What Are Share Purchase Warrants

Warrants are often issued with senior securities preferred stocks and bonds as sweeteners to increase their salability. What a warrant does is it gives you the right to buy a share of stock at a certain price before a certain time.

Bioamber Buys Mitsui Equity Stake In Sarnia Joint Venture Common Stock Business Stories School Of Engineering

Bioamber Buys Mitsui Equity Stake In Sarnia Joint Venture Common Stock Business Stories School Of Engineering

Companies often include warrants as part of share offerings to entice.

What are share purchase warrants. A stock warrant is the right to purchase newly issued shares of a stock at a certain price for a certain period of time. Each Common Share subscribed for will be entitled to a one-half 12 Share Purchase Warrant at a price of 005 per share for a period of 2 years. Warrants provide leverage much like an option when you know how to purchase stock warrants on companies that have an outstanding warrant.

A SPAC unit issued at IPO by the SPAC usually contains a share and full or partial warrants and sometimes rights. Thats a combination of a share and a piece of a warrant. Theres a lot more to it when it comes to SPAC warrants.

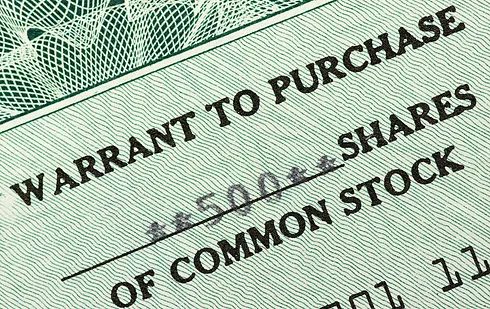

Warrant Shares means the shares of Common Stock or other capital stock of the Company then purchasable upon exercise of this Warrant in accordance with the terms of this Warrant. Stock warrants are options issued by a company that trade on an exchange and give investors the right but not obligation to purchase company stock at a specific price within a specified time period. Warrants are dilutive in nature meaning it dilutes the overall value of equity in shares because the company must issue new shares upon exercising.

Their appeal is that if the issuers stock increases in price above the warrants price the investor can redeem the warrant and buy the shares at the lower warrant price. The stock is issued directly by the company. A warrant is a security based on an underlying security which assigns the owner the right but not the obligation to purchase additional shares of the underlying security at a predetermined price for a preset period of time.

This will magnify your returns if the stock moves up and can even limit your losses when the stock moves down. A stock warrant represents the right to purchase a companys stock at a specific price and at a specific date. The share price is currently 0025 per share.

Warrants trade on stock exchanges just like a stock and do not need a special account. Stock warrants like stock options give investors the right to buy via a call warrant or sell via a put warrant a specific stock at a certain price level strike price before a certain date. While a stock warrant gives the holder the right to purchase the owner does not yet own any stock.

Do you think something like this would be a good idea. A warrant gives you the right to purchase an amount of common stock by exercising your warrant at a certain strike price after merger. When an investor exercises a warrant they purchase the stock and the proceeds are a source of capital for the company.

Should you just buy the common stock should you buy the warrants which are similar to. They may also be issued. In case some of those terms is new to you a warrant allows its holder to buy or sell shares of a company fromto the company at a specific price at a specific time.

What Is a Stock Warrant. And by trading in-the-money I. In stock option Another form of option a stock purchase warrant entitles its owner to buy shares of a common stock at a specified price the exercise price of the warrant.

Sample 1 Sample 2 Sample 3. Warrants are issued by companies giving the holder the right but not the obligation to buy a security at a particular price. Once the SPACs traded for a while you can choose.

A stock warrant is a financial contract between a company and investors that gives the investor the option to purchase the companys stock at a specific price and by a specific date. Like I said each unit comes. A warranty is a contractual statement of assurance given by the seller to the buyer that a certain.

What is a warrant. Partial warrants are combined to make full warrants. Warrant will entitle the holder thereof each a Warrantholder and collectively the Warrantholders to acquire one Common Share upon payment in full of the exercise price of 654 per Common Share the Exercise Price subject to.

A stock warrant is issued directly by a company to an investor.

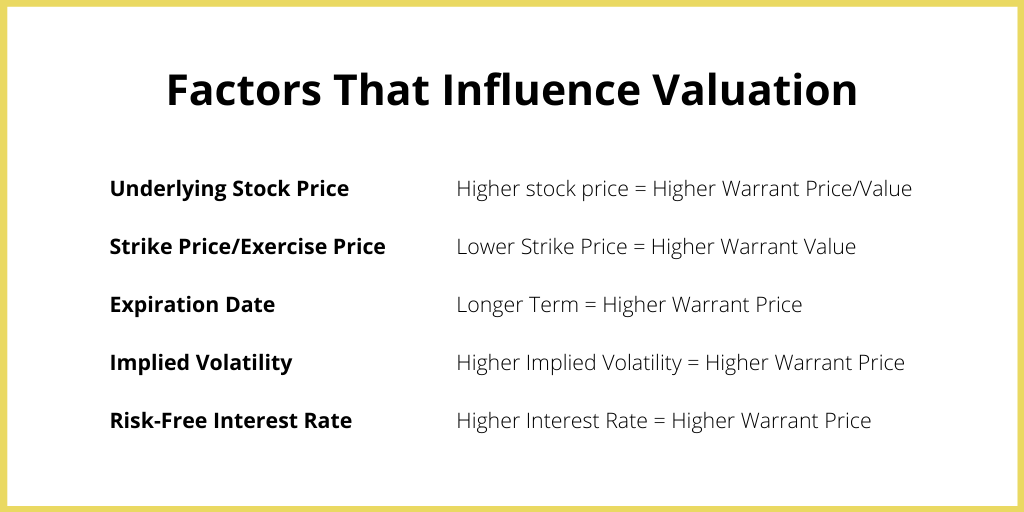

Factors That Influence Black Scholes Warrant Dilution

Spacs Shares Vs Warrants Vs Units Should You Buy Shares Or Warrants Here Are My Strategies Youtube

Spacs Shares Vs Warrants Vs Units Should You Buy Shares Or Warrants Here Are My Strategies Youtube

Convertible Bonds Vs Warrants Meaning Differences Bbalectures Business Articles Convertible Bond

Convertible Bonds Vs Warrants Meaning Differences Bbalectures Business Articles Convertible Bond

Patrick Petroleum Company Company Bank Notes Columbian

Patrick Petroleum Company Company Bank Notes Columbian

Warrants Definition Explanation Examples And Diluted Eps Play Accounting

Warrants Definition Explanation Examples And Diluted Eps Play Accounting

Equity Trading Tips Free Stock Tips Institutional Investors Buy Hdfc Warrants In Hordes 13 Oct 2015 Banks Logo Tips Equity

Equity Trading Tips Free Stock Tips Institutional Investors Buy Hdfc Warrants In Hordes 13 Oct 2015 Banks Logo Tips Equity

What Is A Stock Warrant Youtube

What Is A Stock Warrant Youtube

Free Purchase Agreement Template Fresh 37 Simple Purchase Agreement Templates Real Estate Business Purchase Agreement Agreement Contract Template

Free Purchase Agreement Template Fresh 37 Simple Purchase Agreement Templates Real Estate Business Purchase Agreement Agreement Contract Template

Acquisition Agreement Template 28 Images Purchase Agreement Template Non Compete Agreement Purchase Agreement Templates Agreement

Acquisition Agreement Template 28 Images Purchase Agreement Template Non Compete Agreement Purchase Agreement Templates Agreement

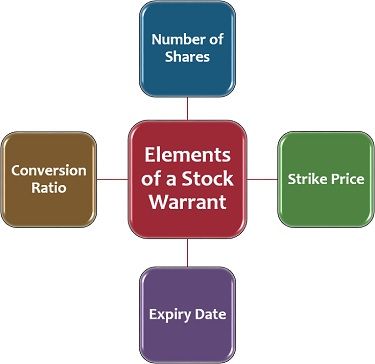

What Are Stock Warrants Definition Elements Factors Types Advantages Disadvantages The Investors Book

What Are Stock Warrants Definition Elements Factors Types Advantages Disadvantages The Investors Book

A Guide To Warrants In Venture Debt Flow Capital

A Guide To Warrants In Venture Debt Flow Capital

Stock Warrants Why Do Companies Issue Stock Warrants

Stock Warrants Why Do Companies Issue Stock Warrants

What Are Stock Warrants Explained Youtube

What Are Stock Warrants Explained Youtube

Watch Stock Warrants Explained Stock Warrants Allow You To Potentially By Lincoln W Daniel Bullacademy Org Medium

Watch Stock Warrants Explained Stock Warrants Allow You To Potentially By Lincoln W Daniel Bullacademy Org Medium

How To Buy Stock Warrants Stock Warrants Hq

How To Buy Stock Warrants Stock Warrants Hq

Stock Warrant Definition Types Why Companies Issue Share Warrants

Stock Warrant Definition Types Why Companies Issue Share Warrants

Common Stock Warrants Exclusive Database

Common Stock Warrants Exclusive Database

/Wiener_Riesen_Rad_Ltd_1898-41accd5aa0f9438198764c26178b58cb.jpg) I Own Some Stock Warrants How Do I Exercise Them

I Own Some Stock Warrants How Do I Exercise Them

Post a Comment for "What Are Share Purchase Warrants"