Stock Price Volatility And Dividend Policy

As per results firms size is also negatively associated with stock price volatility. The Dividend yield can be computed annually by dividing cash dividend per share for common stocks by the per share market value as follows.

Basic Options Strategies Explained The Options Bro Option Strategies Call Option Options Trading Strategies

Basic Options Strategies Explained The Options Bro Option Strategies Call Option Options Trading Strategies

Dividend policy and share price volatility In early corporate finance dividend policy referred to a corporations choice of whether to pay its shareholders a cash dividend or to retain its earnings.

Stock price volatility and dividend policy. The number of factors influences the relationship of share price volatility and dividend policy. On stock price volatility in a short time. Determining the volatility in the stock price for 73 firms listed in Karachi Stock Exchange KSE-100 indexed.

Abstract The purpose of this study is to investigate the relationship between dividend policy and stock price volatility SPV. How Volatility Is Affected by Dividends Once a company decides to start paying a specified amount of money to shareholders in the form of regular cash dividends its stock usually trades with a. The shareholders are not interested in receiving cash flows as dividends or capital gains in a perfect market.

Their findings show that there is no relationship between dividend yield and stock price volatility. The decision to pay dividend is considered strategic and believed to have a notable impact on other decisions of companies such as financing and investment decisions. Between dividend yields and stock price volatility which implies that dividend policy influence stock price volatility.

How Dividend Policy Affects Volatility of Stock Prices of Financial Sector Firms of Pakistan 133 dividend policy and it takes into account only its earning power. The dividend policy stock price vola-tility investment decisions. The dividend yield as one of the proxies of the dividend policy is an indicator of the percentage return on a stock from its dividend price volatility or the uncertainty.

Stock volatility was measured as the standard deviation of stock market prices while dividend policies were captured as dividend payout ratio and dividend yield with five moderating variables firm size growth leverage earnings volatility and financial crisis. Dividend policy and stock price volatility. Adopted to develop a relationship between share price volatility and dividend policy.

This suggests that dividend policy affects stock price volatility and it provides evidence supporting the arbitrage realization effect duration effect and information effect in Pakistan. Dividends can affect the price of their underlying stock in a variety of ways. Allen and Rachim 1996 suggest that the relationship between dividend policy and share price volatility after the inclusion of growth as a control variable would be suggestive of either the arbitrage or information effect.

Some argue that dividends signal to investors that the company is operating effectively while others argue that when all other variables are fixed the payout of dividends does not effectively reduce the stocks volatility. Price volatility of a given stock is low it can lead to a high desirability. It addressed the frequency of such payments whether annually semi-annually or quarterly and how much the company should if it decides to do so pay.

The model was evaluated annually over the 10ten y ears period to measure the periodic. This explains the fact that dividend policy on its own is not the determining factor of price volatility. However they are still in debate.

Contradict to Rashid and Anisur Rahman 2008 the researcher found that the share price volatility is significantly influence dividend policy as measured by dividend payout ratio and dividend yield. While the dividend history of a given stock plays a general role in its popularity the declaration and payment of. Despite its importance it has always been a controversial and an inconclusive topic in the.

Where DY is the dividend yield. This school of thought assumes that in a perfect world of capital market the value of the firm is unaffected by the distribution of dividends. Paying large dividends reduces risk and thus influence stock price Gordon 1963 and is a proxy for the future earnings Baskin 1989.

Consequently there are a great number of studies exploring the relation-ship between dividend policy and share price volatility. Dividend policy and stock price volatility Asset Growth Earnings Volatility and firm size. Therefore to control limit these problems the control variables are included in regression equation.

INTRODUCTIONThe corporate dividend policy debate was ignited following the work of Nobel Laureate Modigliani and Miller 1958 and Miller and Modigliani 1961 hereinafter referred to as MM. The linkage between dividend policy and stock price risk Allen and Rachim 1996. Its worth discussing two main prominent perspectives ir-.

Dividend Policy and Stock Price Volatility Introduction Dividend policy remains a source of controversy despite years of theoretical and empirical research including one aspect of dividend policy. However the dividend policy does not have a significant ef-fect on stock price volatility in a long time. More-over the dividend policy does not have a signifi-cant effect on investment decisions in terms of cash and accrual.

The firm value is determined solely by the earning power of the firm and the firms. There are certain other factors that also contribute in measuring stock price volatility. Allen Rachim 1996 examined the relationship between dividend policy and stock price volatility of 173 Australian listed firms from the period 1972 to 1985.

Evidence that both support and reject the idea that dividends reduce stock price volatility.

Dividend Sensei Positions For 2019 What You Should Expect Next Year Seeking Alpha Dividend Stock Market Investing Positivity

Dividend Sensei Positions For 2019 What You Should Expect Next Year Seeking Alpha Dividend Stock Market Investing Positivity

Small Cap U S Stocks Go Large In Volatility Comparison Small Caps Nasdaq 100 Nasdaq

Small Cap U S Stocks Go Large In Volatility Comparison Small Caps Nasdaq 100 Nasdaq

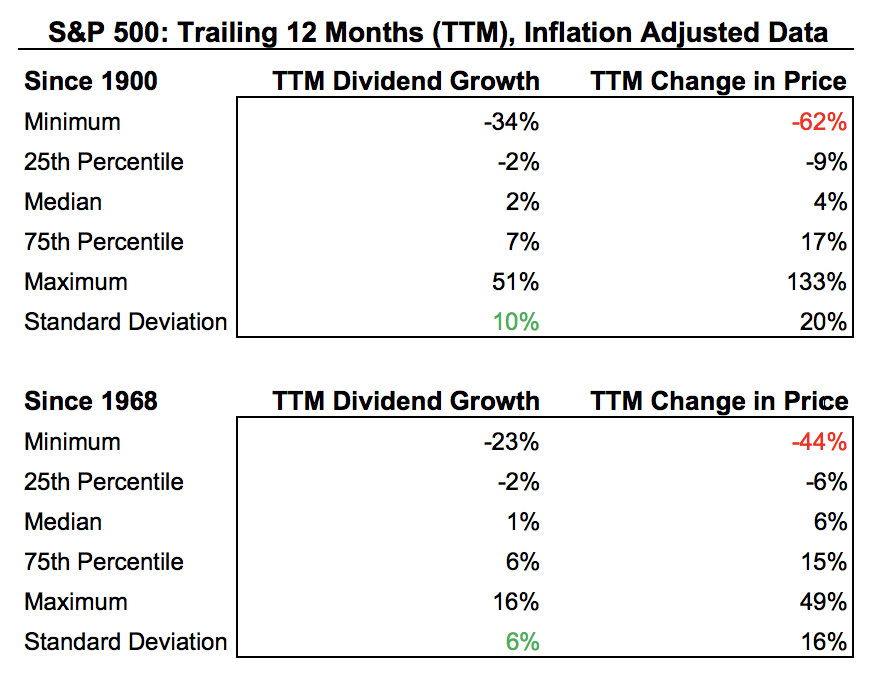

What Happens To Dividends During Recessions And Bear Markets Intelligent Income By Simply Safe Dividends

What Happens To Dividends During Recessions And Bear Markets Intelligent Income By Simply Safe Dividends

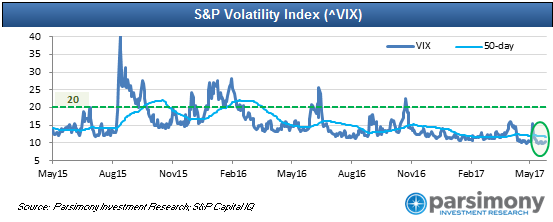

A Bizarre New Low Volatility Loop In Financial Markets Use Of Insurance Against Sharp Market Moves Volatility Index Structured Finance Financial Markets

A Bizarre New Low Volatility Loop In Financial Markets Use Of Insurance Against Sharp Market Moves Volatility Index Structured Finance Financial Markets

Aug 2 Today S Bout Of Stock Market Volatility Didn T Come As A Surprise To Vix Futures Traders Stock Market Chart Vix

Aug 2 Today S Bout Of Stock Market Volatility Didn T Come As A Surprise To Vix Futures Traders Stock Market Chart Vix

Risk On Risk Off Sentiment Indicators Investment Advice Investing Sentimental

Risk On Risk Off Sentiment Indicators Investment Advice Investing Sentimental

Dividend Growth Investing Is A Remarkably Effective Strategy In Order To Find The Best Dividend Growth Stocks Evaluating Th Dividend Growth Company Investing

Dividend Growth Investing Is A Remarkably Effective Strategy In Order To Find The Best Dividend Growth Stocks Evaluating Th Dividend Growth Company Investing

Best Stock Advisory Live Commodity Tips Share Market Tips Free Intraday Tips Equity Tips Mcx Free Tips Free Stoc Stock Market Marketing Tips

Best Stock Advisory Live Commodity Tips Share Market Tips Free Intraday Tips Equity Tips Mcx Free Tips Free Stoc Stock Market Marketing Tips

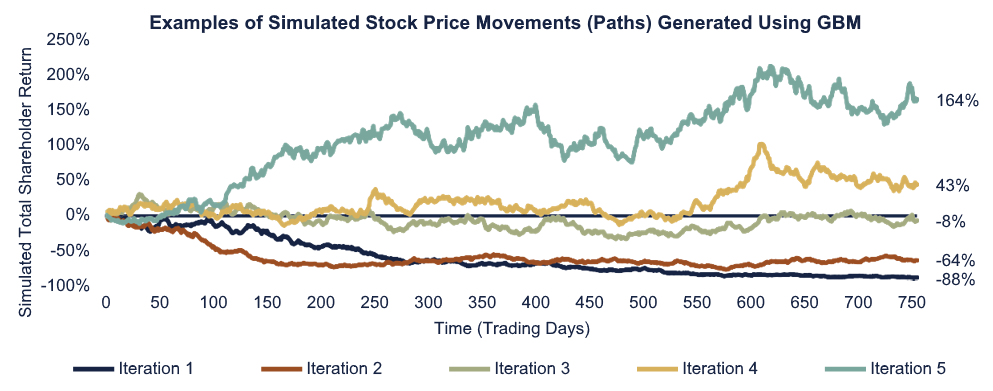

Volatility Over Many Years Investing Creating Wealth Dow Jones Index

Volatility Over Many Years Investing Creating Wealth Dow Jones Index

Understanding The Disconnect Between Consumers And The Stock Market In 2020 Infographic Marketing Stock Market Infographic

Understanding The Disconnect Between Consumers And The Stock Market In 2020 Infographic Marketing Stock Market Infographic

Relationship Between The Stock Price And Its Determinants Stock Prices Corporate Tax Rate Investments Opportunities

Relationship Between The Stock Price And Its Determinants Stock Prices Corporate Tax Rate Investments Opportunities

Timesfinancials Provides Strategic Calls With 99 Accuracy In Market Volatile Conditions Also Times Financia Stock Futures Make Money Taking Surveys Investing

Timesfinancials Provides Strategic Calls With 99 Accuracy In Market Volatile Conditions Also Times Financia Stock Futures Make Money Taking Surveys Investing

3 Canadian Dividend All Stars That Raised Their Dividends In January Dividends Money Investing Stocks Dividend Financial Information Investing

3 Canadian Dividend All Stars That Raised Their Dividends In January Dividends Money Investing Stocks Dividend Financial Information Investing

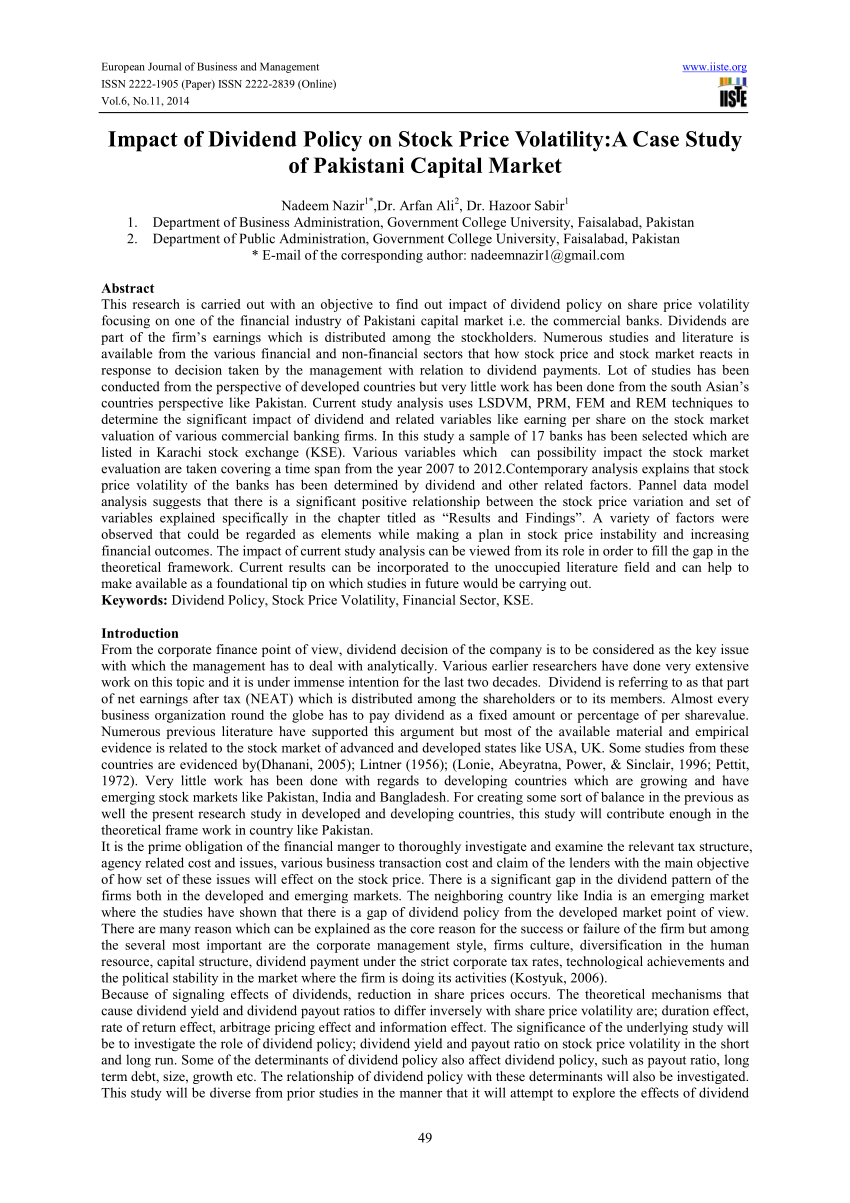

Pdf Impact Of Dividend Policy On Stock Price Volatility A Case Study Of Pakistani Capital Market

Pdf Impact Of Dividend Policy On Stock Price Volatility A Case Study Of Pakistani Capital Market

Wider Yield Gap Seen Helping U S Consumer Staples Stocks Dividend Consumers Stock Market

Wider Yield Gap Seen Helping U S Consumer Staples Stocks Dividend Consumers Stock Market

Average Annual Returns And Volatility By Dividend Policy Dividend Dividend Stocks What To Read

Average Annual Returns And Volatility By Dividend Policy Dividend Dividend Stocks What To Read

Risk Report A Quad 4 Investing Playbook Investing Equity Market Implied Volatility

Risk Report A Quad 4 Investing Playbook Investing Equity Market Implied Volatility

A Simple Hedging Strategy For Dividend Investors Seeking Alpha

A Simple Hedging Strategy For Dividend Investors Seeking Alpha

Post a Comment for "Stock Price Volatility And Dividend Policy"