What Is The Best Inverse Etf

The largest inverse fund by value with nearly 4 billion in assets SH is a common hedging vehicle for investors because it strives to deliver the inverse performance of a widely watched index the. If the SP 500 Index drops by 1 this ETF will rise by roughly 1.

Types Of Etf S Investing For Beginners Investing Money Management Advice Value Investing

Types Of Etf S Investing For Beginners Investing Money Management Advice Value Investing

Inverse ETFs provide opposite exposure that is a multiple -1X -2X or -3X of the performance of the underlying index using various investment strategies such as swaps futures contracts and.

What is the best inverse etf. Those contracts traded daily enable investors to buy or sell a. There are many inverse asset classes and the full list of inverse ETFs is in the table below. There are several inverse ETFs that can be used to profit from declines in broad market indexes such as the Russell 2000 or the Nasdaq 100.

0 Commissions for online stock ETF and options trades When you. Inverse ETFs provide a way to invest in different inverse asset classes. This is a list of all Equity ETFs traded in the USA which are currently tagged by ETF Database.

The fund seeks to deliver thrice the. The ProShares Short SP 500 SH is the most popular inverse ETF with nearly 3 billion in assets. The inverse ETFs with the best performance during the 2020 bear market were RWM DOG and HDGE.

This is the most-popular and liquid ETF in the leveraged inverse space with AUM of 12 billion and average daily volume of over 125 million shares a day. Here are the ETFs you want to hold in another COVID wave. 1 For example the Short DOW 30 ETF DOG profits when the Dow Jones Industrial Average goes down and the DOGs profits are proportional to the Dows losses.

An inverse ETF is essentially an index ETF that gains value when its correlating index loses value. 1 The best-performing inverse REIT ETF based on performance over the past year is the ProShares Short. The ETF seeks a 300 inverse benefit from the NYSE 20 Year Plus Treasury Bond Index.

In the last trailing year the best-performing Inverse ETF was HDGE at 40291. SVXY uses futures to provide short exposure to the VIX. Click on the tabs below to see more information on Asset Class ETFs including historical performance dividends holdings expense ratios technical indicators analysts reports.

This is a list of all US-traded ETFs that are currently included in the Inverse Equities. 7 The expense ratio is again high for an ETF at 93 BPS but the fund is so volatile that a 1 drag on profits. The best and only inverse VIX ETF is the SVXY.

This ETF has an expense ratio of 089. Also there are inverse ETFs that focus on specific. The fund provides a -1x daily return of the SP 500 Index.

To achieve their inverse exposure the first two ETFs make use of various swap instruments and the. An inverse ETF also known as a short ETF or bear ETF is an exchange-traded fund designed to return the exact opposite performance of a certain index or benchmark. It achieves this by holding various assets and derivatives like options used to create profits when the underlying index falls.

The SVXY dramatically underperformed the broader market over the past year. The best inverse funds to buy now can protect you from losses in a potential stock market crash. In essence inverse ETFs work that way too only with futures and options contracts as the transaction driver and not stocks.

The SP 500s total return over the past 12 months is 184 as of February 16 2021.

Tza Inverse Etf Of Small Caps Stock Chart Dated 12 04 18 Today Was A Good Day In The Market Depending On How Selective Stock Charts Chart Small Cap Stocks

Tza Inverse Etf Of Small Caps Stock Chart Dated 12 04 18 Today Was A Good Day In The Market Depending On How Selective Stock Charts Chart Small Cap Stocks

Investing In Inverse Etfs For A Market Correction

Investing In Inverse Etfs For A Market Correction

Inverse Etfs Are Exchange Traded Funds That Are Designed To Gain In Value From A Decline In The Value Of An Underlying Bench The Borrowers Money Market Insight

Inverse Etfs Are Exchange Traded Funds That Are Designed To Gain In Value From A Decline In The Value Of An Underlying Bench The Borrowers Money Market Insight

Please Wait Investing Show Me The Money Investing Money

Please Wait Investing Show Me The Money Investing Money

Best High Yield Corporate Bond Funds For 2020 Corporate Bonds Investing Bond Funds

Best High Yield Corporate Bond Funds For 2020 Corporate Bonds Investing Bond Funds

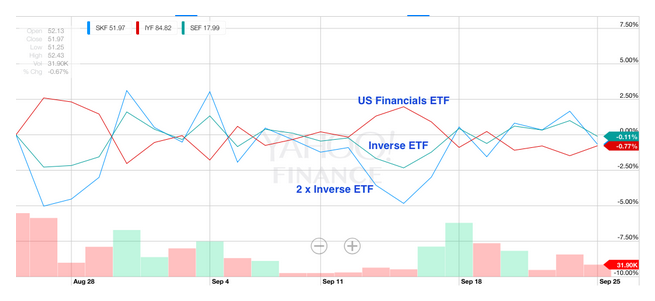

3 Inverse Sector Etfs For Market Bears

Guide To The 10 Most Popular Leveraged Inverse Etfs Etf News And Commentary Nasdaq

Guide To The 10 Most Popular Leveraged Inverse Etfs Etf News And Commentary Nasdaq

Business Chart Annual Business Report Chart Showing Financial Performance Sponsored Annual Business Business C Investing Mutuals Funds Stock Market

Business Chart Annual Business Report Chart Showing Financial Performance Sponsored Annual Business Business C Investing Mutuals Funds Stock Market

Boning Up On Inverse Etfs For Inverse Markets

Boning Up On Inverse Etfs For Inverse Markets

What Is An Etf Exchange Traded Fund Explained Intuit Mint Investing Corporate Bonds Investment Portfolio

What Is An Etf Exchange Traded Fund Explained Intuit Mint Investing Corporate Bonds Investment Portfolio

Don T Miss Hedging With Inverse Etfs In A Down Market

Don T Miss Hedging With Inverse Etfs In A Down Market

3 Inverse Etfs Taking Advantage Of Stock Market Panic

3 Inverse Etfs Taking Advantage Of Stock Market Panic

Labd Etf For Inverse Biotechs 3x Stock Chart Dated 12 09 18 Labd Had Two Very Good Trades Last Week When The Market Was Go Stock Charts Chart Stock Trading

Labd Etf For Inverse Biotechs 3x Stock Chart Dated 12 09 18 Labd Had Two Very Good Trades Last Week When The Market Was Go Stock Charts Chart Stock Trading

What Is An Etf And Are Etfs A Good Investment Investing Money Sense Investing Money

What Is An Etf And Are Etfs A Good Investment Investing Money Sense Investing Money

![]() What Are The Top 2x And 3x Short Inverse Etf S For Spy And Qqq Good Money Guide

What Are The Top 2x And 3x Short Inverse Etf S For Spy And Qqq Good Money Guide

Understanding Inverse Etfs Youtube

Understanding Inverse Etfs Youtube

Know What You Re Buying Leveraged And Inverse Funds Nasdaq Dorsey Wright Commentaries Advisor Perspectives

Know What You Re Buying Leveraged And Inverse Funds Nasdaq Dorsey Wright Commentaries Advisor Perspectives

Leveraged Inverse Etf Mirage Etf Com

Leveraged Inverse Etf Mirage Etf Com

How To Use Inverse Etfs To Hedge Your Portfolio

How To Use Inverse Etfs To Hedge Your Portfolio

Post a Comment for "What Is The Best Inverse Etf"