Stock Market Earnings Tax India

Dividend income is Tax Free too. This means you will get to keep all your profits.

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

Provided Dividend Distribution Tax DDT under section 115O of the Income Tax Act 1961 is paid by the Indian Company declaring the dividend.

Stock market earnings tax india. This rate is the same as for your ordinary income. An investor or trader has to pay the tax no matter whether she makes a profit or not. Sale price minus buying price.

As of 2018 there are seven tax rates on ordinary income ranging from 10 percent to 37 percent. When should you pay income tax on profits made in stocks. Tax liability on the earnings from the US stock by Indian investors depends upon two factors.

The STCG shall be taxed at 15 and LTCG shall be taxed at 10. Where the tax payable in respect of any income arising from the transfer of a listed security other than a unit or a zero coupon bond being a long-term capital asset exceeds 10 of the amount of capital gains before indexation then such excess shall be ignored while computing the tax payable by the assessee. Generally any profit you make on the sale of a stock is taxable at either 0 15 or 20 if you held the shares for more than a year or at your ordinary tax rate if you held the shares for less.

It doesnt matter which income tax slab you are in you have to pay a flat short-term capital gain tax of 15. How to Calculate Income Tax on Stock Market Earning. For short term capital gains stocks held for less than 12 months a special rate of tax of 15 is applicable provided STT Securities Turnover Tax has been paid on purchase and sales transactions.

Any capital loss after. Some of the income tax rules are not clear especially tr. Other than that the gain or loss generated through stock trading will need to be classified as short term STCG for shares held up to an year or long term LTCG for shares held for more than an year.

In this case you will have to pay taxes and that would be flat 15 on your profit. If you hold an investment for more than one year 365 days any profits that arise from your buying and selling of a stock will be treated as a long-term capital gain. In essence STT is an indirect tax and is imposed on a broker rather than the investortrader directly.

You had purchased shares from the stock market valuing Rs1 lakh and before 1 year you sold them to earn a profit of Rs20 000. Even as corporate profits were already expected to grow at a robust pace in FY22 and FY23 the countrys top brokerages have now upgraded the earnings per share EPS estimates of big listed companies for FY21-FY23. Stocks sold after 12 months of holding are exempt from tax on capital gains.

This is lower than the standard tax rate for foreign investors in the US due to the tax treaty between India and the USA. You can read more about dividends in Indian stock market here. After a better-than-expected show by India Inc in the December 2020 quarter there is more good news for investors and market participants.

This amount is taxable at the rate of flat 25. So you will pay Rs 3000- tax here. Short-term gains are taxed at the rate of 15.

For example if you fall into the 25 percent tax bracket you. What are NIFTY and SENSEX. Is the most confusing topic for the taxpayers.

However if a stock is held for less than a year then the gain or loss derived from the stock is termed as short term capital loss or gain. STT is currently imposed on equity and derivative transactions. Which as per section 10 38 of the Income Tax Act 1961 is exempt from tax.

Long-term capital gains investments held for up to 12 months are tax-free. Income Tax on Bitcoin India Cryptocurrencies If treated as Capital Gains which generally is the case the income tax rate is as follows. However shares held for a year or longer are taxed at the long-term capital gains rates of 0 15 or.

For example Lets say your annual salary is Rs 1200000 and you have a short-term capital gain of Rs 50000. The broker in turn collects it from its clients and deposits it with the government. And long term gains above Rs 1 lakh in a particular financial year is taxed at the rate of 10.

One is the nature of earning and the second is the residential status in India. Hence if the company declares a dividend of 100 then you will receive 75. 20 Nov 2020 1017.

If you hold a stock for a year or less and sell it you pay the short-term tax rate. For the short-term capital gain investorstraders have to pay a flat 15 as STCG Tax on their profits. Income from Units - Exempt under section 1035 of the Income Tax Act 1961 - Income other than above in respect of securities.

However LTCG up to Rs 1 lakh a year will be tax free. Short-term capital gains investments held for less than 12 months are taxed at 15 3 cess. I am a student and have started investing in listed shares out of my pocket money from last year.

The tax rate is 30 if the cryptocurrency is held for short term 1 day to 36 months.

Taxation Of Income Earned From Selling Shares Do I Need To Pay Tax

Taxation Of Income Earned From Selling Shares Do I Need To Pay Tax

Latest Income Tax Deductions On Nps Investments Income Tax Investing Income

Latest Income Tax Deductions On Nps Investments Income Tax Investing Income

Mutual Funds Taxation Rules Fy 2020 21 Capital Gains Dividends

Mutual Funds Taxation Rules Fy 2020 21 Capital Gains Dividends

Capital Loss Set Off Rules On Sale Of Stocks Equity Mutual Fund Schemes Mutuals Funds Fund Cost Of Capital

Capital Loss Set Off Rules On Sale Of Stocks Equity Mutual Fund Schemes Mutuals Funds Fund Cost Of Capital

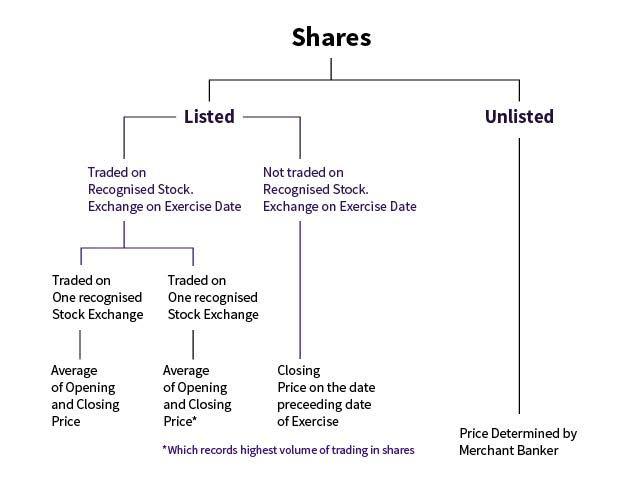

Getting Esop As Salary Package Know About Esop Taxation

Getting Esop As Salary Package Know About Esop Taxation

What Is Exempt Income Tax Free Bonds Filing Taxes Income

What Is Exempt Income Tax Free Bonds Filing Taxes Income

Eligibility To Claim Rebate Under Section 87a Fy 2019 20 Ay 2020 21 Illustrations In 2021 Business Tax Deductions Tax Deductions Business Tax

Eligibility To Claim Rebate Under Section 87a Fy 2019 20 Ay 2020 21 Illustrations In 2021 Business Tax Deductions Tax Deductions Business Tax

Indian Stock Market Hot Tips Picks In Shares Of India Stock Market Marketing Income Tax

Indian Stock Market Hot Tips Picks In Shares Of India Stock Market Marketing Income Tax

Reit Investments Tax Implications In India Real Estate Investment Trust Investing Reit

Reit Investments Tax Implications In India Real Estate Investment Trust Investing Reit

All About Capital Gain Tax In India Infographic Capital Gains Tax Capital Gain Financial Education

All About Capital Gain Tax In India Infographic Capital Gains Tax Capital Gain Financial Education

Tax On Capital Gains In Equity In Various Countries Indian Stock Market Hot Tips Picks In Shares Of India Capital Gain Equity Money Plan

Tax On Capital Gains In Equity In Various Countries Indian Stock Market Hot Tips Picks In Shares Of India Capital Gain Equity Money Plan

Folks Learn The Art Of How To Pay 0 Income Tax In India Many People Don T Know This Yet And It S Extremely Sur Investing Stock Market Stock Market Investing

Folks Learn The Art Of How To Pay 0 Income Tax In India Many People Don T Know This Yet And It S Extremely Sur Investing Stock Market Stock Market Investing

Examples New Or Old Tax Regime Choosing Which Is Better Indian Stock Market Hot Tips Picks In Shares Of India Regime Stock Market Tax

Examples New Or Old Tax Regime Choosing Which Is Better Indian Stock Market Hot Tips Picks In Shares Of India Regime Stock Market Tax

Income Tax Department Helpline Contact Numbers Toll Free Numbers Filing Taxes Income Tax Income

Income Tax Department Helpline Contact Numbers Toll Free Numbers Filing Taxes Income Tax Income

Income Tax Deductions List Fy 2019 20 List Of Important Income Tax Exemptions For Ay 2020 21 Tax Deductions List Tax Deductions Income Tax

Income Tax Deductions List Fy 2019 20 List Of Important Income Tax Exemptions For Ay 2020 21 Tax Deductions List Tax Deductions Income Tax

Mutual Funds Capital Gains Taxation Rules Fy 2018 19 Ay 2019 20 Capital Gains Tax Rates Chart For Nris Mutuals Funds Capital Gain Fund

Mutual Funds Capital Gains Taxation Rules Fy 2018 19 Ay 2019 20 Capital Gains Tax Rates Chart For Nris Mutuals Funds Capital Gain Fund

Recognize 6 5 Cr Msmes Are The Real Economy Draft A Solid Plan To Increase The Credit Flow Budget Eztax In Easiest In 2020 Filing Taxes Income Tax About Me Blog

Recognize 6 5 Cr Msmes Are The Real Economy Draft A Solid Plan To Increase The Credit Flow Budget Eztax In Easiest In 2020 Filing Taxes Income Tax About Me Blog

Mutual Funds Taxation Rules In India Capital Gains Period Of Holding Capital Gain Mutuals Funds Capital Gains Tax

Mutual Funds Taxation Rules In India Capital Gains Period Of Holding Capital Gain Mutuals Funds Capital Gains Tax

Post a Comment for "Stock Market Earnings Tax India"