alpha

Bond Etfs Vs Bond Mutual Funds Use A Mix Of Both Seeking Alpha

Which Mutual Fund Or Uitf Should You Invest In Investing Mutuals Funds Finance Investing

Which Mutual Fund Or Uitf Should You Invest In Investing Mutuals Funds Finance Investing

Etf Vs Mutual Fund Difference And Comparison Diffen

Etf Vs Mutual Fund Difference And Comparison Diffen

Pin On Stock Market Basics For Beginners Tips

Pin On Stock Market Basics For Beginners Tips

Dave Ramsey S 4 Mutual Funds Explained Shawn Roe Dave Ramsey Mutual Funds Mutuals Funds Dave Ramsey

Dave Ramsey S 4 Mutual Funds Explained Shawn Roe Dave Ramsey Mutual Funds Mutuals Funds Dave Ramsey

The Mutual Fund Etf Complex Has A Staggering Amount Of Money And Funds There Is Nearly 50 Trillion And Almost 120k Fu Investment Companies Fund Mutuals Funds

The Mutual Fund Etf Complex Has A Staggering Amount Of Money And Funds There Is Nearly 50 Trillion And Almost 120k Fu Investment Companies Fund Mutuals Funds

Liquidity Is A Slippery Concept When Applied To Etfs Part 2 Tradersdna Forex Thought Leadership Resources Education And Market News In

Liquidity Is A Slippery Concept When Applied To Etfs Part 2 Tradersdna Forex Thought Leadership Resources Education And Market News In

Sa303 Investing Basics Stocks Bonds Mutual Funds Etf S Investing Finance Investing Money Management Advice

Sa303 Investing Basics Stocks Bonds Mutual Funds Etf S Investing Finance Investing Money Management Advice

Vtsax Vs Vti Vanguard Index Fund Vs Vanguard Etf Stock Market Index Investing Investing For Retirement

Vtsax Vs Vti Vanguard Index Fund Vs Vanguard Etf Stock Market Index Investing Investing For Retirement

Post a Comment for "Total Stock Market Etf Vs Mutual Fund"